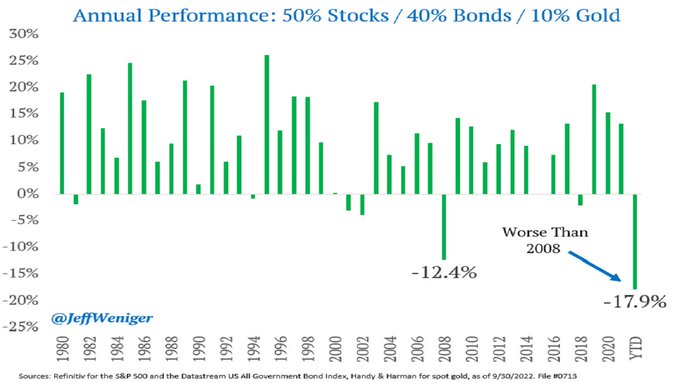

That was a Tweet from Jeff Weniger from WisdomTree and he shared this chart.

WisdomTree has a managed futures ETF with symbol WTMF that for just about all of the first half was up a little as the bear market in equities started and now shows on Yahoo Finance as down slightly YTD. WTMF is not even close to being the best performing managed futures funds but presumably they know the space, know that a lot of the funds in managed futures are up kind of a lot this year so he knows some diversifiers are working but not the ones that people rely on most heavily; fixed income and to a much lesser extent gold.

With all the various alt strategies we look at here in these posts, I go out of my way to repeat the message of moderation with these for the times that they don't "work." If something "works" more often than not and I feel like I understand why it works as a diversifier then that will be good enough for me to use it in moderation, realizing that occasionally it won't "work." Gold is a great example in the current event of something that has a low to negative correlation to equities most of the time but it is not working in the current event. Nothing should be expected to work every time. Even an inverse fund could trip up in a down market depending on the sequences of returns and daily resets.

So if using diversifiers in moderation is prudent for the reasons I lay out above, should we treat fixed income sectors just like any other diversifier? Wrong pronoun there, not we, you, should you only have modest allocations to fixed income sectors? No wrong answer, what do you think?

To Jeff's chart, I've never considered as much as 10% in gold. Ten percent into a couple, two or three maybe, different fixed income sectors might make sense as opposed to all in on long duration treasuries like some people do. So far, the current bear market doesn't seem to have anywhere near the credit risk of the financial crisis. Spreads have widened out a little but they are not so narrow as to be a terrible value and not so wide as to be signaling doom around the corner...they're just right....no need, I'll show myself out at the end of this post.

Short dated, high yield bulletshares which I use are certainly feeling some pain but they are down nowhere near as much long duration treasuries. We've talked about T-bills a few times, we've talked less about floating rate (I have a couple of ETFs from that space in my ownership universe) and short dated TIPS ETFs are down some in price but the "yields" are now much higher. These are all spaces that rely on different things and avoid the full brunt of interest rate risk.

I've been talking about these for ages. Thinking these would be better than long dated bonds was a very simple top down look at the world made ages ago and finding these income sectors took just a little bit of digging. Whether you are an advisor or a do-it-yourselfer, you can do this sort of very simple assessment to avoid the worst, to avoid the riskiest. This is an example of via negativa, removing the negative. Markets are down a lot so client accounts are down too of course but anything that smooths out the ride even a little is helpful.

Hey, we're in Maui! Our first non-road-trip trip in quite a while. Here's some pictures.

Monday sunset in Kihei

Lifeguard tower

Steep hike to the windmills on the west side of the island

Po'Olenalena beach

No comments:

Post a Comment