Minimalist Joshua Becker had a blog post listing other areas besides stuff where minimalism works. He touched on a couple of finance related topics. I will pivot off that to talk about having a collection of investments and why that can be a bad idea. Embedded in all of Becker's writing is that he often equates minimalism with simplicity. I think that's a good parallel. Ideally an investment portfolio is relatively simple.

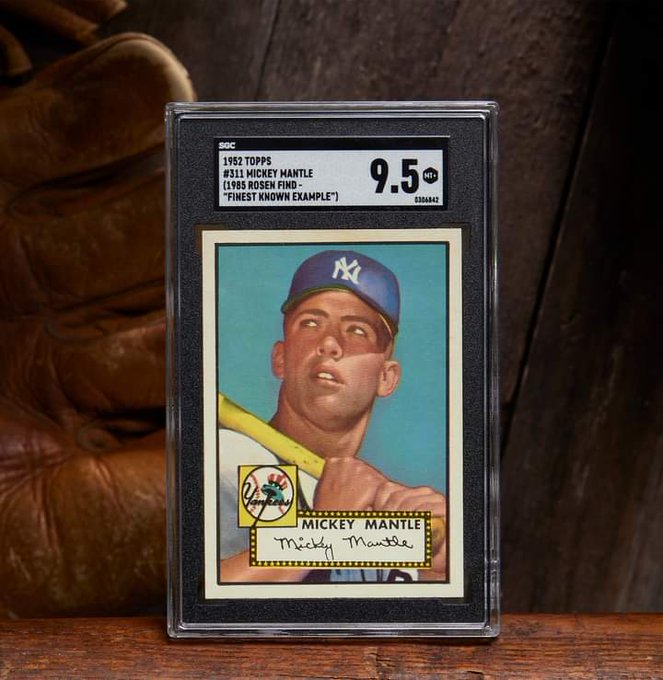

The catalyst for this post is an auction underway for a 1952 Topps Mickey Mantle baseball card with a very high grade of 9.5 where the current bid per Twitter is $4.5 million. Hold on, make that $4.8 million.

I quipped how big does someone's portfolio have to be to allocate that much to an alt/collectible like a baseball card? I also wondered if maybe it was a company that would then sell fractional ownership via shares.

And because it is related and I mentioned it the other day, it appears as though the Air Jordan market is correcting or crashing, per an article in the Wall Street Journal. If Air Jordans are an investible niche (not calling it an asset class) and you either know something about them (as investments) or are willing to do a lot of learning then buying from desperate sellers isn't the worst thing you can do. Like the question above about the Mantle card though, how much are you to allocate to sneakers? You're 50, you had a pair or two when you were a kid and these create some sort of nostalgic feeling; you have $600,000 in total savings, are you going to put $6000 into Air Jordans? How about $3000? I don't have an answer, this is not something I'm going to make an investment allocation to.

Aside from maybe not understanding the emotion (and really not knowing much of anything here), there seems to be no diversification benefit, they appear to be pro-cyclical. The WSJ article implied that the market benefited from fiscal stimuli along with everything else, now markets are in a downtrend and so are the sneakers. Will they recover faster than equities or go up more than equities? I don't know, maybe, not the bet for me. This seems complicated, the way you buy them, there are occasionally questions about authenticity and as I mentioned the other day, proper storage will matter too.

Then I got to thinking about other vintage sneakers, what about suede Pumas, those are pretty cool? I didn't see any for sale at price that made me think there's an investible market there but please comment if you know otherwise. What about Adidas Superstars? Not as cool as the Pumas or Air Jordans but still. I found this listing for $750 on eBay. Maybe it's a joke but why would anyone want these even for free?

If anyone knows about these please comment, but no way. This sort of investment is complicated for most people.

So back to baseball cards. I have a little more understanding here. If you follow baseball, you might know who Wander Franco is. He's a very promising 2nd year player for the Rays. He's shown some flashes of being a very good player and he might turn out to be great. But what if he doesn't turn out to be great, what if he's just mediocre or even just a little above average?

