Let's have a little fun with a difference of opinion about how to incorporate managed futures into a portfolio between to big proponents, Corey Hoffstein from ReturnStacked ETFs and Andrew Beer who runs the iMPG DBi Managed Futures Strategy ETF (DBMF). There are two relevant links, Andrew was on a podcast and talked about return stacking between minutes 47 and 52. He's not a fan of the idea, calling it a niche product most likely to be used by younger, more aggressive advisors who might have something to prove. The other link is a Tweet storm from Corey rebutting much of what Andrew said. You can check out both to see which argument is more persuasive.

Both of them talk about how to add managed futures to a portfolio. You could take some from stocks, some from fixed income or both. Return stacking adds it on top of the whatever stocks/bond mix being used so you don't have to take it from anywhere. Leverage used in this manner is not that new but maybe sort of new with retail accessible funds although I would note PIMCO has done this in mutual funds since at least 2008.

This "where do you take from" is not really a dilemma for me. They frame it as a tracking error issue but we've looked at that before, I don't really find the tracking error problem to be a problem at all. And as we'll see further down in this post there can no guarantee that stacking an alternative on top of stocks or bonds in one fund will be additive to performance.

They appear to disagree over how beneficial it is for managed futures that T-bills now yield 5%. Most of a managed futures fund is held in cash, usually T-bills, which collateralizes the futures used and interest is earned on that cash/T-bills. For a little while now, cash has been yielding 5% while a few years ago it was yielding zero or close to it. This is something I've tried to explore with different people over the years. How much extra benefit does that extra 500 basis points give to managed futures, better worded, how meaningful is it? Anytime I've asked anyone who knows more than me about it, they've said it doesn't mean much. I can't get to that conclusion. It's an extra 450 or 500 basis points, for now, that these funds weren't getting a few years ago.

Corey then devoted several Tweets to the tradeoff between bonds and cash that I didn't entirely follow but Corey said "if you follow Andrew's logic, you'd have to ask yourself 'wait, why do I own bonds at all?'" You might recall from previous posts, I don't own bonds, haven't in quite a while. Some portfolio managers might very well be constrained that they have to own bonds, chances are you are not constrained in that manner. Part of what I've said about the ReturnStacked products is that the decision to buy them has to include that you want the bond exposure they have. I do not.

To Andrew's point about multi-asset funds that use leverage being a niche product, well yes, of course they are. Relatively plain vanilla managed futures is a niche product space. Absolute return is a niche space too. I think these are all niches and I do not think that is a slight.

Corey thought that Andrew was overly focused on line item risk which is the behavior of worrying more about how a couple of holdings are doing (the trees) versus how the entire portfolio is doing (the forest). It didn't sound that way to me but either way, actual line item obsession is a problem but it might be a close cousin to the effort needed to make sure something is meeting expectations that the fund company is setting. If stocks are up 20% in a year and most managed futures funds are down 5%, then worrying that your managed futures fund is down 7% is an example of what line item risk is about, worrying about the wrong thing. If in some environment most managed futures funds are up 7-11% and your fund is down 8%, that is worth digging in to try to figure out if there is a problem and then deciding what to do if there is a problem. Even in that example there might not be a problem but I would spend the time to figure that out.

Here comes some harshness. I have mentioned a predecessor fund the Corey (or Corey's company) managed, the Newfound Risk Managed US Growth Fund which recently closed, it had symbol NFDIX. It was a 75/75 stocks/bonds fund. Because it is closed it is tough to find charts but I found one site that still charts it, portfolioslab.com.

This chart compares it to Vanguard Balanced Index (VBAIX) which is a proxy for a 60/40 portfolio. When NFDIX closed, VBAIX was up about 80% for the same period. Even if the 75% to bonds created a serious problem for 2022, NFDIX should have outperformed 60/40 up until that point if nothing else and it didn't.

The ReturnStacked Bonds & Managed Futures ETF (RSBT) now has one year of track record to look at. You can see what I'm comparing to. Not included but AQMIX is up 11% in this period.

It's only a year but how different is it from NFDIX' first year? I mentioned PIMCO up above. They have a suite funds that travel in this circle. I believe the one that is most widely known is the PIMCO StocksPLUS Long Duration (PSLDX) which is 100/100 stocks/long bonds.

I think Portfolio 2 replicates 100% into NFDIX and the time period is adjusted to capture the same period as the portfolioslab chart. Again you have to want the bonds it owns, 2022 was a dreadful year for it of course, but the comparison looks like what I'd expect. Portfolio 2 here was up 107% versus 17% for NFDIX in the same period. NFDIX traded for a decent period of time and RSBT has traded long enough to make a first impression. Is there something that isn't right with their process? I don't know but I feel like it is a reasonable question at this point.

So maybe the PIMCO funds work better. There are other capital efficient funds that might work better than the ReturnStacked funds. This is exactly what I mean when I talk about a fund setting expectations, being very cautious about complex funds/strategies and only taking bits of process that appeal to you from various sources to create your own process.

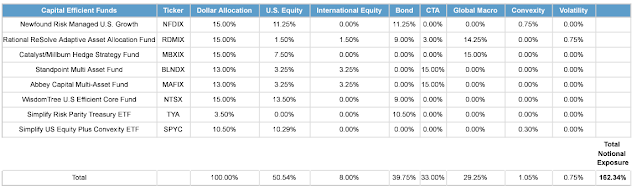

Part of the fund expectations is our ability as potential end users to understand the strategy well enough to know where to poke potential holes. I feel like I've had good luck with that. Caution or even skepticism about complicated funds is an important trait. I've described client portfolios as simplicity hedged with a little bit of complexity. Here's a table that might look familiar, it's an old one of the ReturnStacked 60/40 Absolute Return Index.

It is an extremely complex portfolio. There is influence here and things to learn but no, not my cup of tea. The influence for me that we've talked about many times is using a couple of negatively correlated assets to add a little more equity exposure without increasing standard deviation. It's a form of leverage, gross equity exposure that is a little above target without actual leverage. Another point of influence is that I believe smaller allocations to complex funds can reduce volatility and correlation if that is the objective, it is for me.

I hope the ReturnStacked funds, the other two appear to be struggling as well per their Q1 report (scroll down to page 15), turn it around. This is interesting work they are doing, it is beneficial to me even if I draw different conclusions, they are generous with their work and it is fun to sift through their research.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

5 comments:

I have like 35% of my portfolio almost in RSST. I had used RSBT before, in a smaller allocation, and understand how 2023's march regional bank run hit it hard, but I think your comments show some underperformance from expectations of similar ETF's like DBMF. I think in the prospectus though, Resolve handles the managed futures--I'd wager the system is different from the one NFDIX employed?

Also of interest, RSSY I believe launched in two days. It appears it's a SPY + GSAM carry index. The carry strategy I'm guessing is put towards a 10% volatility given some backtesting used in an article about a few weeks ago: https://www.returnstacked.com/a-different-way-to-outperform-benchmarks/

Given the returns in the article reflect indexes wonder how transaction costs and fund expenses would impact the returns.

Thank you for the comments and the link. I'm curious to see what RSSY will do when it hits the market, didn't know it was this soon. NFDIX wasn't trend like RSST or RSBT, it was just equity and fixed income similar to RSSB. Most of the trend funds do seem to each have their own wrinkle to them. I use ASFYX because it allocates a small slice to a faster signal than what I believe the others use although that didn't spare from getting whipsawed a year ago March.

Missed your point on NFDIX being equity + bond even though you mentioned that several times in your post. I'm a relatively young investor, 35, and so far looking for the cooking ingredients of a portfolio for growth.

So far, reasonable cheap leverage seems to make sense to use to get uncorrelated assets with a high enough expected return. Thinking this is a great way to get cheap beta + carry + managed futures. Make that half your portfolio, e.g. 25% RSST, 25% RSSY, and then blend value + momentum (alpha architect and advantis) w/ international of each, and you probably have a diversified asset + diversified equity factor portfolio.

wondering if you've examined NTSX as a return stack etf

Yes. If you plug the symbol into the search bar to the right you'll find some posts. The short version is the fund track very well. 67% NTSX is very, very close to 100% VBAIX. To use NTSX you have to want AGG-like bond exposure. I do not want that exposure so I don't use that fund anywhere.

Post a Comment