The Wall Street Journal has an article up this weekend about investors rotating to dividend centric stocks and funds because they are doing well in 2025 as market cap weighting has struggled, especially since mid-February.

The Schwab US Dividend Equity ETF (SCHD) seems to garner the most attention. If you read the comments on various articles (always read the comments) there will frequently be at least one comment that says "put it all in SCHD and forget it."

Dividends are a factor similar to momentum, quality and the others. It's a good bet that each factor will have its time in the sun relative to other factors. Dividend investing certainly has had it's share of relatively good years but there will also be the occasional year where it will lag badly. In 2023, SCHD was up 4.57% total return, 78 basis points on a price basis while the S&P 500 was up 26.19%. Of course the year before, the S&P was the stinker while SCHD was only down 3%.

A portfolio strategy that goes narrower than a couple of broad based index funds probably has some exposure to dividend stocks already so the decision about whether to make any changes can be moot, you already have some exposure. Maybe you have enough to capture the effect or maybe not but if a portfolio is reasonably diversified, they're already in.

The blue line and the purple line are dividend stocks in my ownership universe. Yes, they're doing well this year but they are both very long term holds and when dividend stocks underperform, these two typically underperform. However long this good run for dividend stocks lasts, I expect they'll participate and that the next time dividend stocks underperform they will too. I believe they are both great companies but no great company can always have the best stock performance. Knowing they cannot always be best, I mean really understanding that reality makes it much easier to hold them when they are lagging.

In late January we

took a quick look at RDMIX after it changed its strategy to become the

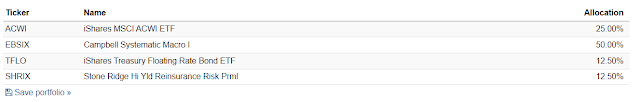

ReturnStacked Balanced Allocation & Systematic Macro Fund. The strategy is now also an ETF in Canada, they sent out an email promoting the ETF which was a good prompt to play around with it a little more thoughtfully. The fund puts 50% into global equities, 50% into core bond exposure (100% into balanced allocation) and then 100% into systematic macro. It's a fascinating idea, all their ideas are fascinating and maybe there is something to learn from the allocation.

You can see how I built the core. I don't want to use AGG-like bond exposure so we're using these substitutes. The allocation mix is true to RDMIX/the Canadian ETF. The backtest includes a leveraged version like putting 100% of a portfolio into RDMIX/the Canadian ETF which is not how they intend it to be used, the above leveraged version and then Portfolio might be a way they do intend it to be used.

To be clear, Portfolio 3 does use the portable alpha approach, it is leveraged by 40%. The alts in the leverage sleeve all have a low to negative correlation to equities and to each other. BTAL is a client and personal holding. Portfolio 3's worst year was 2018 when it fell 7.76%. Portfolio 2 had two years where it was down 5% (those were the worst two) and the leveraged version's worst year was 2018 when it fell 12.26%.

When we do these exercises, I'm not really trying to find something that will compound miles ahead of plain vanilla, the objective is more about smoothing out the ride and trying to build a portfolio that will have a robust result in the face of a market event like in 2022 or maybe even a fast decline like the 2020 Pandemic Crash. Interestingly, Portfolio 3 was only down 6 or 7% in the 2020 Pandemic Crash but for the year, it was that portfolio's weakest up year in the backtest if that makes sense, up less than 5% versus 16% for VBAIX. The Calmar Ratios for all three are much higher than VBAIX but the kurtosis numbers a slightly inferior.

The idea seems to have merit, maybe we should call it the Homemade Hedge Fund. There is no reason anyone trying to implement some variation of this needs to put such a huge weighting into just one fund, EBSIX in this case, for the macro component. EBSIX' worst 12 month stretch was a decline of 13% from June 2013 to June 2014. While that is not a catastrophic number, it's a visible risk that seems easy to mitigate.

ETF Hearsay tweeted that the Brookmont Catastrophe Bond ETF will start trading under the symbol ILS. ILS stands for insurance linked securities. Here's the

site for the fund but there's nothing on it yet. Wes Gray from Alpha Architect replied with some skepticism about cat bonds working in an ETF wrapper. Dave Nadig chipped in noting the 1.58% expense ratio but that is in the middle of the pack of funds. I'll be curious to see if cat bonds can work in an ETF.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment