There was some good buzz around changes made by Blackrock in its model portfolios. They tilted to more value than they've had recently and based on media and Twitter accounts, part of the rebalance included buying the iShares US Equity Factor Rotation ETF (DYNF). I signed up for an account at Blackrock to look at their models, still processing, and while I won't post their models, I am curious if they tend to build their models with many funds or just a few. There's validity in both. Blackrock is a client holding.

I own a few shares of Invesco Russell 1000 Dynamic Multifactor ETF (OMFL). It is similar to DYNF. I bought OMFL to see it it could turn out to be a better mouse trap versus market cap weighting (MCW). As I have said many times with this sort of thing, nothing will always be best and I don't really expect OMFL to be better than MCW, maybe just a little different.

The time frame is short with these three because DYNF is pretty new but they are all close most of the time but not always.

The above data is interesting. OMFL had the highest CAGR with a tradeoff being a standard deviation which makes sense but that the worst year number, 2022, is so much lower is very interesting. Unfortunately, there is no way to know whether it could repeat that when the next bear market comes. I wouldn't bet on it. If I thought OMFL, or DYNF for that matter, was the better mouse trap, I would expect it to be a slight tweak on MCW with a very similar return profile. All the better if it repeats that strong relative result in the next bear market.

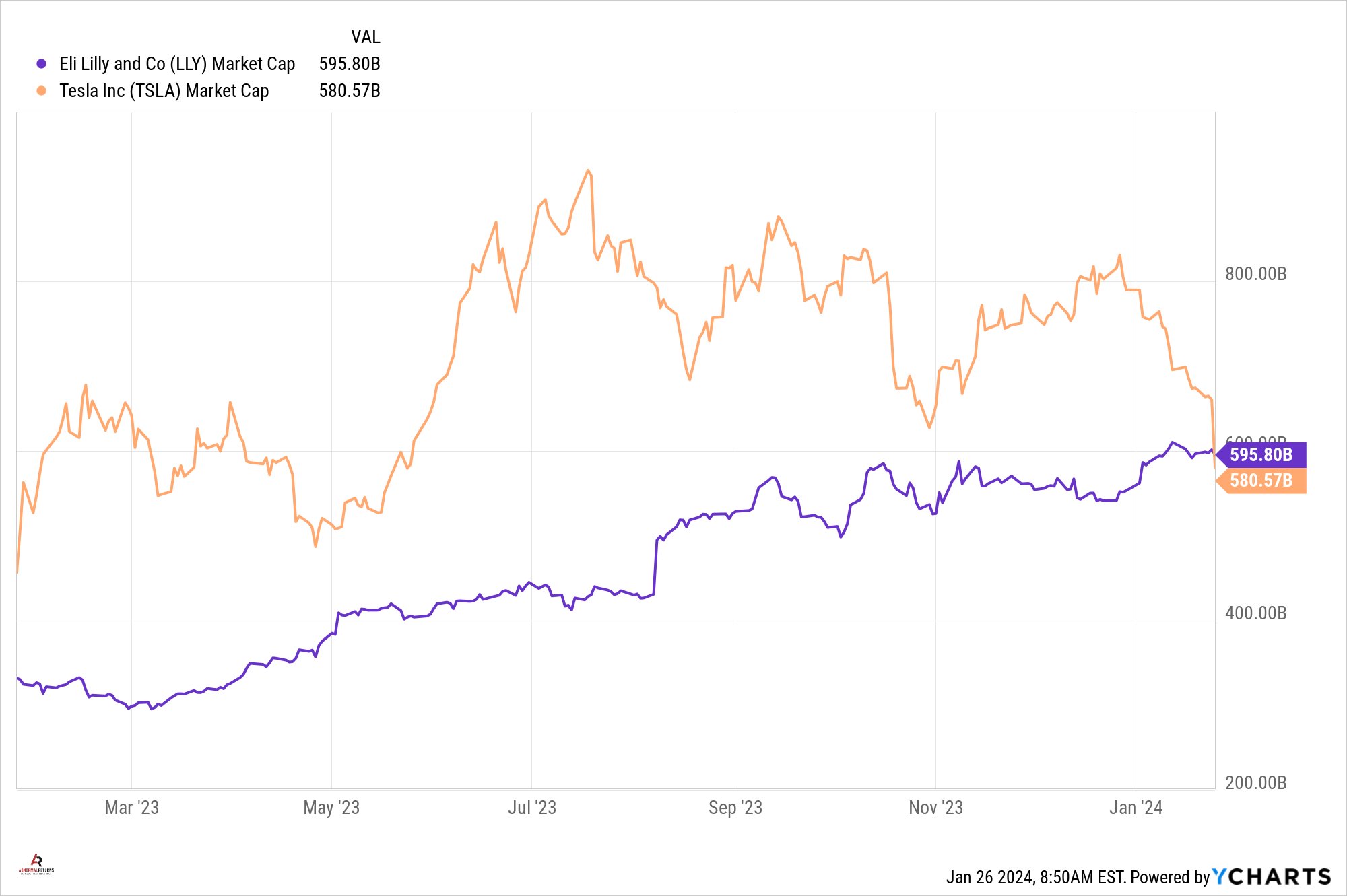

I saw the following chart in a couple of places on Friday.

It's a great visual arguing for smoothing out the ride versus going with a volatile path for your portfolio. The time frame is short but the idea is still captured. In terms of bottom line portfolio results, I have to believe people would prefer the purple line, I would anyway. If, looking back you say that you would prefer the purple line then it is important to understand the tradeoff which is that sometimes the desired long term result means lagging by a lot in the short term. That idea has to really be embraced and accepted as reality to avoid impatience like when the tan line was at its peak last July.

Finally, yet another covered call ETF listed this week. It has a point of differentiation, some are much different and some are a different shade of the same color. The Defiance Treasury Alternative Yield ETF (TRES) is unique as far as I know. It will own Treasury bills and bonds but will target a maturity of just one year. It is not really just a covered call fund, it's more of a options combo fund, with various types of spreads and long options positions that is expected to workout to paying a pretty big distribution. It is not clear to me at this point what the yield will be or how volatile it will be.

Out of the starting blocks, it has 22% weightings each in two bills and two notes and then what appears to be one call ratio spread and one put ratio spread. If the fund does use bonds then I am not sure how the duration will be kept at 1 year +/- unless they mean they can buy paper that was originally issued as a bond but is maturing soon or if there is a way to cut the duration of a bond via some sort of option strategy (my hunch is the former). A quick glance at the notional exposure of the options makes it look like the fund leverages the fund past 100% but if you know differently, please comment.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment