My fascination with creating all-weather asset allocations that don't involve risk parity? I'm not the only one!

Nomadic Samuel, we mentioned him last month, interviewed Jason Buck and Taylor Pearson from an outfit called Mutiny Funds who manage what they call the Cockroach Portfolio which is inspired by the Permanent Portfolio devised by Harry Browne back 40 years ago. The Permanent Portfolio allocates an equal 25% to equities, long bonds, gold and cash with the idea that at least one of the four will always be doing well. Given how well long bonds did from the time he came up with the concept, the performance numbers look fantastic.

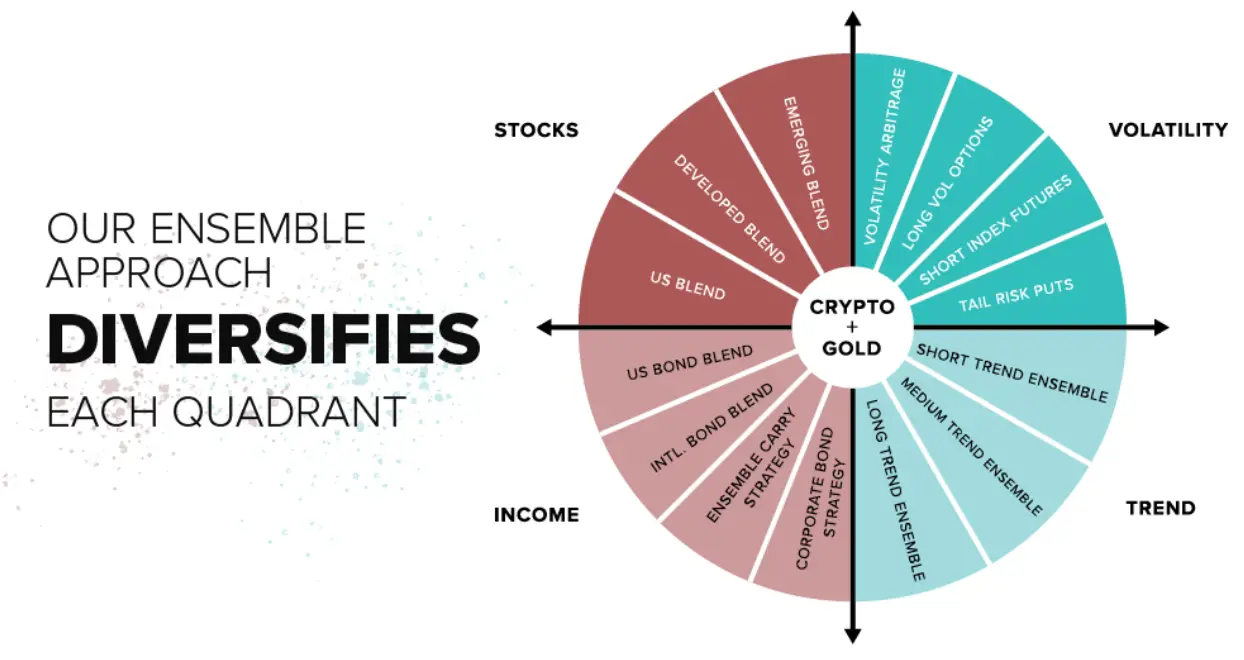

With that as a starting point, the Cockroach Portfolio allocates as follows

The idea of labeling asset classes to be more descriptive of attributes

is an interesting part of this conversation for me. Volatility and trend and specified

in the Cockroach does that somewhat.

The percentages were a little lost on me. I may have misread but it implied 25% allocations to stocks, volatility, income and trend but then later in the interview there was mention of a 20% allocation to fiat hedges, 16% gold and 4% crypto. Depending on the fund structure, they could lever up to add the 20% or maybe they have five equal 20% sleeves.

The stock and income pieces are easy to understand. You probably already have ideas on how to diversify within these two. Volatility and trend are a little more off the beaten path although we've been talking about trend, aka managed futures, which for clients and personal accounts has meat BLNDX for the last 2+ years.

I've never used the word volatility as a descriptor for an "asset class" that I use for portfolios but apparently I should have been because I've been using inverse funds during downturns since the financial crisis so not quite shorting index futures but close. And this go around is my first using tail risk protection. Long volatility options as Mutiny defines it appears to just be a companion to tail risk, similar outcome when markets go south but with different tradeoffs. Volatility arbitrage as they define it is a pairs trade of index futures and volatility futures.

