Risk Parity has intrigued me since I first heard about it however many years ago. The very simplistic definition is weighting the assets by how much risk they have although I might argue the idea is more about weighting volatility than risk but either way. Often, in order to have the bond sleeve have the same risk (or volatility) as the equity sleeve, the bond sleeve would need to be leveraged up significantly.

That relationship can and does change and various applications of the strategy incorporate more than just stocks and bonds and can be very sophisticated and/or complex. I've said many times that I don't think it works very well in a mutual fund or ETF wrapper but I find it worthwhile to study because we might be able to pull something useful from all the work the few funds in the space are doing even if we never use the funds themselves.

AQR had a fund called Risk Parity which became the AQR Multi-Asset Fund (AQRIX) which does use some risk weighting in its process. There is also the WealthFront Risk Parity Fund (WFRPX) which is a Morningstar 1 Star fund that has really struggled, there is Risk Parity ETF (RPAR) and a leveraged up version of of RPAR that has symbol UPAR. The newest fund is the Fidelity Risk Parity Fund which has an alphabet soup of symbols but I'll use FAPYX. If you know of any others, please leave a comment.

The first chart compares FAPYX to the others and I threw in Cambria Trinity which is a different type of multi-asset fund that is much simpler. Looking through to the holdings for FAPYX and AQRIX are fairly opaque due to how the various derivatives are labeled, it's tough to tell what they are and what the notional exposure is. And I was unable to find anything for WFRPX' holdings. Morningstar, Yahoo and even the Wealthfront page had nothing. If you have better luck, please leave a link in the comments.

RPAR, being an ETF, has much better transparency. That fund only goes back to 2020 but I was able to rebuild it on Portfoliovisualizer and look back ten years.

That's actually very close to in terms of year to year results of RPAR which does track an index.

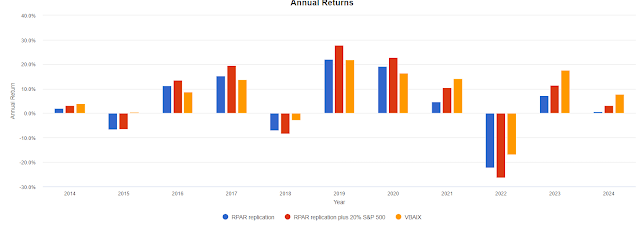

Comparing the RPAR replication to a version that includes a little more equity exposure and to the Vanguard Balanced Index Fund (VBAIX) which is a proxy for a 60/40 portfolio.

And the year by year results.

The results are underwhelming. It's not robust in the face of adverse market extremes. Risk parity funds seem to do worse, certainly in 2018 and 2022.

Now looking at AQRIX compared to RPAR replication and VBAIX. For the first five years, AQRIX was the old AQR Risk Parity Mutual Fund.

AQRIX appears to me to be a better mousetrap and it was far more resilient in 2022 but I believe it to be an inferior diversifier compared to some of the other alt strategies we've studied.

I've said before of risk parity, that I want it to work but where retail accessible funds are concerned it really doesn't work very well. Some of the other AQR funds have what I'd call risk parity influence and it works for them but even the AQRIX predecessor did not work very well.

It seems like the dedicated risk parity funds are a solution in search of a problem.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

4 comments:

NTSX by Wisdom Tree is a Risk Parity ETF, although they avoid the term "risk parity" in most of their marketing.

I do not think NTSX is a true risk parity fund. It is a capital-efficient / leveraged fund.

I would not call NTSX, or the other two efficient core funds they have, risk parity. Like anon 1:52 said, they are for capital efficiency to build out some sort of portable alpha strategy or help manage sequence of return risk, that sort of thing. A 67% weight to NTSX equals 100% into something like VBAIX.

Taaffeite Capital does a Risk Parity fund that delivers 17% pa (after fees and expenses) since 2013. Should check it out.

Post a Comment