Amy Arnott from Morningstar wrote Top 10 Things To Know About Building A Diversified Portfolio. There are some good ideas here, some of which we've covered before like no way of knowing what segment of the market will be the best performer, this pertains to individual holdings too, that REITs aren't great diversifiers but there is absolutely a place for the attributes of higher yield and lower beta and she also touched on alternatives.

She said when it comes to diversification, not all liquid alternatives are the same. Maybe I am selling Morningstar short but I am pleasantly surprised that they acknowledge that alternatives can play a role in a portfolio. I agree with their point here but I think it could have been expressed a little more plainly. If you are going to use alternatives, it is crucial to understand the strategies well enough to know what they will and won't do. Merger arbitrage is not likely to go up when stocks drop a lot, it is likely to be flattish. Over time, if the fund is executing well, it should go up slightly most of the time with very little volatility. You'd have to look elsewhere for alternatives that provide a good chance of going up a lot when stocks drop. And of course, the thing that goes up a lot in down markets will probably go down in up markets so you don't want to be too heavy in that type of alt because stocks go up most of the time.

Business Insider had a quick writeup on Mark Spitznagel's call for the "worst crash since 1929." When rates were low, a flood of debt was issued and now that rates are up it has created a debt bubble that will pop at some point, by his reckoning, after an even bigger run up for equities into a state of euphoria and then whoooooooosh.

So he is basically laying out a serious risk factor and hyping it up some by referring to 1929. Most of us have been through two episodes of the stock market cutting in half and several other 20-30% drops. There will be future such events and maybe Spitznagel will turn out to be exactly right but what happens after that? The market stops going down, begins to work higher and eventually makes a new high. I've been saying that forever, it has always worked out that way and if you don't agree with me that it always will work out that way then you might want to sell right now at the high and never buy stocks again.

As opposed to trying to guess when the next market event will happen, I would rather maintain exposures to holdings that should go up when stocks go down, holdings that should trade like horizontal lines no matter what is going on and have enough cash set aside to meet clients' expected income needs. Knowing, your income needs are secure while the market is crashing, there will be future crashes, is very empowering.

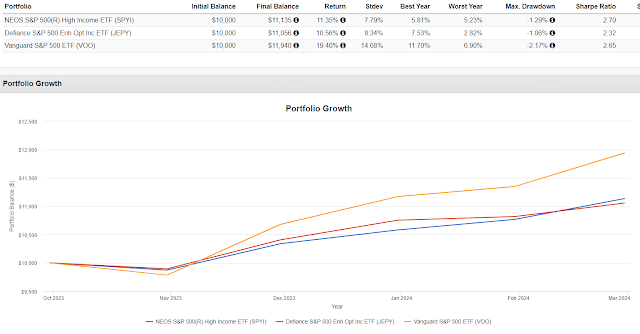

On Wednesday I sat in on a presentation about the NEOS S&P 500 High Income ETF (SPYI). It's another covered call fund whose strategy is to buy all the underlying stocks and sell index options against the basket of stocks. They are capturing favorable 60/40 tax treatment on the options and a lot of dividends from the stocks are qualified. They said this methodology gets the after tax yield up into the mid-eights versus a six handle yield from competing strategies. I am relaying what they said, you can talk to them for more details. The fund is actively managed which allows them to stagger the strike prices of the calls they sell and to not cover the entire portfolio both of which they say allows for better upcapture than something like Global X S&P 500 Covered Call ETF (XYLD).

Well not always but still.

In trying to study these, it is clear to me they are not going to look like the S&P 500 on a price basis and even in the SPYI powerpoint, it didn't really look like the S&P 500 on a total return basis. Since SPYI's inception though, the S&P 500 is up a lot which doesn't allow for down market or flat market assessments which would be relevant.

The following comparison is interesting.

JEPY sells 0dte put options. In an email from Defiance when they started to list this strategy they said these put selling funds should look like covered call funds. So far it is certainly meeting that expectation which again means not capturing the return of market cap weighted equities. There is some price appreciation on a total return basis (need to reinvest most or all of the dividends) and the standard deviation has been much lower so far. I'd like to see a bear market test to feel more confident in that observation though.

Can the attributes of the options funds (derivative income funds) be combined with other things to create a result that is competitive with a plain vanilla 60/40 portfolio but avoids bond market volatility?

Obviously the answer is yes. We could play around with quite a few different ideas but for now, the one above, blending SPYI with Standpoint Multiasset (BLNDX/REMIX) which is a client and personal holding give a result like I described above. Again, it is not a proxy for the S&P 500 but it seems like a reasonable proxy in the very short period available to test for 60/40. It gives up some growth which would compound to a big difference if the numbers stayed consistent (big if) but with significantly less volatility than 60/40.

I think the attributes here are desirable but IRL it would need to be built with more holdings than just two in case something goes wrong for a year or two which could happen with any sort of alternative strategy.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment