Closing out the podcast with Eric Crittenden and Jason Buck on one point they made almost in passing that came back to me today. First we looked at Crisis Alpha from their conversation, then a more wide ranging recap and today, the idea of risk transfer as an asset class, or more correctly an uncorrelated income stream.

The idea intrigues, it has intrigued me for years and years and have blogged about it going back to before any of the US exchanges were publicly traded. Back in the aughts, I used to write about the publicly traded exchanges which back then were just in other countries and how I thought an ETF of them would be a good idea. Then one by one the US changes all went public. There are two ETFs that target capital markets broadly, the SPDR S&P Capital Markets ETF (KCE) and the iShares US Broker-Dealers & Securities Exchanges ETF (IAI) that came out in 2005 and 2006 respectively.

My initial reaction to these was not enough exchanges exposure. Today KCE has 12% in exchanges and market makers (in terms of risk transfer, both exchanges and market makers fit the bill) and IAI has 21% in that niche. So here's the chart YTD;

The S&P 500 is the fatter line. KCE is down about 28% YTD and IAI is down 24%. If there is any positive effect from owning risk transfer (exchanges or market makers) it is not captured in the ETFs. So the ETFs are not the best way to capture the effect. The rest of the tickers are all for individual stocks. Of the individual stocks, NDAQ and ICE (Intercontinental Exchange which owns the NYSE) fared the worst. Virtu (VIRT) has offered some relief in this downturn dropping 16%, CBOE is down 14%, CME has done quite a bit better and market maker SNEX really captured the effect, if there is one going up 17%. CBOE is a long time client holding because it has the potential to do well in these environments thanks to its VIX business. In times of volatility, VIX volume stands to increase.

Eric and Jason talked about trying to invest in Citadel which is a hypothetical because it is not publicly traded. I don't know anything about SNEX. Does CBOE or CME capture the effect? That's in the eye of the beholder but I've never seriously considered either of the ETFs, they don't do what I think CBOE gives me a chance to get. I am not convinced though that any of these can reliably do what Eric and Jason had in mind in the context of building some sort of all-weather portfolio. I own CBOE in the context of constructing a normal portfolio not an all-weather.

Years ago, Bespoke Investment Group mentioned an interesting idea/strategy where buying the S&P 500 at the close and then selling it at the open the next day, so being flat during trading hours, has better returns than just buying and holding. They've mentioned it a couple of other times too and the idea has always stuck with me. It turns out, that strategy is going to be an ETF later this summer, the Nightshares 500 ETF which will have symbol NSPY. There will also be an ETF that does the same thing with the Russell 2000, symbol NIWM, but I have no idea if that has a compelling back test.

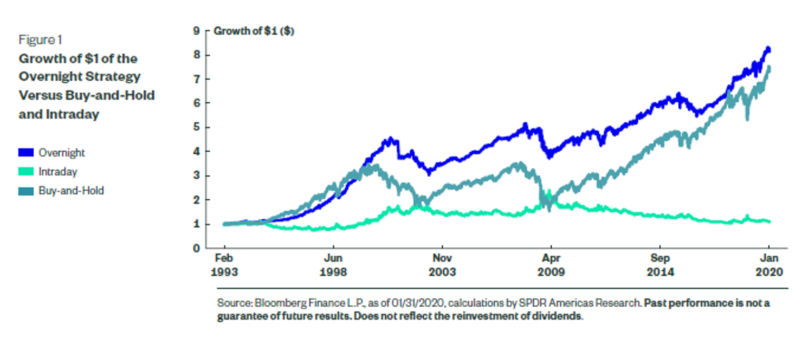

The prompt for talking about NSPY was a Tweet from Barry Ritholtz. I mentioned NSPY in a reply to Barry pointing out that the fund is in registration and that the back test (of course) looks good. I got reply with a link to a paper by the Alpha Architect crew that concludes it wouldn't work in practice because of trading costs. The paper refers to it as the overnight return anomaly which I love. The paper assumed a commission of one cent per share but I don't think that is an issue anymore. That sort of slippage, if it exist is more like what you might give up inside the spread and seems like a fraction of penny now. Here is their chart of the anomaly vs buy and hold vs holding during the day.

There are times where the anomaly outperforms and times where it lags so what does that look like to you then? I Tweeted back to the person who left the link for me that it looks like any other factor. There are plenty of factor ETFs which essentially is some sort of tweak on the market cap weighting of the S&P 500. No factor ETF can always outperform. This factor intrigues me. I have no idea if I will ever use it in any capacity but as one of many factors there will be times it leads and other times it lags.

In the six and a half years ending 11/1/2021, the iShares MSCI USA Momentum Factor ETF (MTUM) outperformed the S&P 500 169% to 121% (cherry picked on purpose). This year though it is lagging by 500 basis points and of course there is no way to know how long it will lag. Can you live with that? Obviously that is up to you but that is what it boils down to, no factor can always be best but then that means market cap weighting, the plain S&P 500 fund is also a factor that can't always be best.

No comments:

Post a Comment