Last summer I wrote a couple of posts about the Cockroach Portfolio, here and here. The portfolio was created by Jason Buck who sat for a podcast with Corey Hoffstein. Here's a quick reminder of the allocation.

It was inspired by the Harry Browne Permanent Portfolio and is intended to be an all weather type of portfolio.

Jason had some interesting comments in the podcast which are a good excuse to continue this conversation. Buck said that if Browne were alive today, he'd take more advantage of some of the more sophisticated tools that are available. Part of the Browne portfolio's long term success, as we have noted many time before, is that it benefited from bond market performance than cannot be repeated unless long bond yields go back to 15% and then from there, go to zero again.

As part of this part of Jason and Corey's convo, Jason added that cash alone may not provide enough of an offset against stock market volatility during recessions and I will add, during bear markets not related to recession. He continues to use long volatility and tail risk to get better "convexity" for downside protection.

Translating that into a simpler way to express it, he favors allocations to things that have the potential to go up a lot when stocks go down a lot. Obviously you would get more protection from an alt that went up a lot in a decline than you would from cash.

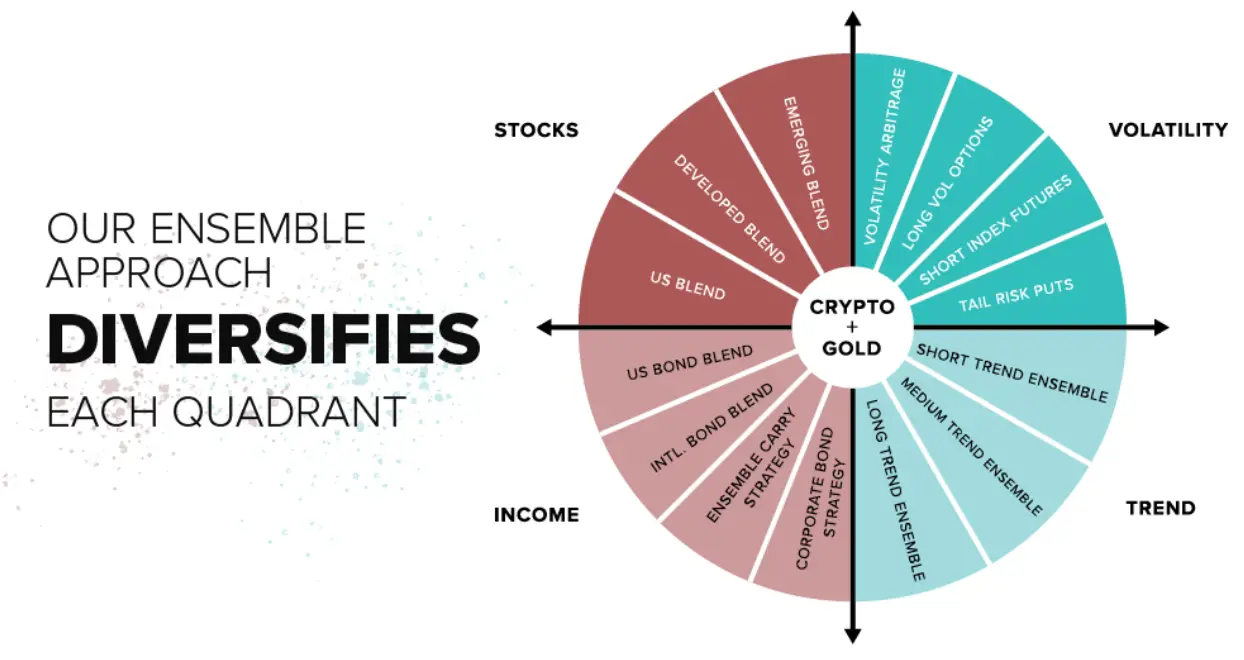

Where we talk about taking bits of process from various sources to create your own process, long term readers can probably see that I have been doing exactly that. With Cockroach and while we're at it, the Rational/Resolve guys, using volatility as an asset class is now embedded in client portfolios. That is the bit of process I take from these guys. The part I don't take is the much larger weightings to those asset classes.

Actually I use both long volatility and short volatility.The way I use them, they have much different attributes. Long volatility is VIX related will hopefully go up a lot when stocks drop. Short volatility, the way I use it, hopefully looks like a horizontal line with a slight upward tilt.

Said for the 1000th time, the reason that I think too much in to these diversifiers is sub optimal is that equities are the asset class that goes up the most, most of the time. Getting to the point of a portfolio of diversifiers hedged with a little bit of equity exposure is likely to result in getting left far behind.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation. All investments carry a certain risk and there is no assurance that an investment will provide positive performance over any period of time. Past performance is not a guarantee or a reliable indicator of future results Roger Nusbaum is an investment advisor representative of Dynamic Wealth Advisors. All investment advisory services are offered through Dynamic Wealth Advisors.

No comments:

Post a Comment