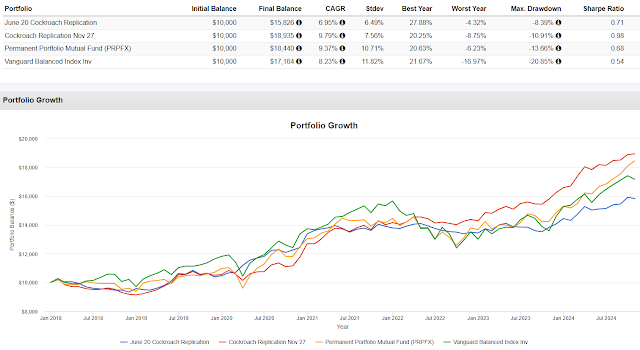

This will be fun. We spend some time here trying to crack the factor code in pursuit of better risk adjusted returns. It's difficult to draw any firm conclusions, more like making some observations that appear to repeat....sometimes.

That brings to this research paper by Robeco Quantitative Research and Erasmus University. I would describe the paper as seeking how to use low volatility equities in various ways to replace some or all of a traditional 60% equities/40% bonds portfolio. The paper introduces the idea of mixing momentum and value in some combo that they never quantified as a possible substitute for low volatility before digging in more deeply into different examples or cases.

The first example to look at they call Leverage In The Strategic Asset Allocation via this table in the paper.

These are easy to model. We'll use Fidelity Low Volatility Factor ETF (FDLO) as a proxy for low volatility for this post.

The results here are consistent with the paper. All three portfolios outperform VBAIX which is a proxy for a 60/40 portfolio and they do so with lower volatility and better Sharpe Ratios. The results are not skewed by one year. The distribution of results are pretty even. All three were better than VBAIX in 2022 by 150-550 basis points.

The second one I'll mention is called "Absolute Returns."

I put absolute return in quotes because the returns on the middle column aren't what I would associate with absolute return. The middle column can be modeled easily and if you click through and read that section, I think they are clearly pointing to client and personal holding BTAL which goes long low volatility names and short high volatility names.Remember, the idea is to see if a better risk adjusted result versus 60/40 can be found not better versus 100% equities. With the "Absolute Return" study, 70/30 and 60/40 both have interesting results. If you care about Sharpe Ratios you might be drawn to the 70/30 combo. Of the individual years available to study, the distribution of returns was even about half the time with two instances where VBAIX was way ahead of the FDLO/BTAL combos and two years where VBAIX was way behind.

The last one I'll look at is including a put option overlay. Our study will be simpler than the paper, we'll just use the Simplify PLUS Downside Convexity (SPD). I've bagged on SPD quite a few times. Somehow, it did worse than the S&P 500 by several hundred basis points in 2022. The result then is interesting in the context of trying to replace 60/40.

While I don't believe SPD is a replacement for VBAIX, the concept of what they are trying to do turned out to be pretty close to VBAIX going back to SPD's inception. Based on the chart, I'm guessing that SPD was positioned in such a way as to miss the bounce that started in late 2022. If you want to give them the benefit of the doubt that whatever happened in late 2022 won't happen again, the idea doesn't seem farfetched. That would really be a big bet though on a fund that failed its first test.

There are a couple of other examples they looked at if you want to click through. Of the three we looked at, the FDLO and BTAL combo is the most interesting. It has better stats than VBAIX and removes bond duration which, banging the same drum again, I want no part of.

Closing out, we'll take the 70/30 of FDLO/BTAL and tweak it a little closer to our typical conversation to add in managed futures and floating rate.

The CAGR of the 60/20/10/10 is a little lower than 70/30 but it does better in terms of volatility and risk adjusted return. Putting 30% or 20% into BTAL is really a big bet. While it hasn't had a problematic period of not working out in the past, if that did happen the next time there's a huge equity market decline, a portfolio that heavy in the fund would get pasted.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.