I tried to recreate the effect with a couple of broad based funds that often have higher volatility but didn't have luck making it work. It occurred to me that we could get closer to the result yesterday that the private equity stocks generated with a couple of sector funds. Technology and consumer discretionary tend to have bigger moves than the S&P 500 in both directions. Here's what that looks like for the last 15 years.

Both iShares US Technology (IYW) and SPDR Consumer Discretionary (XLY) have been client holdings for more than 15 years. To further avoid the insanity of 30% into one private equity manager stock, I also will add client holding Northrup Grumman (NOC). I've held that name for 20 years for clients as well. It's not the best performer but sadly defense industry stocks might be the most important investment theme. I don't feel like this is cherry picking because I've owned NOC for so long and what person who has been in the investment industry for any length of time doesn't know tech and discretionary usually, not always but usually, go up more than the broad market and down more than the broad market?

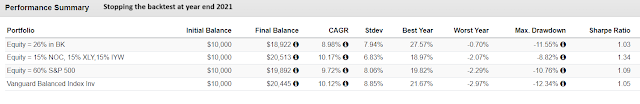

Beyond the equity exposure of each portfolio we backtested below, I used the above alts consistent with how we often blog about all this. Beyond the equities as labeled and the alts above, the rest all went into iShares Treasury Floating Rate (TFLO) as the fixed income allocation.

Portfolio 2, the one where 45% split between NOC, XLY and IYW is competitive with all the rest and the Sharpe Ratio is quite a bit higher but the standard deviation really sticks out for how low it is. Year to year, Portfolio 2 never got left too far behind.

There is a skew though. In 2022, NOC was up 42% which tilted the entire portfolio in a way that might not be repeatable.

NOC was not crisis alpha in The Financial Crisis, not even a little bit. The next time the stock market has a serious decline, I wouldn't expect NOC to put in a repeat of 2022. It might of course but there should be no expectation.

After I typed that paragraph, it occurred to me to stop the back test at year end 2021.

Parts 1 and 2 in this series are really just trying to think through an idea. Barbelling has a little influence in how I build the portfolio. The three equity position version we worked on today is less crazy than yesterday's 30% to one private equity stock to make up the entire equity allocation. I am intrigued but don't know if this can go any further, we'll see. If you have ideas on how to teak this to be more realistic, please leave a comment.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

3 comments:

How did this look during the last tech crash?

@anon can't apples to apples on portfolio visualizer until the month ends but each of the holdings behaved as I described in this posts and others....assuming you mean the event that culminated on 8/5.

IYW and XLY were down more than SPX which I would expect. NOC was up a lot which I wouldn't necessarily rely on, BTAL was up a lot which I would expect, TFLO and SHRIX were flat with a slight upward bias and managed futures was down for reasons we talked about in several recent posts.

My guess is the mix did better due to NOC and BTAL but we'll know for sure when August ends, I will try to remember to circle back.

Wait! I was able to run it on Arch Indexes back testing tool for just the month. Will share it on the blog tomorrow. Thanks for the prompt.

Post a Comment