As we've looked at before, there is plenty of research to support going heavy into various forms of trend following. Meb Faber has talked about this quite a few times, the ReturnStacked ETFs exist because of this idea and here's another article that also talks about it by Optimal Momentum. The following was interesting, obviously citing Ray Dalio;

This is obviously a drum we've been banging for years for the most part. I disagree with them that holding equities for the long term is a bad idea but have gone through more adverse market events than I can remember at this point using strategies/exposures besides fixed income to help avoid the full brunt of large declines.

This led me down a little bit of a rabbit hole to look at using managed futures as a replacement for bonds. Here's a sampling of funds that do just that, they combine equities and managed futures in pursuit of a smoother result, there are probably other ones too. BLNDX is a client and personal holding.

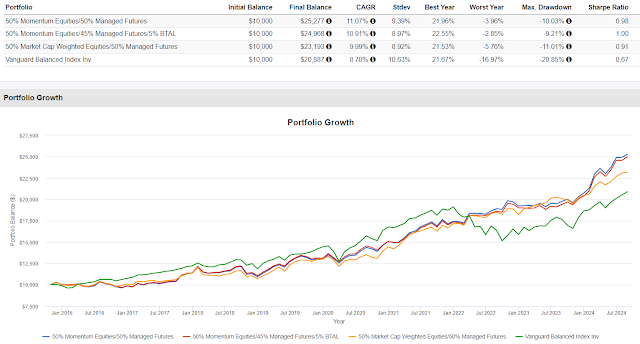

Then I did a little DIY to blend momentum (trend) equities with managed futures (trend).Portfolio 2 uses BTAL as a hedge. BTAL is sort of anti-trend because it shorts high beta. The three versions in this backtest look like VBAIX almost all the time which is ok, VBAIX works almost all the time. They deviated in 2022 for the better and also in 2016 when they all lagged VBAIX.

To the excerpt above, the combination of trend and trend reduced risk and improved portfolio stats. Of course, there is no guarantee it will always work but then bonds didn't work in 2022. In the real world, 50% in managed futures is far more than I would consider but the study makes the point of how trend can play a crucial role in long term portfolio success.

Matt Markiewicz from Tradr ETFs sat for a short podcast with ETF.com. This the is company that issued the 2x SPY ETFs with different reset periods. So far there is a weekly fund and a monthly fund and the talk during the podcast gave me the impression that the quarterly version is going to happen on October 1st. Again today, they were not too far off the mark. You can decide for yourself whether they are close enough to consider using but so far, no catastrophes.

If you have any interest in learning about these, the podcast is worth listening to.

Finally, a screen shot from a marketing email for a very low volatility mutual fund.

I circled the volatility. Obviously, this will be laid out to cast a favorable light on the fund but by and large it does well as a fixed income substitute. There are of course times where it lags all of those benchmarks listed. It has compounded at three times the rate of the iShares Aggregate Bond ETF (AGG) with half the volatility. On paper, who wouldn't want that but holding on to that type of strategy can be very difficult for trying patience. It goes for long stretches doing nothing or at least very little. It's a great example of the need for patience.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

2 comments:

Roger, I appreciate your ongoing blog posts. I find them quite informative. I am enjoying your coverage of the new leveraged ETFs resetting weekly and monthly — definitely worth monitoring. One question — can you share the ticker of the low volatility mutual fund that might be a good fixed income substitute. Thank you for your ongoing work!

It's one I write about all the time. ARBIX which is convertible arbitrage.

Post a Comment