Yesterday we looked at mimicking the Bridgewater All-Weather Portfolio and contrasted it with the idea of building your own sort of all weather-ish effect for your portfolio. Today I'd like to take another look at the Return Stacked: 60/40 Absolute Return Index which is a joint collaboration between ReSolve Asset Management and Newfound Research. Here's the first post from a few weeks ago.

The big idea is they are seeking an all weather-ish result. Return stacking is a potential benefit from capital efficiency that we've talked about a few times recently. The simplest example to explain return stacking would be to put 67% of a portfolio into the WisdomTree US Efficient Core ETF (NTSX) also known as the 90/60 ETF. Putting 67% in captures the effect of 100% in a plain vanilla 60/40 equity fixed income portfolio leaving 33% left over to return stack. If that 33% is put into a 2 year T-bill yielding 3%, then the portfolio would capture the full 60/40 effect with an extra 300 basis points of return stacked on top. That example is a pretty low risk way to return stack versus buying more equities with that 33%, you'd be leveraged up, not leveraged down as I've referred to it previously.

Mimicking the Return Stack: 60/40 Absolute Return Index looks like this;

Through June 30th, 2022 it was down 7.45% versus a decline of 18% for the Vanguard Balanced Index Fund (VBAIX) which is a proxy for a 60/40 portfolio. In 2021, VBAIX was up 9.65% while the Return Stack: 60/40 Absolute Return Index was up 16.56%. So it outperformed All Weather in terms of upcapture and downcapture which isn't a huge surprise. Return Stack has a 62% allocation to equities versus 30% for All Weather and All Weather has 55% in bonds vs 39%.

So more equity exposure helped Return Stack also there was less drag from the fixed income sleeve. If interest rates go down (bond prices up) and equities go down, that implies All Weather should outperform. The difference maker in determining if All Weather actually would outperform would come down to the stack of alternative funds or funds with an alt component. While anything can happen of course, I am confident that Tail Risk (CYA) and BLNDX would do well. I'm not quite as confident in RDMIX and MFAIX and least confident in MBXIX.

In terms of the strategy with Return Stack, it appears to be valid. No portfolio can be best for all times but it is valid and it is obviously well thought out. Some of the alts in there rely on what I'd describe as how things should work meaning certain cross market relationships as opposed to a simpler cause and effect. Tail Risk owns puts, puts go up when markets go down. That is much simpler than the strategies underlying RDMIX and MBXIX for example. BLNDX is not as simple as TYA but it is much simper than RDMIX. Having a little bit of that sort of complexity doesn't concern me but having a lot would.

That doesn't detract from the portfolio, it's an issue of right for me which should be the top priority for anyone going down this road...what is right for you? If you don't think you know the best answer to that question then any starting point, if there's even going to be a starting point, should be an allocation to very simple diversifiers. Simplicity better than complexity will never be wrong. I'd argue simple is relative though.

The other idea I would float in assessing a direct mimic is whether 10 funds is manageable. No wrong answer there either. We've looked it trying to build all weather-ish portfolios using just 3 or 4 funds. Is Return Stack better? Some of the time it would be, some of the time it wouldn't. There is no portfolio that will always be best (repeated for emphasis). If you are interested in this effect and can figure out how to do it with 3 funds or 5 or 6, then I'd say that's better in terms of simplicity than a 10 fund portfolio once you can accept it may not be as optimized as the 10 fund portfolio. Fortunately it doesn't have to be. If Return Stack was the absolute gold standard for this idea and you could capture 80% of the effect, whatever that means to you, with half the funds, would that appeal to you? In this context, it would definitely appeal some people. That's something to figure out yourself as you continue to manage your portfolio, as your portfolio continues to evolve and the time you want to spend on this increases or decreases.

As is often the case when I learn about these things, I am interested in trying to incorporate one or two bits of process into my own process from this, not make wholesale changes. I'm pretty incremental with this stuff which long term readers might recall.

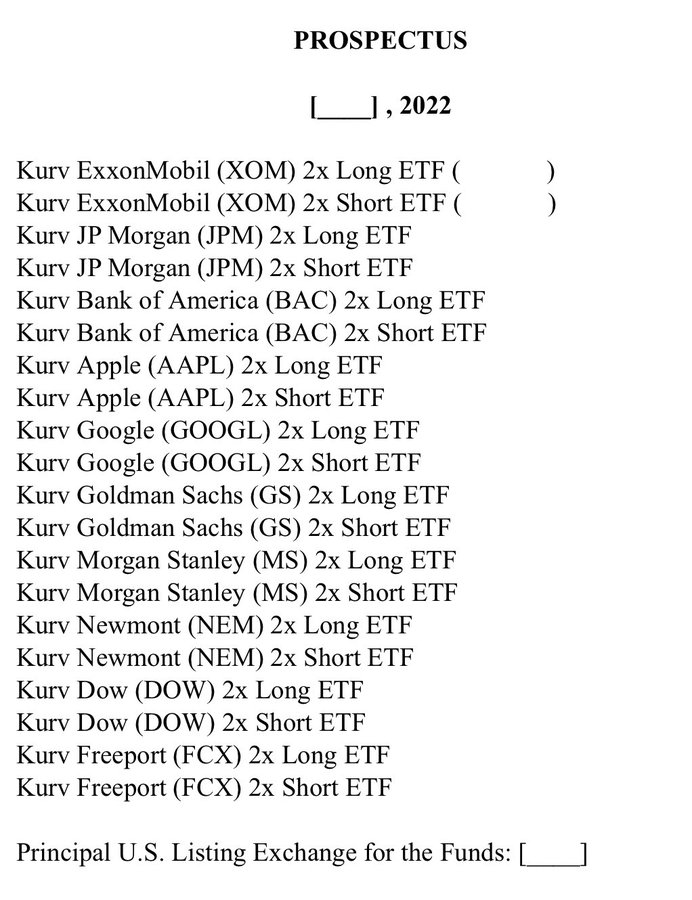

And because I think it's related to capital efficiency and return stacking, check out this image from a Tweet by Eric Balchunas

Eric noted that between several ETF providers, there's over 100 single stock 2x ETF in registration. A stock picker could in theory build a portfolio putting just 50% of their dollars earmarked for stocks into a portfolio these, put the other 50% in 2 year T-bills currently yielding about 3%. So they'd get the return from their stock picks plus an additional 300 basis points, similar to the example above. This is another example of return stacking via capital efficiency. I don't know anything about the filing or if there's a daily reset and if there is, whether that would be more problematic than daily resetting for the indexes or not (I suspect a bigger impact for the single stocks) and I don't doubt other nuances like that. I'm a no on a whole portfolio of these but for a couple of more volatile tech or communications companies, it could be a very useful way to leverage down in building a portfolio.

No comments:

Post a Comment