No it isn't.

But the success of managed futures is drawing more and more attention and assets. A stalwart ETF in the space has been the iMGP DBi Managed Futures Strategy ETF (DBMF). It's new relative to the last couple of years, the performance has been lights out this year and assets are knocking on the door of $1 billion. It's a little more involved than straight managed futures, you can read more here if you want.

We've written a lot about managed futures during this bear market as well as during the financial crisis. I am absolutely a believer in the strategy even though it generally did poorly for most of the 2010's. It worked during that stretch though for maintaining its negative to low correlation to equities as equities rocketed higher.

I'm seeing a lot of attention paid by stock market websites and do-it-yourself investors. There's a lot of sentiment aimed at very large, permanent allocations to managed futures, like 20% large, maybe more. This is similar to suggestions 15 years ago when there were suggestions to put 15-20% into MLPs and REITs for their diversification benefits too. When something does very well, awareness is spreads and people get very excited.

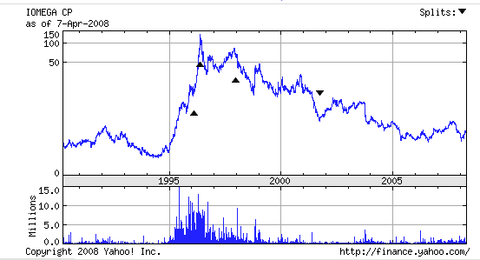

Were you around markets in the mid-1990's? Iomega, symbol IOM I believe, also got investors very excited, the product filled a real need for portable storage and the stock skyrocketed, really a moon shot. David Faber from CNBC referred to some investors as Iomegans for the staunch devotion to the stock. The chart shows you what happened.

It's tough to see on the chart but the stock got a take-under offer in 2008 for less than $4/share. It flamed out and as is always the case with these things, some investors got caught owning too much.

The Iomega comparison is of course different. A popular strategy dropping 95% is far less likely, probably impossible, than a popular stock but something, not sure what, could cause managed futures to severely underwhelm the way MLPs and REITs did during the financial crisis.

There's no ETF for MLPs that exists today that was around 15 years ago so the chart shows Energy Transfer and Plains All American which are two relatively large MLPs and the iShares REIT ETF which was around back then. MLPs and REITs may have been more widely loved back then than managed futures is today. It was clear to me that they would not offer diversification benefit in the face of a large decline and I wrote about it several times. I'm sure people had 15 and 20% allocations to both and weren't helped even a little by them when the market cut in half because they cut in half too. Not that you shouldn't own them but I would expect them to be stock market proxies on the way down. IYR is down a lot more than the S&P 500 this year and MLPs are doing very well, really very well but in line with regular energy stocks. Are they doing well because stocks broadly are down or are they doing well because energy, like XLE, is doing well? Draw your own conclusion, I assume the latter.

I am not saying I think managed futures will ever be like MLPs and REITs during the Financial Crisis. I expect the strategy to work in bear markets to be a diversifier, but what if it doesn't "work" during some event for who knows what reason and those funds drop 35% in a down 25% world for stocks? That seems unlikely but it isn't impossible which is why calls for 15, 20, even 30% for managed futures is poor risk management, it takes on too much, single strategy risk.

Managed futures will probably go up when stocks drop but we've been writing all summer about several strategies that will probably go up when stocks drop. I'd rather not limit to just one in case something unpredictable happens.

For all the grammarians out there, I refer to managed futures in the singular because it is a single strategy.

A follow up to yesterday's post which was inspired by a Tweet from Adam Butler. Adam is part of the team that manages the Rational/Resolve Adaptive Asset Allocation Fund (RDMIX). We've talked about RDMIX several times, it was lights out good in the first five and half months of 2022, the first five and a half months of the bear market. You can read more about it here.

Adam obviously draws a different conclusion about multi-strategy funds than I do. He and I had a pretty good back and forth discussion today on Twitter. Definitely read it for the other viewpoint. My reasoning is very simple, funds like his and that QDSIX that we looked at yesterday are very complex products. Some of the strategies are unfamiliar to me and I don't know how some of them will interact with each other. Also, with so many moving parts I don't think holders can really assess what is going on good or bad save for reading their commentaries. That means an advisor can't answer client questions very easily. I think it is important to understand what you own and that seems like a long shot here.

After being lights out through mid-June, here's what has happened since the S&P 500 peaked in mid-August.

Simpler managed futures is up 9% versus down 14.96% for the S&P 500 while RDMIX is down 4.6%. Such a short time frame is unfair to the fund but I would want to be able to answer the client and I don't think I could. You might draw much different conclusions than me but as I said to Adam, managed futures negative correlation, merger arb very low volatility, simple and arguably the results of simpler have fared well during this event.

2 comments:

What percentage of your portfolio do you have in managed futures? Thanks for the great content!

Thanks for the kind word. About 2% via the allocation inside BLNDX. That is probably a little too light but have 2-3% in several other diversifiers like BTAL and other ones I've mentioned in previous posts.

Post a Comment