I received an email to my work account promoting the Innovator Equity Managed Floor ETF (SLFR). It's a defined outcome fund that uses collars, an option strategy that sells calls and buys puts, that charges 0.89%. The fact sheet lists the beta at 0.71 and the standard deviation at 10.18% versus 1.00 and 14.04 respectively for the the S&P 500.

A common criticism to these funds and one that I believe in and have written about is that whatever you're trying to achieve with one of these funds you can get the same effect cheaper and simpler a different way. I put that to the test as follows.

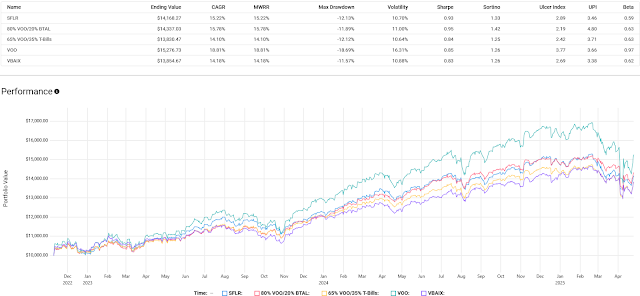

First, for the cheaper part. 80% VOO/20% client and personal holding BTAL would cost 55.6 bp, 65% VOO/35% BIL would cost 68.5 bp, VOO is 3 bp and VBAIX costs 6 basis points. For VOO plus BIL you could just leave the 35% in cash or maybe a cheaper T-Bill ETF but I went with BIL because we frequently use that one for blogging purposes.

The two models I built get pretty close to what SFLR is trying to do in terms of beta and standard deviation and the returns are not that far off. And all three of them are close to VBAIX by those measures.

There's not a ton of differentiation between the two models and SFLR in the year by year numbers although this year, 80% VOO/20% BTAL is about 100 basis points better than SFLR but VBAIX has done the best this year.

Just own less equities was the conclusion from an AQR paper a few weeks ago. All of the ideas above have drawbacks. SFLR will cap the upside based on the strike prices of the calls sold. There can be no assurance that the VOO/BTAL combo will work every time but it has been pretty reliable. IRL, I wouldn't go anywhere close to 20% in BTAL. If equities rip, then 35% to T-bills would cause the 65% in VOO to lag. 100% VOO will at times be a very difficult ride. Anytime bonds do poorly, VBAIX will do poorly too.

I can understand the argument that the defined outcome funds are convenient for doing the work for you so if that is high enough on the priority list then use them but zooming out just a little from the argument above, defined outcome funds fight against the market's natural inertia, its ergodicity, to move from the lower left to the upper right.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment