Barron's picked up on a point we've been making here for I don't know how long about CBOE Holdings (CBOE) having defensive qualities. CBOE is a client and personal holding. They talked about options trading increasing during times of turmoil, yes it does, but oddly it never mentioned the VIX Index or the word volatility. Other exchanges trade options too but my thesis has been that CBOE has this defensive attribute because the VIX option complex trades there.

I believe it is quite reliable in this regard but not infallible. In one of the down days this week, it was also down. It was up 3% today but if you go look at it now on Yahoo, there are some weird after hours prints. There were a couple of prints about $10 below the close and at least one $7 above the closing print.

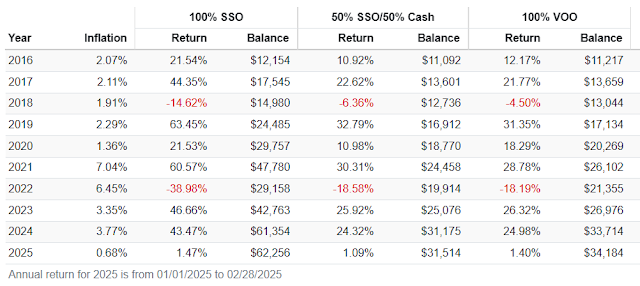

Here's a blog post reviewing research that concludes leveraged ETFs don't lag over longer holding periods anywhere near as much as typically believed. Part of the equation is that the cost of leverage has to be embedded in the pricing of the levered funds.

The personal observation that I am most comfortable with is that 2x long S&P 500 hasn't deviated that badly when looked at year by year.

You can decide for yourself whether it's close enough or not. And 2020 is a great example of what can go wrong, the Pandemic Crash was too big of a hole for it to dig out of. The narrower or more volatile the underlying is, the less likely this observation is to stand up. We've had some fun exploring 2x levered single stock ETFs for capital efficiency but in real life, it's not something I would do. I may be proven wrong but I think the QuantifyFunds 100/100 suite where each fund is 100% in two different stocks have a chance to be useful holds for barbelling volatility and basis points into a portfolio which if correct, would be great for managing sequence of return risk. To be clear, they've only been trading for a week or two which is nowhere near enough time to draw a conclusion.

The ReturnStacked guys put out a short paper on the right way to use leverage and the wrong way to use it. The TLDR for me about the wrong way are the countless examples in history of misusing leverage which they point out. They cite that if a hedge fund uses 5 to 1 leverage to buy volatile stocks and then they get caught in a 20% decline for those stocks, the fund is wiped out. The example they use as the right way to use it is leveraging up by 50% to add an uncorrelated strategy like managed futures (or other alternative).

I'm not a fan of leverage but who cares what I think, can it be used in the manner that the paper describes?

There are no hideous declines in the backtest where the levered portfolios go down far, far worse than straight VBAIX. The portfolio that leverages up to take in multi strategy was obviously the best performer but the trade off was dropping more than the others in late 2018 and then again in 2020 Pandemic Crash. These larger drawdowns were not ruinously worse but noticeably so. You can decide for yourself whether the modest uptick in volatility is worth the modest outperformance.

I threw in 60% SPY/40% Merger Arb for an unlevered comparison. The volatility number for that portfolio versus VBAIX doesn't seem right to me and FWIW, Portfoliovisualizer has 60% SPY/40% Merger Arb with a standard deviation 89 basis points lower than VBAIX and outperforming by 134 basis points annually.

My concern then must be of something that hasn't happened as opposed to repeat of something that has happened. I saw a post saying that managed futures programs have now gone short equities. So if that is correct and this event continues to send equities lower then managed futures should do better than they've been doing, most of the funds I follow were up today, none were down. We'll see if that plays out but it would also have favorable implications for Portfolio 1 in our backtest that leverages up to put 50% into managed futures.

Ok, so back to worrying about something that has never happened. Fair enough that I might be wrong about this but if you are an advisor, do you want to have to explain a type of blow up that has never happened to your clients? The extra 55 basis points (between Portfolio 1 with managed futures and VBAIX) would not be worth the risk to me.

We've talked plenty about different ways to embed capital efficiency in smaller doses. The way I use client/personal holding BTAL, it it went down in lockstep with the index in a long and slow decline, the actual impact could be noticeable, but even then maybe not, but nowhere close to ruinous.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

3 comments:

Hey Roger, while I’m not a fan of leverage, I have been test driving SPMO as an alternative to my present long-held allocation in US LCB via the VFFSX fund. Upside is certainly there; and as you’ve said in previous posts it back tests well.

Even believing this year that we’ve more downside risk than upside gain - I am struggling to see the downside to making the change to SPMO and its momentum approach. While it may drop more, it seems to more than snap back….

Curious what your thoughts are on this?

Thanks, Jeff

If I am reading testfol.io correctly, SPMO has only lagged SPY in 2 out of 11 full and partial years. Those two years it just seemed random.

You might expect momentum to do worse to the downside but that clearly has not been the case. I think part of the success could be what it avoids. It could be very good at picking uptrends but what if it is better at avoiding downtrends? Seems plausible.

Also, SPMO might be an outlier. It is so much better than MTUM and there is one other that SPMO does far better than, might be PDP. Course now that I say all this, watch it get stomped on for a while.

Never occurred to me that SPMO may simply be better as you put it at avoiding downtrends. Simple in hindsight (isn’t everything…?), but the question you raise is a keen observation. Improved return aside, an 81% “win” rate by year relative to the index over the last 11 years is pretty solid as well. 🙂

Looks like a better ‘mousetrap to me. Thank you for your continued work here on your blog; and thank you sharing your thoughts with me on this!

Post a Comment