A quick post for halftime reading. Check out the following.

While the performance wasn't optimal it was in the ballpark. The growth rate, combined with an adequate savings rate would be enough to get the job done, even if it isn't optimal (repeated for emphasis). To be clear though, the Mystery Fund is not intended to be a single portfolio solution.

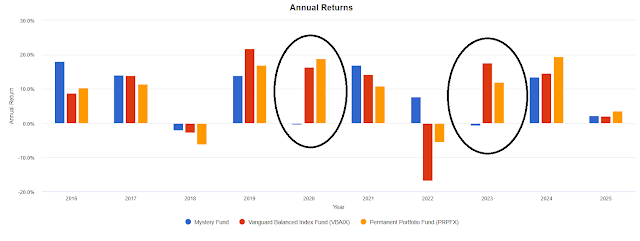

The year by year tells a slightly different story in case it isn't apparent from the chart.

In 2020 and 2023 the fund was unchanged versus up a lot for the other two. If someone bought the Mystery Fund in late 2019, they wouldn't have been chasing heat even but a year later there probably would have been a ton of regret.

In real life, the Mystery Fund isn't suitable as a one portfolio solution despite being in the ballpark. The result is close but the fund isn't valid for that purpose. The point is to understand that a portfolio that is valid for a long term investment plan will have periods where it lags in a frustrating manner.

The important takeaway is to not panic or get otherwise impatient in the periods where your portfolio lags which it will undoubtedly do.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment