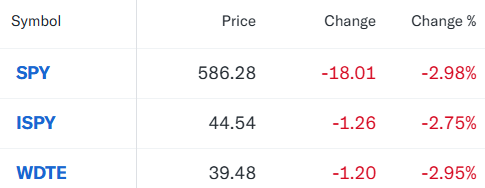

First, I wanted to recap how a few pockets we look at regularly here did in Wednesday's carnage.

Next up are a few YieldMax fund with their reference securities. They YieldMax funds did go down less but they still took on plenty of downside capture.

Client and personal holding PPFIX which also sells puts got hit pretty hard. They emailed me first thing this morning. The huge spike in the VIX required them to mark a couple of positions to market that they believe will self correct (snap back) quickly. We'll see. A smaller portion of the drop was attributable to their risk management process dictating the sale of a "couple of positions." This is a perfect example of why you diversify your diversifiers. I would reiterate that the spike in VIX yesterday was huge.

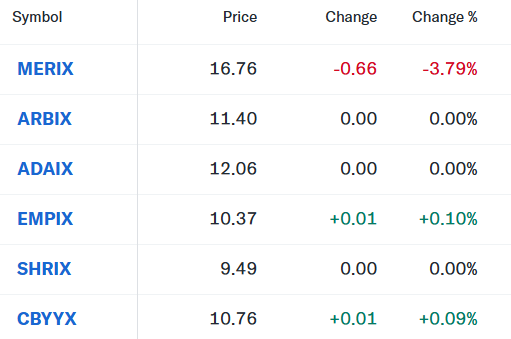

The next batch are horizontal lines that tilt upward. MERIX went ex-dividend, the fund was actually unchanged. It goes ex on the third Wednesday of December every year. These all did what you'd hope they would do but again, there can be no assurances. MERIX and EMPIX are in my ownership universe. EMPIX is due to go ex-dividend today.

Managed futures were a mixed bag yesterday. The standalone fund I use did relatively poorly but was down much less than the S&P 500. Not calamitous but not great either. This is another example of why you diversify your diversifiers.

Invesco S&P 500 Momentum (SPMO) was down 3.2%. We don't talk about the quality factor much but the GMO US Quality ETF (QLTY) was down 2.6% and the Invesco S&P 500 Low Volatility ETF (SPLV) was down 2.05%. And of course Bitcoin got hit hard and is still struggling today.

Finally, a follow up on the GraniteShares YieldBOOST TSLA ETF (TSYY). The fund sells puts on TSLL which is a 2x long Tesla ETF but TSLL is not a GraniteShares product, TSLL is a Direxion fund. The GraniteShares 2x TSLA fund has symbol TSLR. GraniteShares also as a 1.25x TSLA ETF with symbol TSL. TSLL has far more volume than TSLR so kudos to them for going for what is probably a deeper market with TSLL.

The holdings for TSYY were posted this morning. With TSLL in the mid-$30 most of the day yesterday, before Powell, TSYY appears to have sold puts at $28.06 that expire on January 3rd but please leave a comment if you read that differently. Those puts would be assigned below $28.06 or expire worthless (that's what you want to happen when you sell puts) if TSLL stays above that price.

Here's what's happening today in the TSLA complex.If the YieldBOOST funds can live that far out of the money then some sort of barbelled fixed income strategy as we discussed yesterday seems less crazy but the dividends will still be ordinary income.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment