In my ongoing quest to redefine portfolio construction, I've mentioned labeling asset classes based on their attributes versus just their proper names like growth which could include more than just equities or inflation protected which could include more than just TIPS and so on.

This brings us to today and new thought I had about this. We talk frequently about portfolios being relatively simple. I'm a big believer in keeping things as relatively simple as possible. At some point, too much complexity leads to being too smart for your own good or putting it slightly more humorously, too clever by half.

The building block of portfolio simplicity is plain vanilla exposure to equities, individual stocks or the typical fund, and bonds. Stocks are the thing that goes up the most, most of the time but are the most volatile asset class (ex-crypto). Things like plain vanilla bonds or anything else are tools for managing volatility and helping the investor get to the appropriate allocation to equities.

We spend a lot of time here looking at volatility management tools that are more complex than bonds, how to evaluate them for inclusion in a diversified portfolio and how to selectively size them in to a portfolio. One way to think of this then in terms of attributes is that I think that it is best to have a portfolio of simplicity, hedged with a little bit of complexity; complexity that you understand. Just like I don't think you want a portfolio of diversifiers, hedged with a little bit of equity exposure, I don't think you want a portfolio of complexity hedged with a little bit of simplicity exposure.

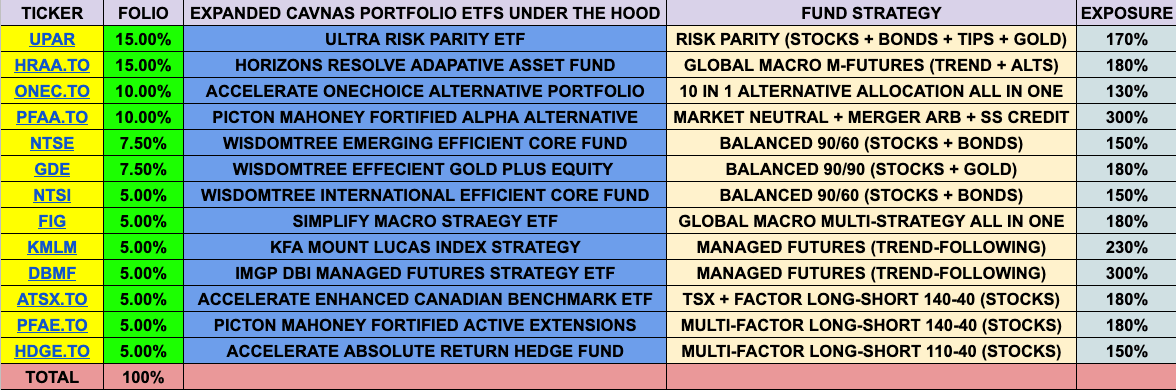

The new articulation for me of simplicity hedged with a little complexity came to me as I read the latest from Nomadic Samuel about a portfolio that he just built for himself and had the courage to post and discuss on his website. First here's the summary;

Read the fund strategy column. Then read the exposure column. If the names of the funds are not that descriptive you can go look at the fund pages from the various providers but Sam provides a good intro to each one in his post.

All in, there are 13 funds but many of them are multi-strategy with quite a few strategies, one them has 10. There's some measure of repetitiveness between some of the funds and per his spreadsheet they all use leverage.

This is pretty much the exact opposite of how I would build any sort of portfolio in terms of being very complex, being very underweight the asset that goes up the most, most of the time, being very expensive from top to bottom, several funds with very short time periods and a lot of reliance on academic research and how things should work. I think as presented, this will go very poorly for him but he does say that he would be shocked if his portfolio looked like this three years from now which makes another point, as presented this doesn't really let him take full advantage of the equity market's ergodicity. That a fund is nominally expensive isn't automatically bad IMO but this is a very expensive mix, with a nod to the other day, it is a very expensive collection of alternative funds.

Let's dig into a few of the funds. I have been interested, intrigued is a better word, in risk parity for many years but have never seen it work well in a mutual fund or other exchange traded product. In terms of protecting against anything (again, in fund form), I don't see it. Wealthfront has a risk parity fund with symbol WFRPX that has been very underwhelming. AQR liquidated its risk parity mutual fund.

UPAR just started trading this year and has gotten pasted. PPRYX has been around for a few years. To the extent an alt would zig when equities zag, that's not really evident. I don't think risk parity can work in a fund and Sam has 15% in UPAR. For a little context, the typical client not in game over mode has well under 10% in alts for their entire portfolio.

HRAA.TO is the Canadian version of RDMIX which can be traded in the US. HRAA just started trading but RDMIX has been around for a while. I am intrigued by it and have mentioned I am test driving it for inclusion in client portfolios but have not made up my mind. It's multi-asset and multi-strategy. It has had a great 2022 but doesn't appear to have captured much upside coming into 2022. This one might be categorized as academic, that should work. I'm not sure what happened after the pandemic crash but it stopped capturing upside after that.

ONEC.TO is a fund of funds that includes more risk parity. Here's the allocation.

It certainly is diversified. Generically, something like this could be part of a three or four fund portfolio. There's a little leverage in there so that is important to factor in if something like this ever trades in the US. It just started trading in January of 2021. It really is a mishmash of exposures, a lot of alts, some gold and some fixed income. Although there's little to no equity exposure, the chart looks like Vanguard Balanced Index Fund VBAIX which is a proxy for a 60/40 portfolio. It outperformed VBAIX YTD and took a slightly different path to the same result as VBAIX in 2021. Something that looks like VBAIX that doesn't take interest rate risk would be interesting to learn about but, this does take interest rate risk.

GDE, good G R I E F. It invests 90% in broad based US equities and then leverages up to by 90% in gold via futures such that the 10% left over from the equities is more than enough to collateralize the gold futures. Since its inception in March of this year it is down 20% vs down 8.8% for the S&P 500 and 10.6% for client and personal holding GLD. The negative correlation potential of gold is nowhere near reliable enough for me to ever consider this fund.

The last one I will pick on is FIG from Simplify which is a fund of Simply funds plus iShares Gold (IAU) and S&P 500 call options (plus a few puts). I've written about Simplify quite a few times. The ideas are very interesting, but there's something not quite right in the execution of the strategies. I would also note that FIG just started trading in May. I am not test driving this, but I do have it on a watchlist of alt names that I track as part of my research. FIG is 26% managed futures. It has 24% in the CDX ETF which owns hedged high yield bonds yet is somehow down since its March inception, more than HYLD. FIG as 20% in SVOL which is an inverse VIX fund, look up volmageddon to see how that has gone in the recent past.

Sam laid out his reasoning for having this sort of portfolio, why specifically he chose these funds and I would note he appears to be a young. I do not know if his life circumstance is such where a game over approach is appropriate.

In terms of complexity, several of the funds blend together multiple complex strategies and the blend itself is complex in terms of the math applied and the outcomes sought, they are complex-complexity. I would contrast that with simple-complexity like client/personal holding BTAL which is long low volatility and short high volatility with the intended outcome of not looking like the stock market most of the time. Yes complexity, but that one sentence, is the strategy, simple-complexity. Client and personal holding BLNDX combines equities and managed futures for a result that should look somewhat similar to equities with lower volatility. Simple-complexity.

Funds of funds like some of the ones Sam has listed are complex-complexity. I can see being convinced that some fund like that, that you're able to wrap your head around could take a somewhat large 5% weighting to counter balance a portfolio that favors simplicity (plain vanilla). Sure, with the risk being that you're wrong, that the research underlying it does not "work" in the real world. A 5% allocation simply becomes a lag.

The alts I use are simple-complexity, far fewer moving parts, more direct cause and effect with easier to understand strategies and outcomes.

It is important to understand that the stories, the research, the backtesting, the articulation on all of these types of funds sound great. I think to have this much in funds like this is to be enchanted with all of the stories and again, I think it will end badly if he sticks with it. If some sort of game over in terms of exposure to normal equity market volatility really is appropriate, there would be far better (simpler) ways for him to build toward that objective.

No comments:

Post a Comment