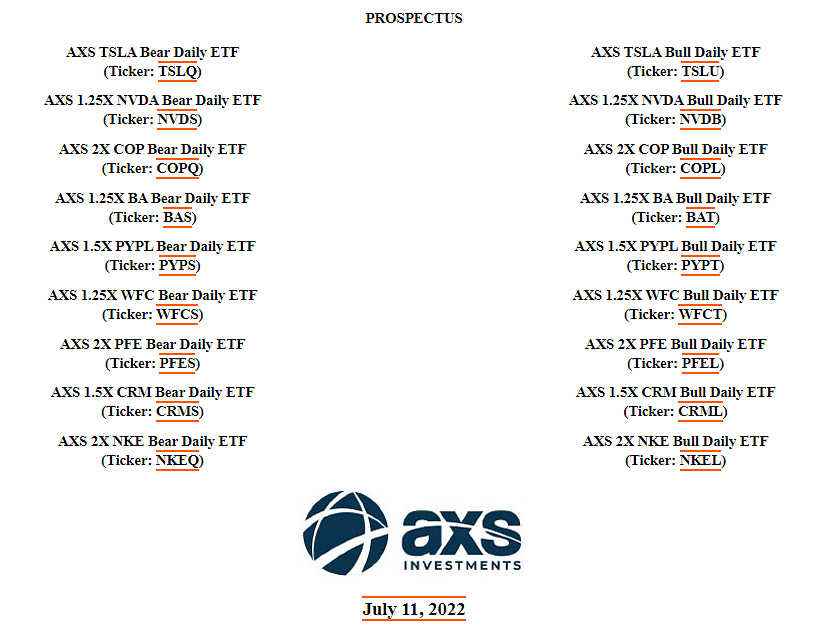

The other day in a post about capital efficiency and leveraging down we looked at a bunch of 2x long and short, single stock ETFs in a filing from Kurv and mentioned the possibility that these would be coming to the market soon. A batch of these from AXS appear to have been approved and more are coming.

You can see then that PFEL will allow you to double exposure to Pfizer (PFE) or go short with 2x leverage. Some of the more volatile stocks in this batch use less leverage but they're all the same idea, getting more exposure with your investment capital. You stand to gain more or lose more, that's the point.

In talking with a couple of people on Twitter I learned that there is a daily reset with these which can get in the way of a 2x long fund actually capturing twice the gain (or loss) over an extended period. I said the other day that my hunch was that the daily reset would be more of an issue for individual stocks than indexes but we can kind of get sense of what that might look like. 2x single stock ETFs have been trading in London for a while so let's see what it looks like with Alphabet.

Obviously it is not precise over longer periods. Can you live with that imprecise tracking? There's no single right answer for everyone, can you live that? And if you can live with how it has traded, now realize there can be no guarantee about how it will track in the future. YTD, Yahoo Finance shows GOOG down 16% and the 2x GOOG down 33% which seems very close to being where it "should" be. Maybe the answer needs to include a willingness to sell when it drifts too far above where it "should" be. By the same token though, should it be bought when it drifts too far below where it should be? That's tough because you'd be increasing the leverage and just because it's below where it should be doesn't mean it has to revert to some sort of mean.

In what is kind of an interesting twist, although these are going to come to market, there is an opinion from the SEC that's been made public that says advisors would likely be breaching their fiduciary obligation if they recommended these to clients. This baffles me. I don't doubt that some advisors would use these incorrectly, it rains all over the idea of making use of the latest capital markets technology to build a capital efficient portfolio that could actually reduce the amount of risk and volatility that clients are exposed to.

A client sitting on a ton of employer stock at Microsoft (MSFT) might want to strip MSFT out of their broad based index fund versus owning even more There a leveraged MSFT single stock ETF in registration that would allow them to do that. MSFT has a 6.07% weight in the S&P 500. A $500,000 allocation to an S&P 500 ETF owns $30,350 worth of MSFT. Putting $15,175 in to a 2x short MSFT ETF would neutralize the MSFT exposure for this client. Direct indexing would also address this scenario but I'll go on record as saying that like ESG, direct indexing will generate a whole lot more noise than news.

The posts over the years from me about barbelling risk and volatility and now invoking the term capital efficiency are a pursuit for some sort of investing utopia, a Capital Efficient Utopia if you will, where 2% of the portfolio gets allocated to a 10 bagger every year while the other 98% compounds at 3% annually with a beta to the S&P 500 of 0.1, so 1/10 the volatility of the S&P 500 in overly simplistic terms. In that unrealistic utopia, you'd really only have 2% exposed to serious risk. If the one speculative pick crapped out, the other 98% would be still adding 3% leaving the overall account up a few basis points.

Obviously buying one stock every year that turns out to be a 10 bagger is not a repeatable strategy. One of those in a lifetime would be a great stroke of luck. The point isn't to chase after an impossible outcome but to think about what can be learned from the example, what influence if any should be taken?

Taking a tiny step closer to reality (this is a process we're working through), how about building a portfolio mostly comprised of absolute return products with small equity exposure in a leveraged fund tracking a broader index. Believe it or not, there's 5x levered S&P 500 ETF trading in London. The LSE lists some wild stuff, man. It looks like it just started trading toward the end of 2021 so no up market to study. That ETF is down 75% this year, 75%!

An investor wanting just 20% exposure to equities could put 4% into SP5Y to build their 20% allocation, put 80% into some mix like the ones charted along with SP5Y and since we're leveraging down, put the remaining 16% into T-bills or cash. This is more of a game over portfolio with only 20% in equities whether that is 4% in SP5Y or 20% in the SPDR S&P 500 (SPY).

Pretend someone actually did this, there's a dilemma now about when to

rebalance that position in SP5Y back up toward or all the way to its 20%

notional value, 4% actual dollars allocated. There's no comfortable

answer to that question but echoing a point I make frequently,

regardless of which direction the next 20% is, buying a broad index

after a large decline is not a bad idea. Buy some now, buy some later?

That could work even if it turns out to not be optimal. If you agree

that American capitalism is not permanently broken and there will be new

highs at some point, then yeah, buying at least a little now if you

haven't already bought some in here down 20-25% from the peak has merit.

Where the first half of the year has been pretty bad, the allocation to SP5Y would have cost the portfolio 300 basis points, the absolute return funds would have added up to very small losses all of which looks very efficient in terms of exposing a small portion to risk assets but avoiding interest rate risk. If somehow the S&P 500 cut in half in just the first six months of the year, then 20% SPY and all the rest being the same, the investor would be down 10% plus a little more from the absolute return funds vs down about 4% from SP5Y going almost to zero plus a little more for the absolute return funds. Fewer dollars at risk by taking huge leverage?

It's not leverage that does people in. More precisely, it it the misuse of leverage that does people in. The example we went through isn't realistic for too many people, or maybe anyone, but it is instructive in terms of balancing out risk/volatile assets, exposing less to market segments that are as cyclical as equities. This seems relevant for things like managing sequence of return risk.

This sort of thinking has influenced how I've been constructing and managing portfolios pretty much since I started as an RIA. Exploring the newest capital markets technology (a term BTW from my time at Fisher Investments 20 years ago) like 2x single stock ETFs and a 5x S&P 500 ETF and figuring out where to make incremental changes. I'm not one for wholesale changes.

How we allocate to risk and how we protect against adverse risk events are key IMO to how investment management will evolve. This is why I work in this field, to constantly learn more, refine and hopefully improve.

Disclosures from that first chart, MERFX is a long time client and personal holding. I recently added PPFAX (PPFIX is what's charted though) personally and for some clients where appropriate and the other two I am in the early stages of trying to learn about. I'll have more about PPFAX soon.

No comments:

Post a Comment