We've actually talked about this concept quite a few times but that name is new to me. The initial focus of this post is pointed more to advisors but there is utility here to individual investors too.

Line item risk refers to when a person (client) focuses in on the one or two things in the portfolio that are doing poorly. It's human nature but depending on the holding in question, this sort of focus can be very unproductive and is a good chance for the advisor to increase clients' understanding of portfolio construction.

One way we've looked at this is with gold. I held gold in client accounts for a very long time because it tends to have a low to negative correlation to equities which is a desirable trait for the times that equities are going down. I regularly said though that if gold is your best performing asset, then things in the rest of the world probably aren't going very well. Marrying in a recent term, is gold a form of crisis alpha? It certainly has some crisis alpha attributes. Odds are pretty high that something that does well in a crisis won't do very well when there is no crisis.

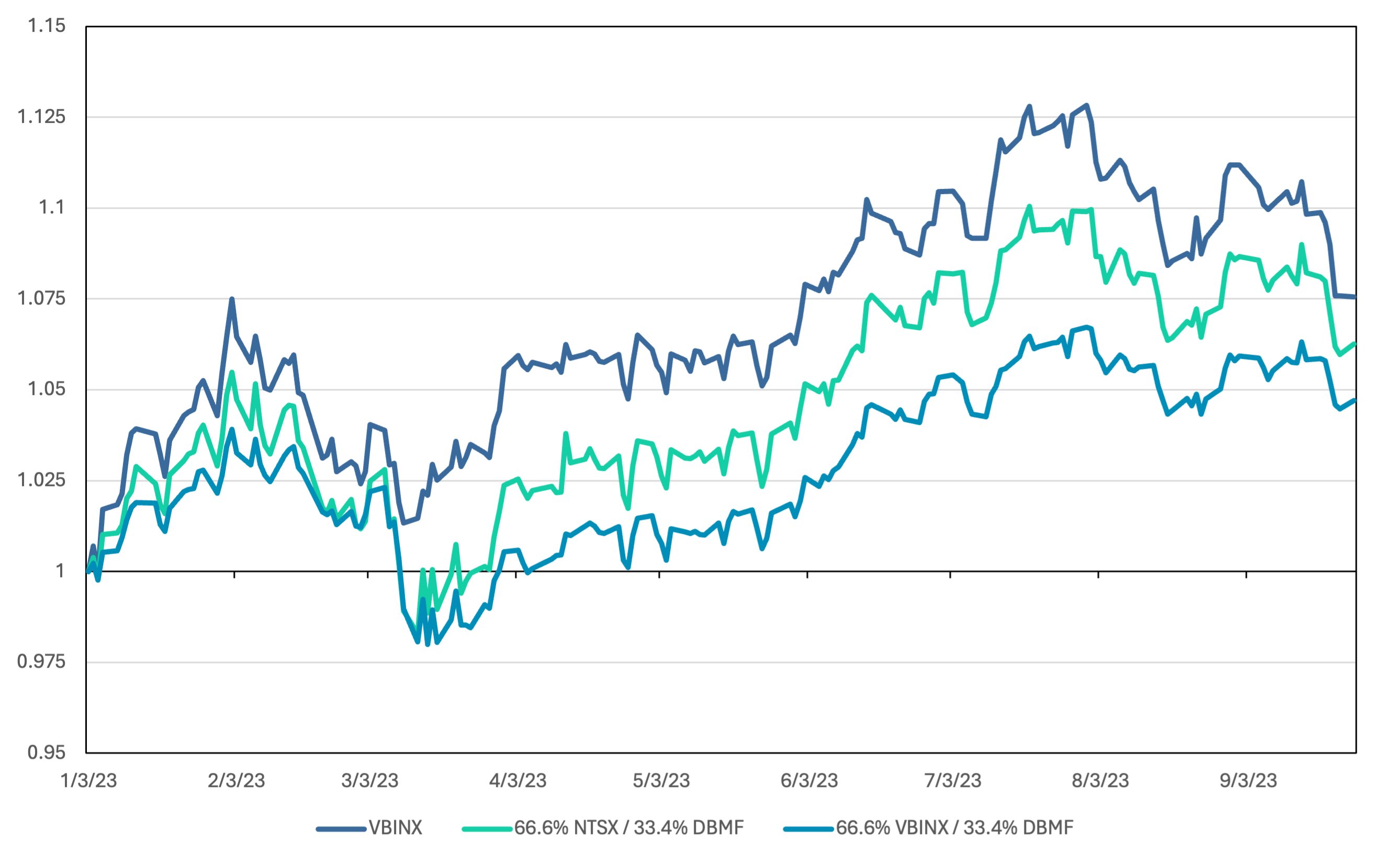

In a similar vein, we talked a lot about managed futures tending to have a negative to low correlation to equities too. The 10 or so years leading into 2022 were fantastic for equities. During a fantastic run for equities what would you expect an asset/strategy with a negative correlation to equities to do? It tends to have a negative correlation so it is unlikely to go up when stocks go up.

Yet another, broader context here is the idea that if everything goes up together during a bull market, then what is likely to happen in a bear market? There's a good chance they'll all go down together. That's not a well constructed portfolio.

Continuing on, if you build a portfolio with narrower holdings like individual stocks and narrow based ETFs, one of those holdings will be the best holding for the year and one will be the worst. How good is the best, how bad is the worst? What if the thing that has been the best performer for ten years is one of the worst this year? It happens. Not every great long term hold will be a great performer every single year. A bad year doesn't necessarily mean the story is over but you need a long term perspective and you have really understand that great, 20 year holds will have periods of seriously poor performance.

We also talk about holdings setting an expectation for what they will do. For example, long time client and personal holding AGFiQ US Market Neutral Anti-Beta ETF (BTAL) sets the expectation of not looking like the stock market and it meets that expectation often enough for me that I keep it. If stocks go up 20% one year, it is not likely that BTAL would be anywhere close to that. Odds are it would be down a lot in an up 20% world. A fire department buddy told me he bought Tesla stock. I made some comment about it being a fire