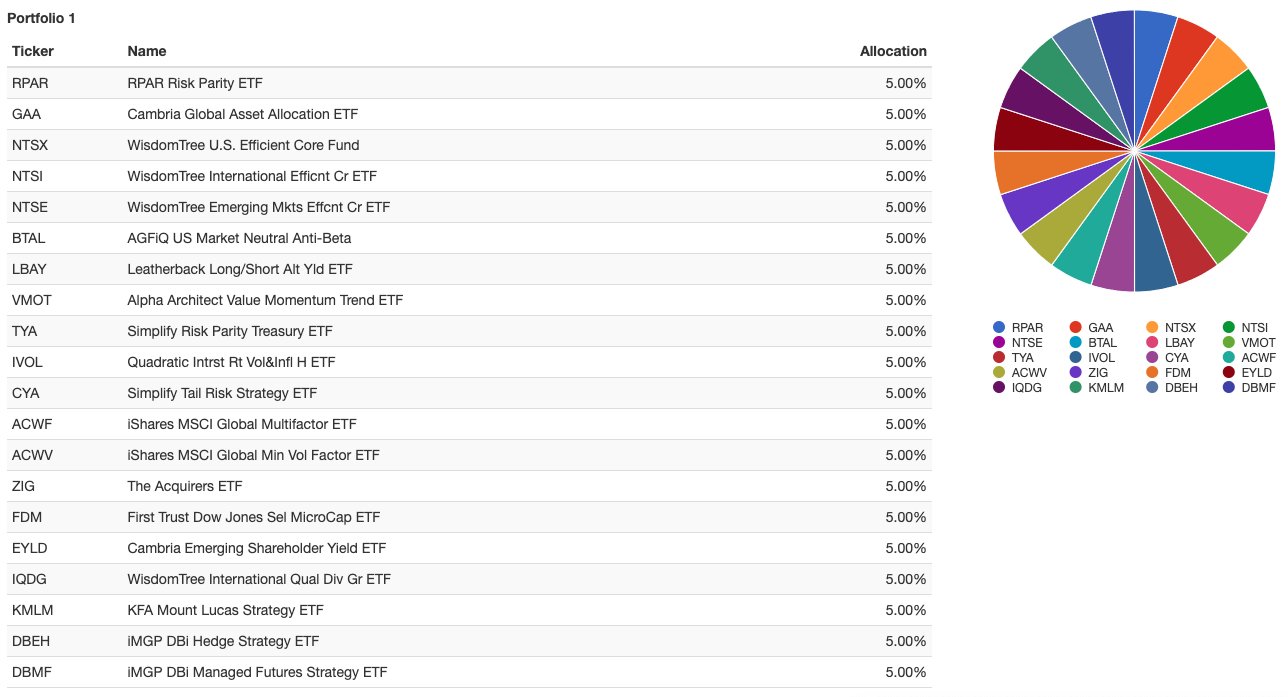

Some interesting conversations and the like related to portfolio construction and the use of alternative strategies. Nomadic Samuel kicked it off on Twitter with the following portfolio in a poll, asking whether a simple two fund, equity/bond 60/40 portfolio made more sense.

The above portfolio is a great benchmark for over the top complexity. I am obviously not a fan of plain vanilla 60/40 but there's all sorts of middle ground to build something simpler that minimizes interest rate risk for anyone interested in doing that. I certainly am, in line with my belief that for now, bonds have become a source of unreliable volatility.

An episode of Bloomberg Quick Takes talked to an advisor who'd built an inflation portfolio with a long list of holdings including the iShares Interest Rate Hedged Long Term Corporate Bond ETF (IGBH). The advisor said it had no interest rate risk which doesn't appear to be exactly right per the chart but clearly the hedging softened the blow relative to most plain vanilla bond funds.

It's been down about half as much as the AGG. Is that good enough? No wrong answer, is that good enough? I think it is. Also charted are two funds I use for clients, one that has done better than IGBH and one that has done worse. IGBH, BKLN and BSJP are all from traditional income sectors. In trying to minimize interest rate risk, I am trying to reduce the full impact of the bond market carnage, I don't necessarily think though that having zero in traditional income sectors is ideal. AGG down mid-teens, longer duration treasury ETFs down quite a bit more is something to avoid if possible but trying to be down zero percent likely exposes the portfolio to other risks that might be harder to see coming which is a conversation about specialization leading to fragility.

Diversification means owning things with different attributes that respond differently to various market and external events. The lift in yields has been a market event. AGG and longer dated treasury ETFs have had the worst reaction, the holdings charted above have had a different reaction that was not as bad and non-fixed income diversifiers have probably done the best by and large, at least the ones we've been writing about all summer.

You can't expect one of those three segments to always be best/worst which is why it makes sense to own more than one of those segments. Underweighting fixed income duration was an easy call to make but I wouldn't expect future calls to be so easy.

This year has been a fantastic lesson in how diversification works as bonds did so poorly. If you've been reading my posts for a long time, you know this part of my process is many years in the making, investing a lot of time seeking out how to protect against the eventual increase in rates, understanding the various strategies available (what would work and what would not) and all the rest we've been writing about. When you talk about long term investing, it's not just buying something and holding it forever. There also needs to be what I'll call risk planning which is what the above describes.

If we're thinking about risk planning for the next ten years, I might wonder about a lost decade for US equities like we had from 2000-2010 and whether that might mean foreign equities rotate back into favor like they were back in 2000-2010.

It's good to start thinking about these things ahead of time.

No comments:

Post a Comment