Barron's had a short article about quality stocks struggling of late. It wasn't crystal clear what they were trying to say. The enormous hit to United Healthcare on Thursday could have been the prompt because that is in some quality indexes/funds like the GMO US Quality ETF (QLTY).

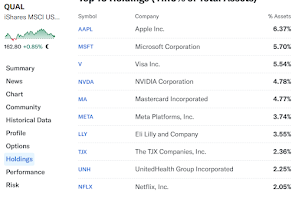

I included buybacks (PKW), Shareholder Yield (SYLD), and the iShares Quality (QUAL) with the S&P 500. Even sliding the chart to the highwater mark of mid-February doesn't change the story much, they all are close to the S&P 500 except for SYLD. I'm not sure how interesting this is but something that is interesting is the differences between top ten holdings of QLTY and QUAL.

They have names in common but QLTY appears to tilt more to value with QUAL being growthier. Same factor but some different interpretations which is worth keeping in mind if a factor interests you and you're down to trying to select one.

The WisdomTree Putwrite ETF (PUTW) changed on April 4 to the WisdomTree Equity Premium ETF and it now has symbol WTPI. I haven't had time to dig in but the strategy appears to now be more involved than selling an index put that expires in a month which is what PUTW did. The puts sold are close to or even in the money, there's more to it than that, and they expect to have to roll forward every month which means buying back the current put and replacing it with one that expires later.

One insane nitpick from me is in one of the presentations they refer to options being exercised when they mean assigned. WisdomTree must have a basis to believe WTPI is better than what the old PUTW did so we'll see but I am skeptical.

Speaking of new, complex funds that sell volatility, Simplify launched two of them, SBAR and XV, which sell something called barrier puts. I've never heard the term before but the descriptions of each fund seem buffer-ish or like defined outcome-like. I'm not sure that is correct though.

I've said many times that selling volatility is absolutely a valid strategy but the blow up factor is higher than many other strategies. I would differentiate simple covered call funds like JEPI or XLG from the types of option overlays than many of the Simply funds use. The relative returns of JEPI or XLG may or may not be satisfactory depending on the period studied but they're blowing up like an inverse VIX fund isn't a reasonable probability. A fund that sells index puts anywhere close to the money isn't like playing roulette but in the right combo of circumstances, could really get hit.

Sizing becomes very important with these funds. XV targets a 15% annual distribution which is very high even if many of the YieldMax funds yield 60%. Assuming XV can deliver on the 15% "yield," a 5% allocation would provide 75 basis points of yield for the entire portfolio which is of course a variation of barbelling yield that we talk about regularly. If a fund weighted at 5% drops by 2/3 in a blowup, the impact on the portfolio would be felt but wouldn't be ruinous.

One point that Dave Nadig has brought up recently about the YieldMax funds is that over the course of 2024, YieldMax was saying that the distributions were a combo of income and return of capital but then as Dave tells it, when the year ended, all of the distributions were reported as being income. This doesn't matter in an IRA obviously and it would be up to the end user whether it is important to them if used in a taxable account.

And, why not;

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

2 comments:

This is also interesting: https://www.wsj.com/finance/investing/private-equity-world-engulfed-by-perfect-storm-2a2da2ad

thank you for the link

Post a Comment