We've spent the last few months looking at ways to to diversify equity volatility with different types of alternatives, some that should go up a lot when stocks go down and others that should look like horizontal lines that tilt upward slightly no matter what is going on in the world or the stock market. I think people want their fixed income exposure to mostly look like horizontal lines that tilt upward slightly while kicking out some yield. About the only fixed income funds that have done that have been 1-3 month T-bills and even they weren't really yielding anything at the start of the year.

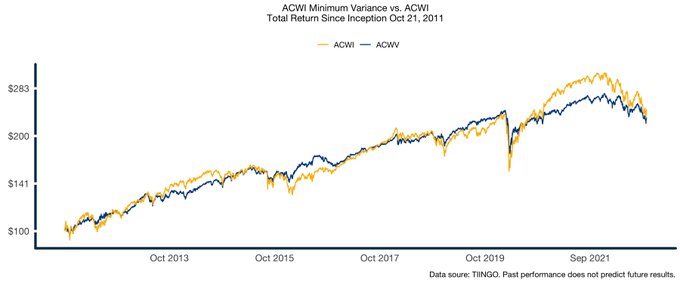

The catalyst for this post is a research paper from ReSolve Asset Management that looks at a whole much of different equity factors in search of optimization. I found the paper via an Adam Butler Tweet which included this image of which Adam said "unsurprisingly, the ACWI Minimum Variance ETF has kept up with the ACWI Cap-Weighted ETF since inception, with 3/4 the volatility and 4/5 the maximum drawdown. Same return, lower risk."

He's citing different fractions but generally describing the 75/50 concept we've talked about a few times where you target 75% of the stock market's upside with only half the downside. The point is that the factor, in the above case it's low volatility, has generally kept up with market cap weighting (MCW) with only 80% of the drawdown (his number). More on low volatility in a second.

In evaluating diversifiers in years past, one way we used to frame it was to look at whether the potential diversification benefit was a direct cause and effect or more relied some number things "going right," a few things or a lot of things.

An inverse fund might be the best example of immediate cause and effect. If stocks go down today, an inverse fund will go up. Over a longer period, the daily reset could definitely work against the holder of the fund but more often than not it will go up when stocks go down for a longer period.

Inverse fund SH has been working quite well all year as a mirror image of the S&P 500. Direct cause and effect. Gold is an example of a diversifier that should work. There's a historical tendency for investors to flock to gold when stock drop. Should is not working this year for gold, there's no direct cause an effect. That doesn't mean you shouldn't use gold, that's up to you, more like you should understand the drawback of there not being any direct link. There have been many times over the last 10 years or so where I've blogged or Tweeted that gold was in fact going up during some sort of stock market decline, unfortunately, it isn't doing so on this go around.

Client and personal holding BTAL is much closer to the direct cause and effect end of the spectrum. It goes long low volatility stocks and short high volatility stocks. In some sort of serious drawdown where low volatility stocks somehow fared worse than high volatility stocks and BTAL would not do well. The odds of that sort of outcome are quite low but it is not impossible. Far more reliable than gold in my opinion but not infallible.

Any sort of diversifier you might have used before or are using now will have some sort of risk factor that threatens it not "working" in some random event which is why I want small allocations to several different types of diversifiers.

Bonds have a long history of holding up when stocks go down, we all know this. We also know that this trade has failed miserably this year. The iShares 20+ Year Treasury ETF (TLT) is down 39% from its high back in late 2021. Bonds up stocks down is much closer to the should work end of the spectrum, it is most definitely not direct cause and effect. It's the same logic as with gold but a little more reliable maybe, bonds should go up when stocks go down.

Assessing the risk of something that you might target 40% allocation to takes on much more importance than something you might allocate 5 or 10% to. I've never been anywhere close to 10% in gold but plenty of people think that's an appropriate sized allocation. That's a captain obvious type of statement but still. The current event could very likely mean the end of 60/40 where investors just put 40% in bonds and that's it.

Back to minimum volatility. Maybe we shouldn't be putting 40% into bonds, should we change how we allocate to stocks. Could the right equity factor or maybe more than one factor absorb some of the volatility that goes with MCW or other higher beta equity exposures?

SPLV and USMV are two of the larger minimum/low volatility ETFs. YTD they are both holding up much better than the S&P 500. During the 2020 Pandemic Crash, SPLV did a little worse than the S&P 500 and USMV did only slightly better but neither offered protection. During the Taper Tantrum in 2013, both low volatility funds underperformed but that was also a very short term event. There was some sort of market event in Sept/Oct 2016 where low volatility funds went down quite a bit more than MCW, but again that was only a month and half. As I play around with the chart on Yahoo Finance, there's sort of a mixed bag on performance. But there is this.

USMV had a serious period of outperformance. When I see something like that, I immediately want to try to assess whether it can repeat. Right here right now, I don't know if it can repeat. The cyclicality of small cap and momentum outperforming off the bottom is a little easier to understand, I think that is more reliable than relying on min/low volatility.

I've come to not want to use minimum volatility. I'd rather have market beta or maybe even more than market beta with the equity portion of the portfolio and use the 40%, or whatever the allocation is, to manage the equity volatility but not be all in fixed income with that 40% as we've been talking about for years and years.

Whatever you're going to use, even if you stick with plain vanilla fixed income, you need to spend the time understanding cause and effect versus should or however you describe it which will help you have the right expectations. Then you need to understand the risk or better yet, what could go wrong. It's crucial to understand that any defensive thing will not work every single time, nothing is infallible. Even the inverse fund could compound in such a way that maybe it would only by up 5% in a down 20% world or worse. Long bonds at all time low yields were risky. Hopefully that was obvious, we've been banging that drum here for a while.

Here's the link to the ReSolve paper, it is dense reading though, not plainly written but some good things to pull out from there.

1 comment:

Your blog does an excellent job of breaking down complex financial concepts into easily digestible pieces. Diversification is indeed a double-edged sword, especially for those involved in alternative asset management, and your article sheds light on the importance of understanding the specific risks associated with it. Your mention of the challenges in diversifying across alternative assets like real estate, private equity, or commodities resonates well with investors navigating these waters. Keep up the good work of educating your audience about the intricacies of portfolio management in the realm of alternative assets!

Post a Comment