A few weeks ago, Walker Fire (the department I volunteer with) was called out for a structure fire. We don't get a lot of those but this one was pretty straightforward for actual fire suppression. What was more complicated was getting the first engine to the house and then how to stage the other engines and water tenders (water tender is a water truck). It was at night and it was down a long, winding driveway with blind corners. We did not know if there'd be enough room to turnaround down there which is pretty important for safety reasons. I got out and went down on foot and called the engine I was in down to me, there was just enough room to turn around.

This incident then led to a couple of trainings to reiterate structure fire tactics. We do this every fall but the fire we had sort of kick started our trainings for the year. With both structure fires and wildland fires there are some very basic tactics and techniques that pretty much always are effective, more like "you can't go wrong by..." As part of our after action review (AAR) for today's training I said that I think it is important to understand the most basic, elementary fire suppression methods cold, to have them absolutely dialed in which then makes it easier to safely adapt when a fire poses unique challenges.

Anything unique that an incident calls for builds off the basics. So it is with portfolio construction. The basic, most elementary portfolio construction is 60/40 equity/fixed income. Maybe it never should have been but it is, it is easy to think in terms of 60/40, it has been a default and it made sense up to a point because of how well bonds did for decades.

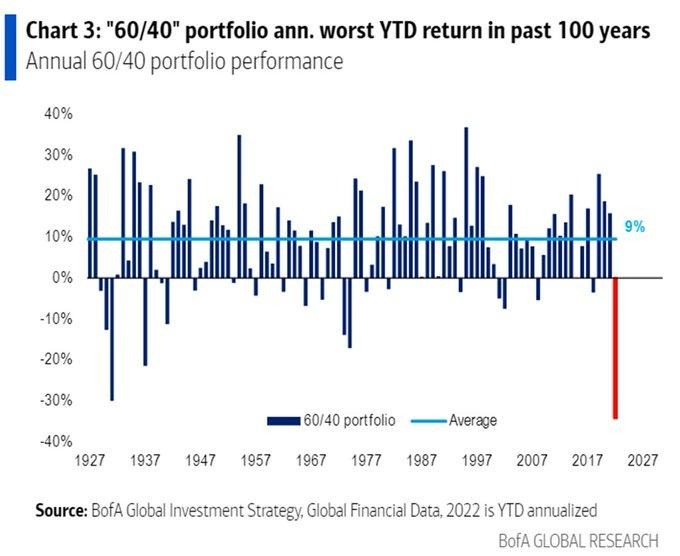

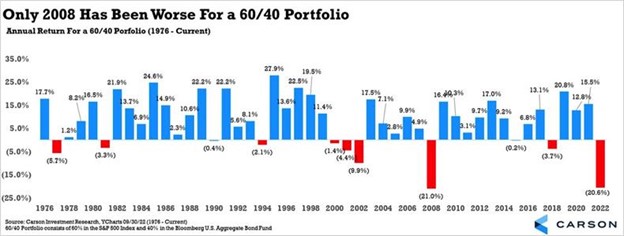

This year, the tide has gone out on 60/40 as 2022 turned out to be the year where markets and investors suffered the consequences for all-time low yields continuing to move lower. Here's a short article from Barron's about how 60/40 has gone wrong this year and also a couple of graphics I found on Twitter.

Yahoo Finance has the Vanguard Balanced Index Fund (VBAIX), a proxy for a 60/40 portfolio, down 22.6% this year versus down 24.8% for the S&P 500. For a little context, from the S&P 500's peak in October 2007 to the low in March 2009 when the index dropped 55%, VBAIX was down 37%. On an absolute basis that might not inspire confidence but on a relative basis, bonds were a huge help during that incident. In the tech wreck, VBAIX looks like it was down about half as much as the S&P 500 so you can understand why investors had faith in 60/40.

The 4% rule was based on this too. The 4% rule is of course the most basic, most elementary rule of thumb for sustainable withdrawals in retirement.

Something we started talking about a while ago was that both ideas were built on interest rates from the bond market that no longer existed. That meant that the past performance literally could not be repeated. Interest rates have since gone up a lot so maybe we are getting back to a point where great returns can again be had from bonds but even if not, at least we can get good yields. Adequate yield with no volatility is probably what most people want from bonds. I don't think that is where we are though. Good yields at the short end yes and if you have individual issues for plain vanilla fixed income, you're really muting the volatility. The yields for further dated paper are not horrible but not great although the volatility could still be sky high if rates keep going up.

At some point there were references to treasuries having become return-free risk which is a play on words of risk-free return. With no yield, longer dated notes and bonds are essentially equities or they have the volatility profile of equities. In the case of ETFs like ZROZ, TLT and TLH they literally have equity-like beta. The charts of those three look almost identical to the S&P 500 this year but they are all down more than the S&P 500.

I would propose that there is nothing wrong with the 60/40 concept. To the extent it hasn't worked for people, I would propose this year's failure is more about static allocations to the same fixed income sectors without doing some sort of forward looking analysis or maybe more correctly stated, a reassessment of how risks in the bond market had been elevating then figuring out whether trying to avoid those elevated risks was appropriate and then figuring out how to avoid those elevated risks for those for whom that was appropriate.

Where fixed income is a diversifier against stock market volatility, I'm not sure why you'd want to necessarily dial down the amount you have in diversifiers as opposed to changing the makeup of your diversifiers, your 40% for 50% or 30%.

The chart compares the S&P 500 to three diversifiers that are intended to look like horizontal lines that hopefully tilt up slightly. I think that is the volatility profile people hope to get out of bonds. A portfolio of 60% S&P 500 fund and 40% divided equally between those three diversifiers is down 14.67% this year compared to 24.8% for the S&P 500. In round numbers it is down 60% of what the S&P 500 is down which is pretty similar to how VBAIX did in the two market events I cited above. Those diversifiers are doing what bonds used to do in my opinion.

I continue to believe that intermediate and longer term fixed income will be sources of unreliable volatility, essentially equity beta and if you don't want that for your bond portfolio I think it makes sense to learn more about using that 40% differently than you used to.

3 comments:

I'm glad I got out of my foreign and long dated bond funds many months ago. Wish I had added on more diversifyer besides DBMF. I sure hope what the Fed is doing works, I have my doubts. What websites do you use to keep up with things going on the in ETF world. I look at ETFtrends.com

Difficult for me to have confidence in the Fed but fingers crossed there.

Anymore it is much easier to have content about ETFs pushed to me on Twitter. A few follows like Nadig, Balchunas, Geraci and Hearsay Jim leads to seeing useful info from various other people in the field. ETF.com is my first stop usually to look under the hood while I find VettaFi's screener helpful.

Quite a few people avoided the 40% being down. Owning CDs and some corporate bonds held to maturity, although they didn’t yield much, avoided the trashing that bond ETFs got.

So all depends on where your 40 was invested. It was t totally u foreseeable that interest rates had to rise. Although maybe not as fast.

Post a Comment