There's a news story out there about an advisor who got into a world of trouble loading up on levered long equity ETFs for clients. I saw this on Twitter, I added

In theory a 60% target weight to equities c/b swapped for 20% in a 3X fund. Problem is daily reset which effects the tracking. Over a longer period this could lag badly, outperform by a ton or be right in line, no way to know. Is there a way to create this w/o the tracking issue?

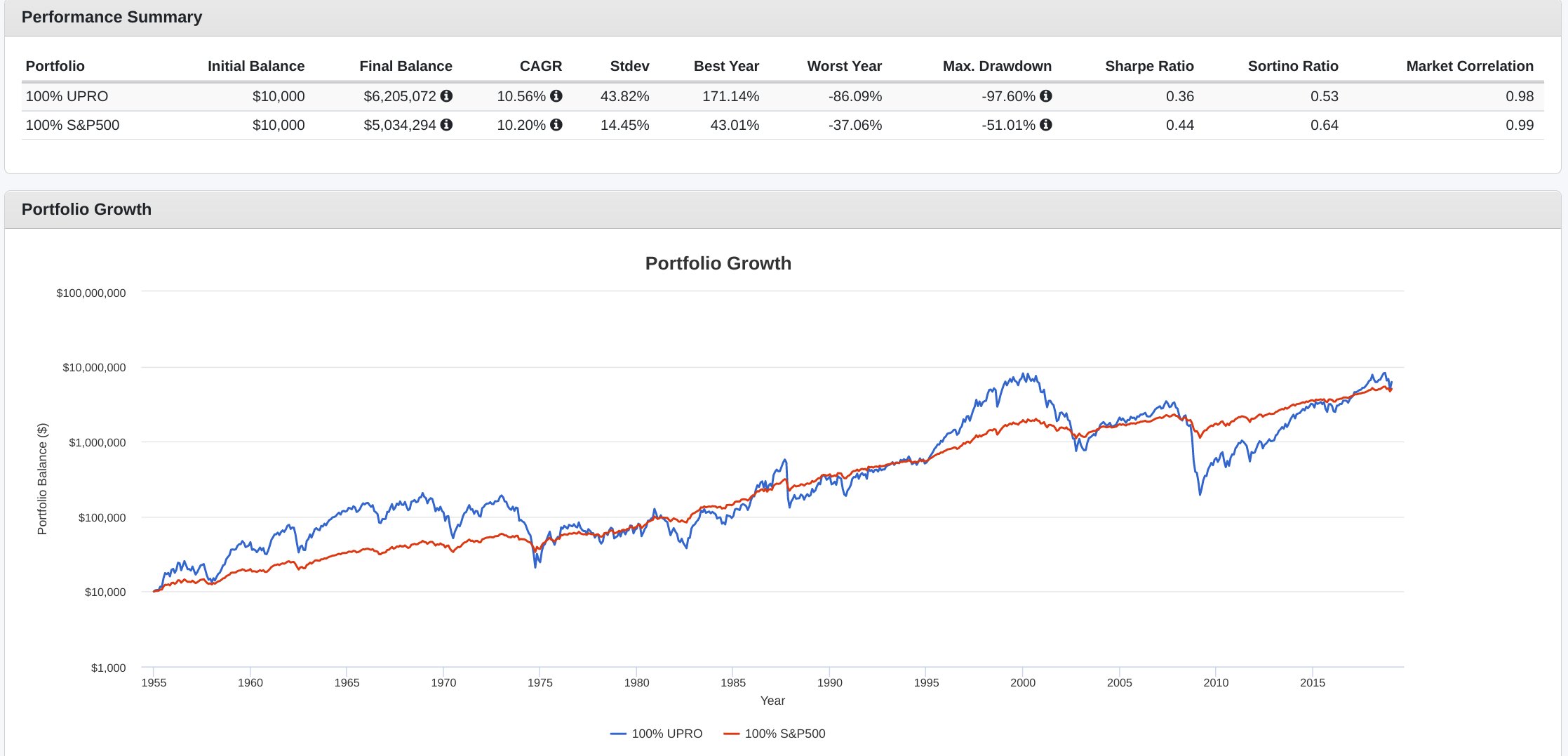

I got a reply from @HMLCompounder who back tested 3X S&P to the cash index with the following result.

He said it actually works pretty well but later added that you'd need to be more tactical. Note, this is very much a theoretical conversation. The gross numbers aren't that far off but some of those drawdowns look like deathblows. The question in my Tweet was about creating some sort of term product in the name of capital efficiency (leveraging down) kind like the buffer ETFs where a fund would capture 3x over a two year period then you could roll it over if you wanted to stick with it. I have no idea if there's any demand for that and I doubt I would want to go that complex but it's interesting.

Related to leverage, @nomadicsammuel on Twitter found a new ETF called the Direxion HCM Tactical Enhanced US ETF (HCMT). Turns out there's a mutual fund version with symbol HCMDX with a track record back to 2015. The basic strategy is that it can lever up to 200% long equity exposure based on its HCM Buyline Method. It can go defensive into cash proxies and per the latest update on the fund's website, I think I see it adding up to about 135% net long. So leveraged long in uptrends and cash proxies in downtrends? Let's see how it's done.

A slightly better CAGR with far more volatility and a much bigger drawdown than plain vanilla. Is that worth it? As a simple replacement for equity exposure, not for me, but Yahoo Finance shows the fund having a $1.3 billion AUM. It's hard to tell when ever got defensive. Maybe the 2020 Pandemic Crash was too fast for it's signal and in 2022 it was down almost twice what the S&P 500 was (per Yahoo Finance).

Obviously I have no idea how holders are using the fund but maybe there is some sort of capital efficient allocation that combined with other funds could deliver a better result than a plain 60/40 fund like Vanguard Balanced Index (VBAIX). When I say better result, I don't yet know if I mean in nominal terms or risk adjusted.

The portfolio potentially has 100% notional long exposure but RYMFX and client and personal holding BTAL often have a negative correlation to equities so potentially leveraging down and BIL is a cash proxy which for the time being has higher yield than it's had in ages.

Portfolio 1 outperformed in 6 of the 9 years studied with slightly less volatility. It spent so much time running below Portfolio 2 because it lagged by a lot in 2016. Portfolio 1 didn't really provide much cover in 2022 though because HCMDX was down 39% that year.

Playing around with different weightings, 40% to HCMDX, 5% each to the two alts and 50% in BIL was a little more interesting maybe. 80% notional to stocks less the negative correlation from the alts and a whole lot of cash lagged VBAIX in CAGR 6.47 compared to 7.35, had a standard deviation of 8.07 versus 10.32 and in 2022 was down 13.14% while VBAIX dropped 16.87%.

We've looked at plenty of portfolios with the same high level objective that backtested much better than the one we looked at today.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment