We've had a lot of fun over the last year or two looking at the Cockroach Portfolio run by Jason Buck and Mutiny Funds. It is Permanent Portfolio inspired. Where the Permanent Portfolio allocates 25% equal portions to stocks, long bonds, cash and gold with the goal of having at least one of the four going up at all times, the Cockroach Portfolio allocates as follows.

We haven't had much luck trying to replicate it thus far but as I was listening to Jason on some podcast recently I had some further thoughts on how to get to something useful for investors. Part of the reason it has been difficult to replicate is that ETFs and mutual funds we'd have access to are probably not as good as the myriad of managers that Mutiny can access to add into the Cockroach. And there are a couple of sleeves that probably can't be accessed at all.Using the word replication may not be precisely correct, the objective with these sorts of posts is to take what by all accounts is a successful asset allocation strategy and see if there is a way to apply some of the principles even if we can't nail down short versus medium versus long trend.

Back in June we built out the following in an attempt to replicate it as closely as possible.

The actual Cockroach Portfolio is leveraged but I reduced the weightings down proportionately to take the leverage out as follows. Below is the updated attempt at replicating the strategy.

There are some changes compared to what we did in June. The equity exposure shifted to momentum from market cap weighted. Relative value can be expressed as a form of long/short that seeks outperformance as opposed to arbitrage or market neutral so I added QLEIX. I used client holding CBOE as a proxy for long volatility. It takes on some attributes of VIX when the market goes down along the lines of if VIX goes up 5% in reaction to something, CBOE might go up some fraction of 5% (casual observation).

Client and personal holding ASFYX has a shorter trend overlay on top of the more normal 200 day/10 month trend and I added EBSIX for a little diversification and that is a name we use regularly for blogging purposes. With TFLO and client holding BKLN, we are taking duration out of the fixed income sleeve more in line with my thoughts.

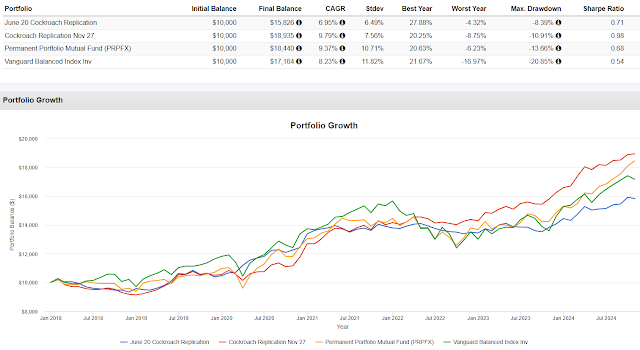

The June version doesn't keep up with the November version, PRPFX or VBAIX but it was down the least in 2022 and has the lowest standard deviation. The November version was the best performer and the standard deviation looks good too, probably thanks to removing the terrible run that bonds with duration had along with the volatility that space has taken on. Both the June and November versions handled the 2020 Pandemic Crash much better than PRPFX and VBAIX and as I mentioned, they did better in 2022. The Calmar numbers are surprising at 0.80 for the June version, 2.60 for the November version, 0.66 for PRPFX and 0.17 for VBAIX. Higher is better for Calmar.

The portfolio names here self explanatory. Where Cockroach views Bitcoin as a hedge against some sort of bad outcome with fiat currencies, I'm changing the idea to be about asymmetry. Bitcoin has an obvious asymmetric outcome, it could go up a ton or crap out entirely. Portfolio 1 then has no asymmetry, the gold plus Bitcoin sleeve in the actual Cockroach is entirely allocated to gold. Portfolio 2 is what we looked at above (I don't know why the CAGR and the other data points are different) and Portfolio 3 uses client holding Novo Nordisk (NVO) which has turned out to deliver a different type of asymmetric return.

I did it this way so that you can decide whether you think asymmetric exposure is worth adding or not. Yes, NVO is cherry picked but that is not about looking forward but a different look at what getting asymmetry right can add to a portfolio. Of course, something with asymmetric potential could fail miserably. Maybe along the lines of Taleb, someone believing in adding asymmetric opportunities would split up the 4.15% we're assuming for this blog post.

The November version has some compelling attributes and is far more realistic than any other versions we've played around with. One thing that could hold it back is it really only has 33%+/- in equities, the two momentum ETFs, CBOE and QLEIX sort of. In the last ten years, QLEIX has looked somewhat similar to equities five times and looked very different the other five. It is also worth mentioning that of the years available to backtest, the November version only was the best performer of the four, one time. The long term result has been valid but year to year it might have been difficult to sit with.

Please leave a comment if you have a different angle to construct this idea.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

2 comments:

Finding reliable help is always a concern, and having a Crypto Customer Service Phone Number can make resolving wallet issues or transaction delays so much easier. Your article does a great job explaining the common challenges in the crypto world and how users can get support quickly. I especially liked the tips on staying safe while contacting service teams—very practical advice!

Great post! To explore more details or get in touch, click this link: safepal customer service numberThe safepal customer service number provides peace of mind for users who want dependable assistance at any stage of their crypto journey. From first-time wallet setup to resolving complex technical problems, Safepal customer support focuses on user safety, clarity, and smooth performance. Contacting the support team through official channels helps users avoid misinformation and ensures long-term wallet security.

Post a Comment