That card apparently sold for $56,000 in April 2020. I doubt too many of us reading this have $4.5 million in total, let alone to buy a Mantle but $56,000 is more likely accessible but how does that kind of money on an unproven player make any sense? The value of Franco's cards rely on two things, what happens in the hobby, there will always be booms and busts, and what he accomplishes as a player which is still up in the air. If the hobby continues to thrive but Franco craps out, his cards will drop in value even as the market goes up.

Contrast that with a 1951 Bowman Willie Mays card, here's one $18,500. There's only one realistic variable that will move the price of this card, the overall boom/bust cycle of the hobby. There's nothing that Mays is going to do that will impact the price of his cards. I have no idea if his cards would appreciate more or less than other cards but it is a good bet the price will be higher if not in the current cycle, then during the next boom.

$18,500 is probably even more accessible (obvious statement) but this is way out of my league. I've never spent $185 on a card, not even half of $185 on a card. Involvement at this level requires serious study, although I might know a little, despite being less complex than a current day rookie with no established track record, buying vintage cards of HOF legends at this sort of price point is still plenty complex. And as I always say in these sorts of posts, if you want to spend, not invest but spend, a couple of hundred bucks on fractional ownership of a card like the Mantle, go for it, it would probably be fun.

A little more on point now to a stock and bond portfolio is the recent swell in hatred on Twitter directed toward Jim Cramer. I sort of know him from my time at TheStreet.com, I am not going to bash him and he can certainly defend himself. What I've said about him before that I think still applies is that he has put himself in a position have having to churn out opinions on stocks, many different stocks, all day long. It's not logical to think someone can have an informed opinion on so many names which sets him up to be wrong a lot. If you publicly express an opinion on 50 stocks a day you're going to be wrong a lot, no matter who you are.

When I was at Fisher Investment 20+ years ago some clients would come in to the firm with what we called a collection of stocks, not an investment portfolio. This is a very useful term. It refers to a listing, a collection if you will, of names picked from the bottom up because they look promising as opposed to managing things like sector weightings, different volatility characteristics, owning a couple of things that might go up when markets are going down (presumably these would lag an up market) and the other ways we talk here about diversifying a portfolio.

On Cramer's afternoon show, he used to take calls from viewers who would tell them the handful of stocks they own and ask "am I diversified?" Maybe he still does that, I've literally never watched a full episode so I don't know. If you timed buying Amazon, Netflix, Apple and Facebook perfectly and then did a great job timing an exit you made great trades of course but you had a collection of stocks that only diversified issuer risk, not market risk.

Managing a collection of stocks is far more of a full time endeavor than managing a simpler, fully diversified portfolio. And to the extent risk happens fast as Mark Yusko says, getting caught wrong-footed in that collection will be disastrous.

Has anyone reading this ever been a paying customer to any of varying incarnations of Cramer's subscription services? I think there was Action Alerts Plus at one point and the latest is his Investment Club. Throughout the years, the impression I've gotten is that he has more been picking stocks to add to a collection, not developing a diversified portfolio. If that is correct, then on top of picking (and changing opinions) on a bunch of stocks all day long on TV, complicated enough, he is making it more difficult by recommending a collection of stocks to subscribers.

You don't need to do this. You don't need to have an opinion on hundreds (thousands?) of stocks. You don't need to do any of the any complicated things people do that make managing their personal finances more difficult like buying a $5000 baseball card or a $1500 pair of sneakers. And most important of all, you don't need to have a collection of stocks.

Things like cards and sneakers and artwork and wine, collectible currency, it's all fun to read about. And I can't stress this enough, you want to spend a little money go for it, you're not making your life more complicated by building a collection of 1 or 2 items but where investing is concerned, I would say to always choose relative simplicity.

2 comments:

Hi Roger,

I have been reading the various iterations of your blog since the Great Financial Crisis. I believe I had a trial subscription to Jim Cramer's "Action Alerts Plus" (if that was the name of it back then). This would have been for a short time back in 2005. From what I remember it was more of a collection of stocks. I don't remember any part of the subscription talking about portfolio construction built at the sector level and how each stock fit into a sector target weighting. Seems like it was just a list of 30 or more stocks that each were good for one reason or another.

Kevin

Hi Kevin,

Thanks very much for the info and for sticking with me so long!

Post a Comment