cracker and he acknowledged that it is very volatile. I don't know if it will do well going forward or not but I think it can be counted on to be more volatile than the stock market for the foreseeable future. That is one expectation is sets, maybe there are others? Other stocks set an expectation of being less volatile than the stock market. Most consumer staples stocks fit that category. Maybe some random staple stock you like will outperform long term, maybe not but it's a good bet it will have less volatility.

Here's a blog post from Mark Rzepczynksi about tradeoffs for various types of holdings. Do you want less volatility? Then you probably have to give up outperformance? Want the potential for asymmetric returns? Then you probably need to accept more volatility and maybe more risk.

Part of navigating the line item issue is the need to be able to evaluate risk to some extent. The simplest example of the day is fixed income with any sort of duration. I've been bagging on long and intermediate bonds and avoiding them in client accounts for many years. I was certainly wrong on the timing as yields kept going down but the risk was there and getting worse all the way down in yields. It was so obvious, again, even having no idea when or if there would be a consequence, you remember terms like return-free risk and trading bonds for capital gains? The carnage finally came in 2022 and by some accounts it was worse than 1981. I don't know if that is true but 2022 was very bad and the trend has continued this year but the decline in 2023 has been less severe.

Once you've allocated risk correctly, more of a top down process, I would encourage focusing on the bottom line number of the portfolio first. Then make sure things are generally behaving as you think they should. Any that are not doing what they "should," why aren't they and then figure out what to do. If you have bonds that mature in 2035 or 2040, maybe they haven't done what you would have hoped for but in terms of figuring out what to do, you're in a bad spot. Selling a bond trading at 75 cents on the dollar, or worse, is, hate to say it, permanently impairing your capital.

The Vanguard Balanced Index Fund (VBAIX) as a proxy for a 60/40 portfolio was down about 17% last year. If you were down 10% then you did pretty well and that is what matters. In that context, does it matter if three out of your 30 holdings were down 30% as an example? I would argue no, especially of those were tech names. Tech was down a ton last year. In terms of expectations, if tech drops a ton, any tech you own is probably going to go down a lot too. That's how it works.

If you're an advisor I would encourage educating your clients along these lines to minimize the number of times they are surprised. As a do-it-yourselfer, it is important to remember the points mentioned above to reduce the odds of succumbing to emotions.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.