Man Institute had an interesting research paper that fishes into the same waters we do here. The first line from their paper was "the reliability of bonds as a defensive diversifier was brought into question in 2022, particularly in light of the inflationary environment." Their use of the word reliability amuses me because that is the word we've been using, bonds have become a source of unreliable volatility is how I've worded it most frequently. I mentioned work from Man Institute back in April. The current paper looks at a strategy they call the Yieldy Put and how to blend it in with a 60/40 portfolio.

Yieldy Put is 50/50 trend (managed futures) and long/short quality stocks. The rationale is that "both (strategies) historically performed well in equity crises yet had positive carry in the good times. Hence the ‘yieldy put’ moniker in the title of this paper. Further, the two strategies are complementary to each other, with L/S quality often capturing the sudden ‘flight-to-quality’ effect that can potentially derail trend-following strategies." They compare the following allocations.

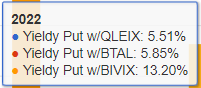

The sweet spot is 50/50 into a 60/40 portfolio and the other half into Yieldy Put. I modeled it with three different funds for the long/short piece, AQR Long Short Equity Fund (QLEIX), client/personal holding AGFiQ US Market Neutral Anti-Beta Fund (BTAL) and Invenomic Institutional Fund (BIVIX) that we looked at in May. They each do very different things. QLEIX tries to smooth out the ride, BTAL has a pretty reliable negative correlation to equities and 60/40 and BIVIX swings for the fences with a very high standard deviation.

The rest of these models allocate 30% to iShares All Country World Index ETF (ACWI) because that's closest to what Man used, 20% to iShares Aggregate Bond ETF (AGG), 25% to AQR Managed Futures (AQMIX) and the last 25% to the respective long short fund mentioned above.

In the same period, the Vanguard Balanced Index Fund (VBAIX) which is a proxy for 60/40 compounded at 8.56% with a standard deviation of 11.63%. The QLEIX version is not night and day different, it has a somewhat lower but still adequate CAGR. The BTAL version shows that 25% to that fund is probably way too much. And the BIVIX version is of course interesting but a fund that can go up a ton, it was up 61% in 2021 and up 49% in 2022, can also go down a ton. That's more a rule of thumb than a comment specifically directed at BIVIX.

I remodeled these swapping floating rate in for AGG. The differences were much less than I would have guessed.

However, the TFLO versions did considerably better in 2022 than the AGG version.

We've gone through essentially this same exercise 100 times. Today's post was just a different variation on the same theme. Yieldy Put, the way we constructed it, is pretty solid but I wouldn't want to be caught with 25% in BIVIX in case it ever does go down as much as it went up in some of those years. I would also want to diversify the risk of so much into two alternative strategies. As we always say, nothing can work 100% of the time and diversifying your diversifiers mitigates that risk and in my opinion is worth the basis points that might be given up for that peace of mind.

The paper referenced a well known sports cliche. "Attack wins games, defense wins titles." I'd never thought of this in terms of how I try to manage portfolios but of course it fits whether we're talking about smoothing out the ride or the concept of 75/50 (75% of the upside with only 50% of the downside) or something else.

Participating in markets can be whatever you want but I think of it as a long game. My nephew was asking me all sorts of market related questions over the weekend at a family function. He's very new at it so I tried to gage my answers accordingly. I said the S&P 500 is it 5500 right now. It will go to 11,000, no question. If it only takes four years, that would be great. If it takes 20 years, that would be pretty weak but it will happen. Maybe, it won't take that long but maybe it goes to 2750 on its way to 11000.

As long as you understand your time horizon and have the right asset allocation, you're (my nephew) account will do exactly what you need it to do. Knowing all that, leads me to wanting to smooth out the ride, have a little defense on at all times and "win the title."

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

2 comments:

This comes down to (a) adding managed futures to diversify the bond allocation (a well known benefit), and (b) substituting some L/S equites for and ACWI equities allocations. Equities go from 60% in a 60/40, to 55% in the Yieldy Put 50/50.

Just run Portfolio Visualizer on 60/40 vs that 55% allocation. Or, more specifically, run 100% ACWI vs 100% BIVIX vs 50/50 ACWI/BIVIX. That explains most of the benefit. There is no question that BIVIX is an excellent diversifier over this time period.

It makes BTAL look pretty weak as a diversifier in comparison, at least over this time period.

Thank you Max. I do believe there is a lot of value in BTAL but not at 25%. An allocation that large is IMO way beyond the point of diminishing returns.

I am not comfortable projecting forward a backtest that includes 60 and 50% single year returns the way BIVIX rallied a few years ago. What is the real BIVIX? The first four years of the backtest or 2021/22?

Post a Comment