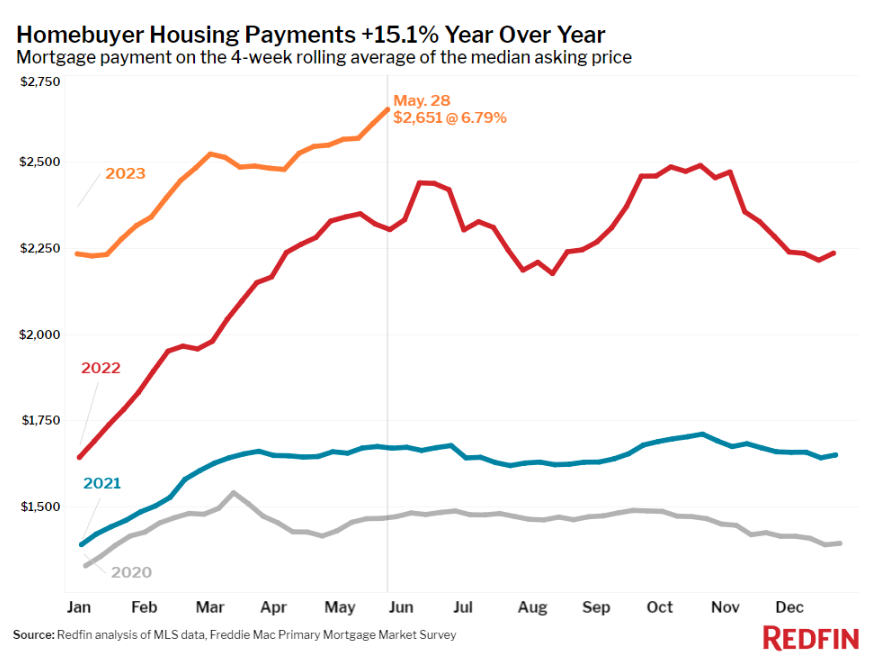

During the pandemic, interest rates were taken to zero which took mortgage rates considerably below 3%. So borrowing for housing was essentially free. Free money pushed housing prices much higher, then headline price inflation skyrocketed causing the Fed to dramatically raise rates. This sequence of events greatly distorted the housing market. This chart is a few months old but it paints a good picture of the affordability problem created from prices going up about 50% and rates slightly more than doubling.

You've probably seen content noting that many in the Gen-Z and Millennial cohorts believe they will never be able to own a home.

Quite a few years ago, James Altucher caused a little commotion when he loudly talked about why owning a home is a bad idea. His reasons included less mobility, having to pay for things like taxes and insurance, having to pay for repairs and maybe most interesting, that when you factor in taxes, insurance, upkeep and mortgage interest, that the return is pretty lousy. There's something to the argument, more so now that mortgage rates are high again. According to mortgagecalculator.org, if you take out a $320,000 30 year mortgage today for a $400,000 house, you will pay $506,899 in interest before you own the home outright. Then factor in the other stuff and you might not come out ahead in the end.

I do believe in home ownership and I think James softened his stance a little, he might have bought a house actually, but it is also worthwhile to understand the other side of your belief. Despite the potential for a poor rate of return on a house you live in, once the mortgage is paid off, you have all sorts of optionality. A very hasty way to assess future value might be to take today's value plus the interest and the term of the loan so maybe the $400,000 house today will be worth $906,000 in 2053.

Even if the $906,000 is very wrong, the house will hold some amount of value in the future. That value is optionality. It could be optionality to live rent free (other than taxes and insurance) which is an idea that Bloomberg explored. The article profiled a few couples, mostly Boomer-aged, who'd paid off their mortgages. There are now almost 40% of homeowners that are mortgage free, with people aged 65-74 being far and away the largest cohort in that sweet spot.

The article seemed to be concluding that the combo of higher prices and higher interest rates is causing older generations to age in place instead of downsizing and/or moving some place warmer. According to Redfin (via Bespoke), Boomers who are relocating are paying cash. If you're 50 or 60 then you very well are close to being paid off, so you have a lot of equity, so sure, if moving is right for your situation, why not pay cash, maybe financially downsizing a little bit to bolster savings and bypass the debt obligation generally as well as the prevailing seven whatever percent mortgage rate?

This ties in with the National Retirement Risk Index, compiled by The Center for Retirement Research (again, via Bespoke) that currently shows that roughly half of households think they will not be able to maintain their standard of living through retirement. Sadly, 50% might be too optimistic.

Where home equity in the context we're working with in this post is optionality, anyone who might not be able to maintain their standard of living when they retire should take care to make well thought out decisions with their optionality. Moving to a smaller city or town is certainly one way to beef up their retirement, they might be able to downsize a lot, financially but you don't want to go too rural either.

I think the best way to avoid squandering this optionality is to start the planning process early, earlier than you think you need to. This doesn't have to mean deciding where you're going to move 15 years from now but maybe understanding some of the pros and cons of places you might consider moving to. I have no idea if we would ever move although being 90 here might be tough, but southern Utah is a place we might consider. The winters are far less harsh than Walker and I think we'd be able to downsize financially into a new place but the tax situation (property and income) is less favorable than Arizona. Maybe we never leave Walker but instead rent a place for a couple of winter months. Feasible but expensive.

I would describe those ideas as broad sketches and we have a couple of others. Success, however you come to define it, is probably enhanced by taking up a genuine interest in this because it is your retirement outcome and as we know, "no one will care more about your retirement than you."

1 comment:

This post highlights the significant impact of recent interest rate changes on housing affordability, especially for younger generations. The juxtaposition of rising prices and higher mortgage rates has created a daunting landscape for potential homeowners, sparking valid concerns about future ownership. While James Altucher's skepticism about homeownership is worth considering, the long-term value and optionality of owning a home can’t be ignored. As retirees face uncertain futures, proactive planning around housing and equity becomes essential to maintain financial stability and lifestyle choices.

Post a Comment