This Tweet caught my eye;

Here's a better look at the image.

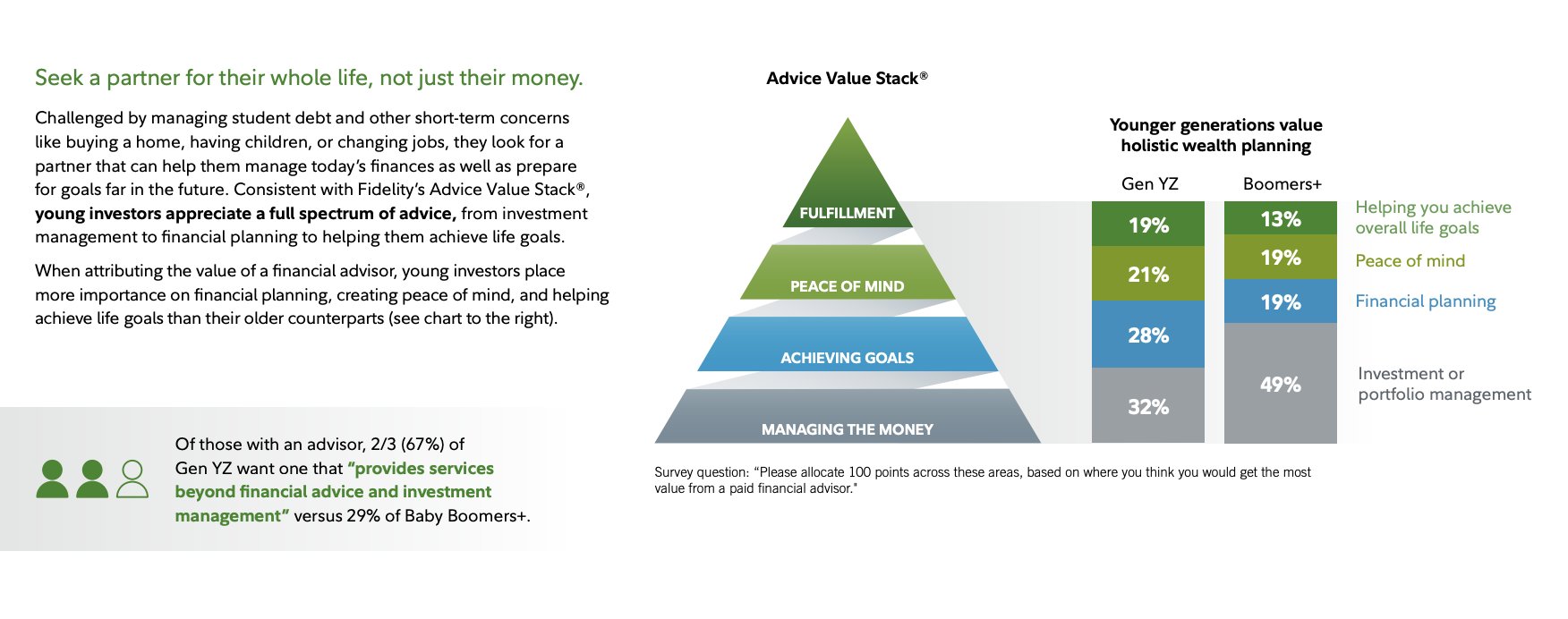

This is fascinating if accurate. Are financial advisors necessarily qualified in these other realms, qualified as life coaches? Sorry, but the answer is no. Not that a given financial advisor can't be qualified or knowledgeable but I think it is a stretch to automatically assume an advisor can weigh in competently peace of mind and fulfillment. I've been writing about these things for eons now and will confidently say my awareness of these life quality issues is strong.

I do believe that an advisor can have their act together, can have figured some things out and be on solid footing. I think that is important but I also know that is not true of all advisors.

Part of how I engage with the fire department as the chief is to try to set examples for things like fitness, demeanor, doing work that maybe other chiefs would not do (shoveling snow in the winter, picking weeds in the spring) and knowing what personal issues to not bring to the station house. At a minimum I think a financial advisor can walk the walk, set an example, with their own fulfillment, piece of mind and maybe this is unfair but also set an example by having their financial house in order.

Anyone can be susceptible to living beyond their means, including financial advisors. More harshness coming but if your doctor is 100 pounds overweight, how seriously can you take their advice on diet? My doctor got the stomach surgery a while ago. There are some things for which he has no credibility for me. What about a marriage counselor on their third marriage? I think this applies to financial advisors too. My views and comments might be harsh but where you're well being, financial or otherwise, is concerned it is ok to be critical as hell.

We've taken many looks at outside interests here over the years, I just used one of mine as an example above. Having interests, hobbies and activities is a path to varied experiences which I think can lead to increased competence of coaching fulfillment, piece of mind and other related topics. When you have multiple dimensions you have more life experiences to draw upon to potentially help a client or a friend.

It is important to know your limits though and never make something worse. Here's an example. A firefighter who is about 10 years older than me asked for help getting started lifting weights. We're going to meet at the station house (this is where I work out, we have built up a robust weight set) this week. My first question before we do anything will be about any sort of injuries or anything he badly hurt over the years. Deadlifting is one of the most important exercises someone can do. What if my fire dept colleague has had serious back issues? He still needs to deadlift. The answer to muscle weakness due to injury is not to allow the muscle group to stay weak. But it is beyond my knowledge base to know how someone with a history of back trouble should get started. Again, there is no question they should be deadlifting but someone with more specialized training would be needed to help in this case. There might be other exercises that are a stepping stone to deadlifting that should be done first for a while.

As an EMT (another FD anecdote), there's far more I don't know about medical than I do know. It is crucial to know where that line is.

Hopefully everyone continues to develop themselves, take on new interests, pursue new hobbies, learn new things. I think I'm pretty good at this. Continued personal development may not make a financial advisor fully qualified to become the life coaches that Gen Y and Gen Z appear to be looking for but it will help provide more rounded service, be a better resource for life issues even if not a fully qualified resource. If you're an advisor and clients would generally say about you "let's get his opinion, he usually has a good perspective on things" then you're already helping your clients beyond their finances.

8 comments:

I found this blog when searching for financial advisors for business owners. It's a refreshing change from the other blogs I've read. The author has taken the time to give some really interesting information on financial advisers' unique roles as life coaches. I appreciate the useful information!

This post challenges the notion of financial advisors doubling as life coaches, highlighting the importance of expertise and credibility in both realms. The author emphasizes the need for advisors to lead by example and maintain personal fulfillment and financial stability. Thought-provoking insights on the intersection of finance and well-being.

Income and Financial Growth in Orlando FL .

Financial advisors may excel in money matters, but assuming expertise in life coaching can be misleading. While personal examples and diverse interests enrich understanding, knowing one's limits is vital. Like in firefighting or medicine, specialization ensures competent guidance. Source for more about Basha Wealth Management.

Financial advisors as life coaches is an interesting and valuable concept! Combining financial expertise with a holistic approach to life planning makes so much sense. Money decisions are often deeply intertwined with personal goals, family needs, and long-term dreams. A financial advisor who can guide clients through these broader life aspects can truly make a positive impact. I believe this integrated approach can lead to more personalized and effective financial strategies, especially when considering alternative investment advisors who can offer unique perspectives and solutions. Thanks for shedding light on this emerging trend!

Financial advisors, while knowledgeable in finance, may lack qualifications as life coaches. They can embody personal success and discipline, setting valuable examples. Yet, issues like peace of mind and fulfillment require nuanced understanding. Advisors must avoid overstepping into areas like mental health or relationships where expertise is crucial. Personal development enriches their advice, yet doesn't replace specialized coaching needs. Clients benefit from advisors who enrich lives holistically, albeit within their expertise, fostering trust and broader perspectives beyond finances.

"What an insightful post! The way you've outlined the role of a financial advisor is both clear and comprehensive. It's a great resource for anyone looking to understand the importance of having a financial partner."

Lifestyle Money Management is a firm of Financial Advisor in Adelaide.

Financial advisors can play a significant role as life coaches by offering holistic financial planning, behavioral coaching, personal development, health and wellness integration, and support with family dynamics and legacy planning. By addressing both financial and personal aspects of clients' lives, they can help individuals achieve a more balanced and fulfilling life. Integrating these coaching elements into financial advisory services can enhance clients' overall well-being and success. Best Cash Flow Forecasting Software | Financial Forecasting Tool

Financial planner in the industry generally offer investment management, but not all investment managers offer a comprehensive approach to financial advice. At Ameriprise, you’ll receive one-to-one personalized advice based on your individual goals and needs. Through personalized advice and our digital tools, we can help you define your goals, see your progress, review your investments and plan for the expected and unexpected.

Post a Comment