Let's start with a couple of follow ups.

It looks like the GraniteShares YieldBoost SPY ETF (YSPY), the fund that sells put spreads on the Direxion 3X SPY (SPXL), readjusted its spread down to slightly lower strike prices, it shows being short 170.87 and long 157.20 that expire today. Unfortunately, SPXL is trading with a $147 handle as I write this. So either it will take the loss or more likely it will roll down again which might be expensive to do. Selling volatility is a valid strategy but it is very tricky to do. The timing for YPSY's launch is unfortunate for sure, but it is too early to draw a definitive conclusion beyond yeah it's risky and volatile.

Next, the SPDR Bridgewater All Weather ETF (ALLW) did have some changes overnight. Yesterday I think I missed the full roster of holdings and now the website shows the notional percentages of assets it owns.

Most of the global nominal bond allocation is with futures contracts, same with commodities. Equities are mostly SPDR ETFs and the inflation linked bonds are individual issues. Obviously the fund is leveraged which is consistent with risk parity. Mid-day, the fund is down a little in what was an ugly tape for equities.

Fidelity has a portfolio analysis tool for advisors that I tried out this morning. I put in a 6 fund portfolio that is consistent with funds we use for blogging purposes and compared to the Fidelity Target Allocation 60/40 Model Portfolio. The Fidelity model had 15 funds plus 2% in a money market.

Giving them the benefit of the doubt, I would guess the Sharpe Ratio is better than -0.03 and the Sharpe Ratio for the Test Portfolio is higher than 0.49 on Portfoliovisualizer. I will play around with this more but it does reiterate a point that you can build a robust portfolio without needing 15 funds.

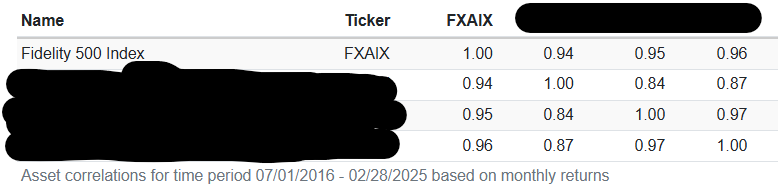

These four domestic equity funds add up to 25% of the model. It's diversification without a difference. It's probably not ok to reveal the funds other than a generic S&P 500 fund but there's no reason, that entire 25% could be in FXAIX.

Lastly, one of the Bloomberg pre-market emails talked briefly about people being unable, financially, to retire, that continuing to work is their Plan A. Coincidentally, I got my annual email from the Social Security Admin with my updated numbers. An important point to reiterate is they want us to know what our numbers are.

You can go get your numbers. It's not too difficult to understand how far your expected benefits will go relative to your expenses and other preferred lifestyle needs. Are you 50 or 60, whatever age, you probably have some idea of when you hope to retire, if that is your preference. So it boils down to math on a spreadsheet. If the numbers don't look favorable or there's not enough of a margin of safety for you to be comfortable, what can you start doing now to fill the gap?

Think your payout will get cut? Ok, do the math, where does that leave you? There of course has long been the threat of a 21-23% cut starting in 2034/2035. While I am skeptical that it will ever get cut, the easiest way to implement a cut would be to eliminate the spousal benefit. In my scenario, spouses would still get the survivor benefit.

There's nothing new from me on this, just the reminders that they do want us to know what our numbers are and that no one will care more about our retirement outcome more than us.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment