We regularly look at capital efficiency and its potential uses in portfolio construction. There's plenty to learn from it, we've studied it here quite a bit and for me the answer goes no further than slight influence with a couple of alt strategies. I don't believe I am dismissive of it but I am wary or at least, very cautious.

The last few weeks have provided a good example of what can happen in adverse market conditions. Consider the following two portfolios.

Despite the leveraged semiconductor ETFs, when blended with USMV, the portfolio is underweight technology versus the S&P 500 using simple math, it works out to about 26% versus closer to 40% for the S&P 500. The tech exposure dials up slightly when you account for the beta of the semiconductor group versus the broader tech sector but this is still underweight versus the putting 60% in an S&P 500 ETF. The managed futures and floating rate exposures as diversifiers are both consistent with other blog posts.

Narrowing in on semiconductors is a form of barbelling returns, the benchmark iShares Semiconductor ETF (SOXX) has compounded almost 5% more than the broad tech sector but with a higher standard deviation. In terms of risk weighting or volatility weighting, a smaller allocation to semiconductors could deliver the same benefit to a portfolio as a larger weighting to broad tech. This type of barbelling is a form of unlevered capital efficiency.

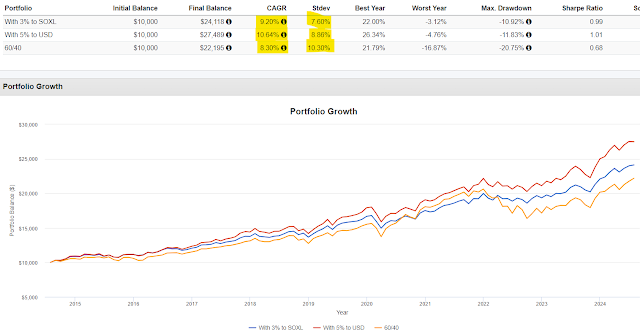

The results seem valid to me. For ten years, the two portfolios had higher returns with less volatility despite including leveraged ETFs. Notice though that the portfolio with the 2x fund did better. They even did much better than 60/40 in 2022 dropping only low to mid single digits. Thinking about this in theory, heck yeah, capital efficiency for the win!

The period captured in the chart is from July 10th. In just three weeks you've got brutal declines in USD and SOXL. I threw in the unlevered SOXX for comparison. If this had been rebalanced back on the first day of the year, the 3% weighting to SOXL would have topped out at about 9% on July 10th before cutting in half. Should more SOXL or USD be bought? If so, when should more be bought? I don't know the answer, the point is that this becomes a much more difficult way to engage with markets. It makes the investor more prone to succumbing to emotion and making a suboptimal decision. If someone were going to actually do this, I'd hope that they would plan out ahead of time how they'd handle a serious decline. Here we are, cut in half, whatya gonna do?

We haven't even talked about the risk of the levered funds that comes from the daily compounding effect.

As noted above, USD actually compounds at a higher rate than SOXL which is probably due to SOXL having to dig out some very big holes along the way including, maybe, the one it is in right now.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment