One of my many quirks (we all have them) is a never ending fascination with investment portfolios that either are or are thought to be sophisticated like the Permanent Portfolio, various endowment portfolios and so on. The Trinity Portfolio by Meb Faber and Cambria Investments is another example. I've written about it a few times. The results haven't been great but the idea of trying to figure out how to allocate so much to trend is intriguing even if I'm never going to go as heavy as Meb believes in.

In addition to the Cambria Trinity ETF (TRTY) there are six versions that as best as I can tell are separately managed accounts (SMA) offered through Betterment. The ETF allocates 25% each to equities and fixed income, 35% to trend and 15% to real assets. The six SMAs allocate as follows with Trinity 1 being the most conservative ranging to Trinity 6 as the most aggressive.

I realize that several of them don't add up to 100, you'd need to ask them about that. One mistake I think I've made with trying to replicate the concept is to assume trend just referred to managed futures. Looking through to the holdings of the ETF and the 6 portfolios, the transparency is fantastic, it looks like momentum stocks are considered part of trend. At the moment, TRTY appears to just have 7.98% in managed futures funds and it has 8.32% in one ETF with the work momentum in the name. I'm not sure what other funds would be lumped in with trend but you can look for yourself and try to figure that out. The 6 models include the Cambria Global Momentum Fund (GMOM), which is a fund of funds, but I don't see that held in TRTY currently.

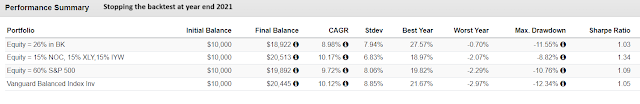

With all that in mind, I tried to backtest this a little differently to see if we can improve on past results with this which haven't been very good. Benchmarking to TRTY, we can go back almost six years.

The second portfolio is comprised of:

The result for Trinity 6 Replication might be surprising but most of the outperformance came from 2022. It was up 23% that year. The version with momentum stocks was down 2.2% that year, the 60/40 was down 16% and TRTY was down 3.3%. The second portfolio being near the top for the entire back test makes sense due to having 55% in equities.

The portfolio I labeled as Trinity w/Momentum stocks used Trinity 4 as a starting point. The Cambria website reports performance from Nov 2016-March 2024. Apples to apples, for that period Trinity 4 had a CAGR of 6.00% and standard deviation of 9.85% and a max drawdown of 19.35% while Portfolio 2 that we created had a CAGR of 8.85%, standard deviation of 8.75%, and a max drawdown of 7.21%.

The usefulness of my quirk, aside from being fun, is to explore different sources of influence to help the portfolio evolve. The Permanent Portfolio with 25% each to stocks, gold, long bonds and cash is designed to always have at least one holding that is going up no matter what. The influence is to include something like AGFiQ US Market Neutral Anti Beta ETF (BTAL) in the portfolio. It has been very reliable for going up when the broad market goes down. Unlike the Permanent Portfolio, 25% into the thing that should go up when stocks drop would create a huge drag for the 3/4 of the time that the stock market is going up. This is why we spend a lot of time here on holdings that provide different defensive attributes than BTAL, this is where uncorrelated holdings can play a role.

The results for TRTY and what I guess are SMA versions of the Trinity Portfolio are pretty underwhelming but if you know anything about Meb, you know he's a smart dude and there is something to this approach and value in trying to learn from it. Momentum does not always outperform but there are attributes worth exploring and there are differences between the various momentum funds. For example, the iShares Momentum ETF (MTUM) lags noticeably behind some of the other more plain vanilla momentum ETFs. I would not describe GMOM as plain vanilla.

Markets are evolving, investment products are evolving, so to me it is logical to spend time to understand whether your portfolio should evolve....selectively.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.