We're going to cover a lot of ground with this post. We'll start with a paper from Cambria with the amazing title of The Bear Market In Diversification. The TLDR is that the basic building blocks for how to build a diversified have lagged badly behind the S&P 500 for a long time causing frustration for some investors. Here's a great chart to illustrate the point.

GAA stands for Global Asset Allocation and it has been lagging for 15 years. The other thing that stands out from this chart though is how much smoother the ride is for GAA. GAA consistently had smaller drawdowns. It's not quite apples to apples because GAA includes bonds but the point of frustration setting in when doing the "right thing" lags for an extended period.

That leads to a Tweet from Krishna Memani who worked at Oppenheimer for a long time and who has been running the Endowment at Lafayette College since 2020.

Cliff Asness retweeted it and chose rhetorical violence in taking Memani down calling this a "stupid argument." Cliff goes on to ask "d

o you actually think just doing what’s worked better over the last 30 years automatically is what will work better going forward?" Of course that is what diversification is all about. There's no way to know what happens next, what will lag or what will do very well. Diversification offsets the consequence of guessing what will work and being wrong.

We spend a lot of time here on how to diversify to try to smooth out the ride and how to hold up better when markets have a year like 2022 or 2008. For us, that includes alternatives. Barron's had an article about alternatives sought by the "super rich." Kind of what we talked about Friday, these ideas are expensive and create a sense of exclusivity which I would avoid but where part of the story is trying to find uncorrelated return streams, maybe it's worth spending a little time learning about the exposures.

Included in the article were aging whiskey which I don't what that is, like maybe something to do with leasing the barrels? Another one was music royalties. Hipgnosis Song Fund traded in London for a while before some sort of buyout.

If another music fund ever lists, I'm not sure Hipgnosis' results would cause some new fund to automatically be a buy but people do make money in this space. I can believe that the royalty stream could be uncorrelated but that doesn't mean a publicly traded fund would trade in line with the royalty stream.

There were a couple of other ones mentioned including parking lots. We all know someone who has said "parking lot's are cash cows." I found one stock that is a parking lot business, Mobile Infrastructure Corp (BEEP). BEEP came about from a SPAC deal and for now, it is a REIT that pays no dividend. It has mostly trended from the upper left, to the lower right before rocketing up by 50% in the last couple of weeks perhaps thanks to a refinancing package.

From my perspective, there's no reason not to learn about these things even if there's no catalyst to ever step in but one of them could turn out to be the next catastrophe bond fund (I'm saying that as a positive as I have begun moving clients into that space).

Also from Barron's an article about to how to prepare for a potential uptick in stock market volatility. The article was so empty, I'm not even going to link to it but there were two comments to mention. One said to just buy a low volatility fund and another said to sell call options.

This brings us to the heart of today's post about trying to build a set but don't completely forget portfolio. The first part is the core of the idea which is broad based equity beta. It almost doesn't matter because whatever you choose is going to be suboptimal 2/3rds of the time if not more. To the above paragraph, low volatility and covered call funds will be suboptimal more than 2/3rds of the time. That doesn't mean they are invalid for every investor's circumstance.

We've looked at some covered call funds that really don't capture any upside. If you want or need some market upside, don't buy a fund that's never had any. Market cap weighting is probably the simplest way to go, it certainly will get the job done assuming no panic but it will often be suboptimal versus other ways to access the broad market including momentum and quality, there was a time where equal weight and buybacks had decent runs outperforming. Some sort of all world proxy fits the bill too.

I would not pick value as a proxy for broad based equity beta but not because it has underperformed for so long. Well sort of due to the underperformance. Where growth has been so dominant, I could see the tables turning to favor value for an extended period and if you are on the wrong side of that you could end up getting left far behind or compounding the problem by switching at the wrong time. I think it's just simpler to avoid this decision and go with a broader exposure for broad based equity beta.

The next allocation in this set but don't completely forget is a first responder type of defensive. This can be anything that reliably goes up when stocks go down. For me this is AGFiQ US Market Neutral Anti-Beta ETF (BTAL) which is a client and personal holding. In the models below, every back test has a 5% weighting to BTAL. I don't think a huge weighting to a first responder is crucial. This slice of the portfolio will go down more often than not, it is a tool to smooth out the ride.

Next up is an exposure to second responders like managed futures, long/short, gold (commodities) or some sort of macro strategy. Ideally this sleeve would have a low to negative correlation to equities but might not necessarily go up on a day like last Wednesday. The idea is that these can go up over slower, more protracted equity market declines.

The last slice would be horizonal lines that tilt upward. This could include arbitrage, catastrophe bonds, floating rate, even T-bills as examples.

