Yesterday's post, my first foray into portfoliovisualizer, was a ton of fun. It tied into the idea of capital efficiency which I have been writing about for a good 15 years, long before I ever the term and leveraging down which is a phrase I think I can claim originality for.

I want to continue the conversation with what I think turns out to be a different take on the traditional 60/40 portfolio with an assist from portfoliovisualizer. Here's what I plugged in.

NTSX is commonly known as the 90/60 ETF. It allows investors to get the effect of 100% in a 60/40 like with the Vanguard Balanced Index Fund (VBAIX) with just 67% of their assets leaving 33% to add return opportunity or manage volatility or both. RYMFX is self explanatory and client and personal holding BTAL is a hedge for the most part. MENYX is the traditional fund version of a closed end fund I used before the GFC for clients. I've circled back to it lately and I'm test driving MENYX to use for clients.

Quick side bar. Data providers like Yahoo, don't correctly account for the "dividend" from this type of fund because of how it is characterized. I'll have more on the fund soon, but what appears to be dreadful results on Yahoo are not correct.

A 50% allocation to NTSX equates to 75% in plain vanilla equities. MENYX is an equity portfolio but the beta hovers around 0.7 which is sort of like a further 14% to equities which gets us to 89%. The extreme negative correlation from BTAL and the often negative, sometimes positive but low correlation from RYMFX brings that down to where the portfolio resembles 60/40 as measured by VBAIX. Here are the results.

Portfolio 2 is 100% SPY and Portfolio 3 is 100% VBAIX. And I set Portfolio 1 to rebalance annually. The period studied goes back to NTSX' inception. The short time frame isn't ideal but NTSX is simply a slight tweak on a long standing idea.

Portfolio 1 lagged SPY which makes perfect sense. It came out slightly ahead of VBAIX. VBAIX outperformed for what looks like 5 quarters starting with Q4 2020 but gave back the lead this year when yields jumped up and of course BTAL and RYMFX are having great years in 2022 while MENYX is only down a little over 3%.

The portfolio stats are very interesting. Portfolio 1 has a much lower standard deviation at 9.04 than VBAIX. The Sharpe Ratio (the amount of risk taken for the return achieved) although not world beating, is far superior to VBAIX, likewise with the Sortino Ratio.

Where the 40 in 60/40 is allocated to bonds and the reason to own bonds is as a buffer for equity volatility, the recent events in the bond market make it worthwhile to consider less exposure to interest rate risk while using other tools to buffer equity volatility. I've been doing this, and writing about it, for years.

A 50% weight to NTSX works out to a 29% weight to fixed income, obviously less than 40%. I would say BTAL and RYMFX are more efficient buffers, they seem to go up more than bonds used to do before the current bear market. MENYX should soften the blow in bear markets but that relationship is far less cause and effect than BTAL and RYMFX. Speaking of the current bear market, Portfolio 1 is down 5.27% YTD, SPY down 12.62% and VBAIX down 11.64%. As I've been doing with these posts I'll also add that in the 2020 Pandemic Crash (Jan 31-Mar 31), Portfolio 1 down 8.6%, SPY down 19.3% and VBAIX down 12.3%.

The lesser drawdowns are noteworthy. Portfolio 1 has holdings that should go up when equities decline. The weighting to bonds in VBAIX usually has effectiveness, it's valid, but I don't believe its optimal. Years ago, I made the active decision to greatly reduce or otherwise avoid the interest rate risk that goes with longer maturities.

For years, we've been writing about how to build robust portfolios that have just a few fund holdings, like just 3 or 4 funds. I tip my cap to the guys at ReSolve Asset Management, Jason Buck (Cockroach Portfolio) and Nomadic Samuel for making return stacking interesting to explore. These portfolios I am exploring sort of nibble at the edges of what those guys are doing.

Where I am trying to differentiate is that robust outcomes can be had with much simpler allocations to funds whose strategies are themselves simpler.

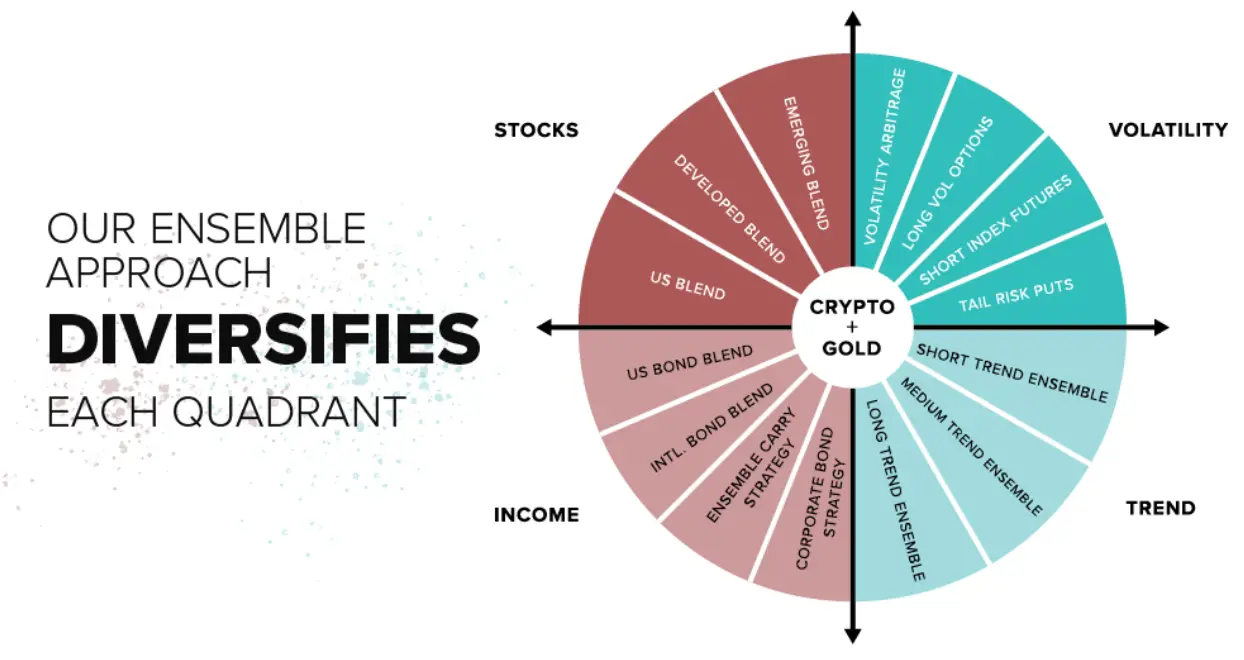

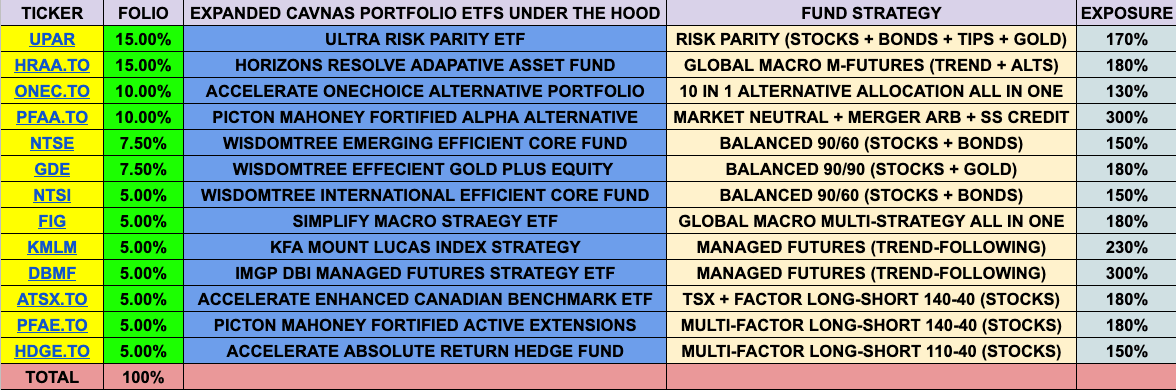

The is the allocation for the Return Stacked 60/40: Absolute Return Index.

Here's the Cockroach Portfolio.

Here's Sam's DIY portfolio.

There's a lot of moving parts to all of them. Also if various exposures, 29.2% to global macro for example, change within some of those funds, either due to style drift or some sort of active decision, you might not know for months. Also reliance on risk parity is problematic, it just doesn't work in a mutual fund or ETF. If time proves me wrong, great, but the track record is dismal.

If there is complexity to Portfolio 1 with NTSX, MENYX, BTAL and RYMFX along with any other portfolios I put together, it's all first level complexity. The funds are all narrow in their scope whether they are complex or not. Going too far down the multi-asset, multi-strategy trail goes toward second level complexity of what are the funds doing, have they changed what they're doing, if so how will I know and what is the impact on the rest of the portfolio? Back to the global macro example. If MBXIX makes a big change on that front, not only do I need to answer all the questions in the previous sentence, I also need to guess how that change might impact the rest of the portfolio and if too much of a deviation, I have to figure out how what change to make.

I've mentioned test driving RDMIX. I will sheepishly admit that I thought owning it might help me better figure out what they're doing because the results are compelling. A couple of months later, no dice.

There is still plenty to learn though from all of this. The work done by ReSolve and the Cockroach Portfolio led me to do some more research on volatility as a portfolio exposure beyond VIX products which led me to Princeton Premium Income Fund (PPFAX) which I bought for certain client accounts and one of my accounts. It sells weekly, out of the money put spreads on the S&P 500. That's all it does. If that is complex, it is first level complexity. Once you figure out the strategy of selling put spreads, you don't need to go down the rabbit hole of how changes in the fund will impact the rest of the portfolio because there won't be any changes.

There's also a little introspection required to construct portfolios that involve any complexity, the other day we talked about simple complexity versus complex complexity, do you know you're limits? I'm very comfortable understanding the advanced exposures these guys are talking about like convexity, carry, tail risk and so on but it gets away from me when funds blend 5 or 6 of them into one product.

For me it is much easier to have plain vanilla with small exposures to simple complexity with PPFAX and BTAL as examples. I believe Portfolio 1 at the beginning of this post is just that. It's important to give the portfolio a name, even if it's lame so I will go with Random Roger's 75/29 Balanced Portfolio. The guys down in marketing will love it!

No comments:

Post a Comment