That got me thinking about VIX related ETFs and whether they could play a role in defense. The drawbacks to a permanent allocation to VIX products is that the shorter the targeted maturity of the fund, the more it goes down. All short term VIX ETFs are all down close to 99% since inceptions. Note I am not talking about ETFs or ETNs that sell short VIX, that strategy amounts to picking up nickels in front of a steam roller with some history of funds blowing up. Eric Balchunas coined the term Volmageddon a few years ago after a spike in VIX destroyed one the short selling funds overnight if I recall correctly.

This chart though shows how just about all the VIX ETPs have done this year versus the S&P 500.

Relative to the bear market, they are offering protection. That long term though, ouch bro.

But what's going on in the middle of that chart? VIXM is the ProShares VIX Mid-Term Futures ETF and VXZ is the iPath Series B S&P 500 VIX Mid-Term Futures ETN. In a down 99% space they look like stalwarts. VXZ is an ETN so I'm going to rule that one out. Where the short term VIX products are far more live by the sword die by the sword, they are offering more protection this year but the 21% per Yahoo for VIXM looks pretty good too.

When these products first came out, they drew a lot of heat because they really weren't pure VIX proxies. That reality might be working in VIXM's favor as a hedge if it spares it a 99% decline. I'm going to spend more time but I think there might be room on the next go around for VIXM. Maybe it should just be bought at VIX 15 or 17 or some other low number as a hedge against complacency. To be determined.

But there is no scenario for me, where I want 20% or 25% in some combo of TAIL or VIXM. That is way too much exposure to something that hopefully has a negative correlation to equities. Maintaining that balance will neutralize a lot of equity upside and remember, stocks have an up year 72% of the time and I want that ergodicity to work for me. My goal with, I'll start calling it volatility exposure, is to mute some of the downside in conjunction with other strategies/diversifiers.

On a related note, for the 1000th time from me, I want nowhere near that much in gold. It tends to have a low to negative correlation to equities and in periods like now, it helps a little. YTD it is flat, helping a little. Back in March its YTD gain was 12% vs a similar sized decline for the S&P 500. For my money it is helping. But for five years ending 12/31/2021, so before the bear market started, it had half the gain of the S&P 500 and for ten years, it had about 1/10th the gain of the S&P 500. Nothing bums me out about that result for gold but something like 10% or 20% to something with that sort of return expectation is too much of a drag especially considering you'd have another 20% in volatility as described above.

I think 4% is too much to start with for crypto but wouldn't sell simply because it grew to be that large or larger. I'd want to try to hold on to try to benefit from the asymmetric potential but I don't think it has any of the attributes described in the article. I think the ship has sailed on all of it; inflation hedge, diversifier, anything else or at the very least it has failed the current test so badly, it can't be counted on to have those attributes. I could still go to a bazillion though, so I have not sold. I don't think we've hit levels so panicked that I'd buy more. We'll see how that develops. I want to be clear about Bitcoin, although I talked the other day about the possibility that the whole thing is BS the asymmetry of it either going to zero or a bazillion is still in tact in my opinion.

Even though I would do things much differently, I am very intrigued by the Cockroach Portfolio, the thinking underlying the decisions and the influence, despite being dissimilar, of risk parity. Maybe I'm not clear enough when I appear to bag on risk parity, there is a lot to learn from the thinking that underlies it.

Taking the Cockroach and tweaking it for someone who is not looking for a game-over allocation, I would go way more than 20% or 25% to equities. Repeated for heavy emphasis, equities are the thing that goes up the most, most of the time. I would want a non-game over portfolio to get more benefit from the market's ergodicity than 25% could give, 25% that is seriously neutralized from the volatility sleeve. To be clear, I do not think the Cockroach as presented is ideal for game-over either.

Similarly with trend following, pure trend following, not BLNDX which is 50% equities and 50% trend (managed futures). It tends to have a negative correlation to equities. RYMFX is a great ticker to look at to build an expectation because of how long it has been around.

If you want to talk about maybe 50% in equities, maybe 60% and then figure out smaller allocations to the rest, I think that is more in the ballpark.

The quest to refine a portfolio is, for me, never ending. I owe it to clients to keep learning, I owe it to myself as a form of personal development and if you've been reading me for any length of time, I hope I've conveyed how much fun I have with the research process. This was a fun post.

No comments:

Post a Comment