- Broad based equity beta 65%

- First responder 5%

- Second responder 10%

- Horizontal line that tilts upward 20%

Conceptually, this is not that far from 60/40. The first responder exposure allows for increasing the equity exposure as a form of leveraging down as we've described it before. All the models below have the above weightings but I bet 70% equity would work too.

Referencing the weightings above, all of the portfolios have 65% in equity beta. Where equity beta is the driver of returns, I've labeled the portfolios accordingly. They all have 5% in BTAL and for the second responders and horizontal lines that tilt upward I'm using different ones in each portfolio. The names don't matter too much but you can play around with those yourself.

Yes the ACWI version lagged by a good bit but had the lowest standard deviation so that's something but that doesn't translate into a better risk/reward as measured by the Sharpe Ratio. Foreign will outperform domestic as some point. Buying ACWI now is a bet on reversion to the mean. Early on, the MCW and Quality versions outperformed VBAIX slightly, probably just due to having a little more equity exposure and all three of them significantly outperformed in 2022.

In should not be surprising that the minimum volatility version has less volatility and a lower return. The min vol version was only down 1.76% in 2022 which is fantastic but the tradeoff is years like 2020 when it was up 85 basis points while all the others ranged from up 10.83% to up 17.90%. The min vol version is valid longer term but 2020 would have been a challenging time to hold.

The final ones attempt to diversify some of the idiosyncratic risk of just using one factor or one second responder and so on. Northrup Grumman and CBOE are client holdings. We've mentioned those two names in this context before because they have some first responder traits.

The version with momentum had the highest return by quite a bit. Market cap weighted plus NOC and CBOE had the second best return but had the best Sharpe Ratio. A couple of them lag performance-wise but that tends to coincide with less volatility too which is a decent trade off.

A key point of understanding that will become apparent if you play around with the ideas yourself is that anything that you would gravitate to would be suboptimal more often than not. The equity factors tend to take turns having the best performance. A first responder defensive is going to go down frequently. Some will have more bleed than others but if you're first responder is leading the portfolio, chances are things aren't going very well in the world. Second responders can provide long periods of frustration. Looking at the history of a backtest is different than enduring a dry spell. Managed futures is a phenomenal diversifier but has been in a funk for awhile. The current funk is nowhere near as long as the languishment of the 2010's though.

Where we allocated 10% to second responders, only one of the models has all 10% in managed futures. In real life, I don't have that much. When managed futures was enjoying its 2022 glory there were of course many calls to put huge weightings into managed futures which is a behavior we've seen before with MLPs and REITs before the Financial Crisis. A couple of managed futures funds are doing well this year but trying to guess which one will be the stand out is difficult to do and if you split 20% of your portfolio between 5 of them, you'd probably feel the same frustration of owning just one that was languishing.

The portfolio above that I called blending three funds for each category except BTAL and adding NOC and CBOE has 12 holdings. Adding some asymmetry would add one or two more to that number. It would be easy to shave one or two off in the broad based equity beta sleeve but I think diversifying your diversifiers for second responders, if the weighting you choose is large, and horizontal lines that tilt upward is important in case something goes wrong. Where just 5% is allocated to a first responder, I believe there is less need to diversify that sleeve.

One last thought before closing out. Where we've been talking about a portfolio that has four quadrants, that seems sort of Permanent Portfolio-ish. Let's move a little closer to that idea by equal weighting broad based equity beta, second responders and horizontal lines that tilt upward. We'll keep BTAL about the same. 25% in BTAL would pretty much neutralize the equity beta. Two different versions;

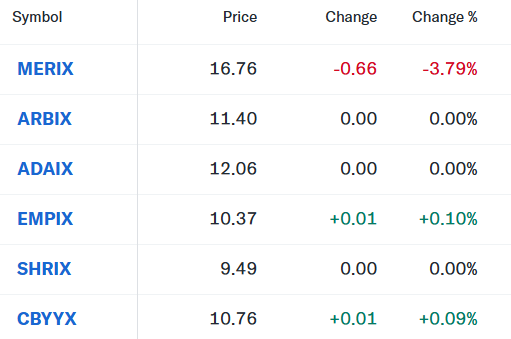

MERIX is a client and personal holding.

They both look pretty good but if we stop the backtest at yearend 2021, they both lag VBAIX by 350 basis points annually.

Where I called this set but don't completely forget, there would be work to maintain those general weightings. If some sort of asymmetry like Bitcoin was added and started to pay off though, I would let that grow without rebalancing. Chances are anyone taking on this on would also want to have some sort of cash bucket too.

Does any of this meet the burden of simplicity hedged with a little bit of complexity? That might be a push if 35% of these portfolios are in various products that offer alternative return streams but maybe we can get there in a subsequent post.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.