For today's post, I want to take on what I think are a couple of commonly held beliefs about investing.

The first one is whether or not we need to worry about outperforming the market from year to year. Do we even need to try? I know plenty of advisors and do-it-yourselfers do focus on this but I would tell you it doesn't matter. To clarify, this thought excludes certain pools of capital like hedge funds and stock picking mutual funds.

How many years have you been a market participant? Assuming you are not brand new, without looking, how many years have you outperformed the market and how many have you lagged? Odds are you don't know. Without looking, I don't know. I know I've outperformed in the few years that it mattered (large declines) which does not imply any guarantees about future results. An investor with ordinary skill, not gifted not woefully incompetent, will have years where they are ahead and years they lag, there's no avoiding that.

What matters is having enough when you need it. You're 81 and been taking income from your portfolio for 15 years, what matters to you more, that you can continue to take what you need from your portfolio or that four year run in your mid-50's when you beat (or lagged) the market? If you're 81 and can no longer meet your income need from your portfolio, that is what matters. The example assumes no sort of serious medical or family calamity that altered your financial plan, life happens that way sometimes.

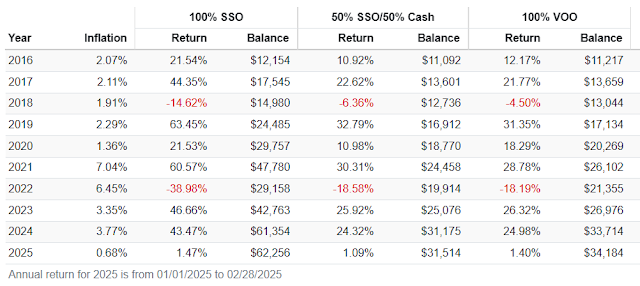

Here's a portfolio I pulled out of nowhere versus the Vanguard Balanced Index Fund (VBAIX) for a decently long period of time.

Looked at over the course of almost eight years, who wouldn't want that result? Market equaling with far less volatility. It's statistically superior by almost every metric. Here's the thing, it lags almost every year. Someone sitting in this would lag year after year. There were a couple of instances of outperformance in the period studied including 2022 when it was up 46 basis points and it is slightly ahead this year too. The convergence of the growth rates is probably just a coincidence. Over the next ten years, if markets are up eight times, I would expect it would lag those eight times.

I'd be happy with that standard dev number and lagging by 100 bps annually. The important thing is having enough when you need it and one way to improve the odds of having enough is by avoiding behavioral errors that permanently impair capital and one way to avoid those behavioral errors is to smooth out the ride in such a way that the portfolio goes down less fairly reliably (no absolutes).

There are quite a few different types of participants for whom this does not apply as I mentioned above and certainly personality types for whom this would not fit but reliably going down less while getting decent, not even great, upside participation prevents a lot of problems.

The other one isn't necessarily a common held belief, more like deconstructing the thought process to a Barron's article that looks at how to hedge against a crash. It was essentially a list of possible ways to hedge that highlighted the negatives of those ways before concluding that bonds are the best tool. Forgetting all the work we do here with countless ways to offset market volatility with alternatives, the article didn't mention gold or commodities. I mean....

Holding on to 100% of something like VBAIX all the way through market cycle after market cycle is absolutely valid other than addressing sequence of return risk when you get within a few of retirement. But for anyone not wanting to ride that roller coaster all the way down in that part of the of the cycle, I would say to think of hedging in very simple terms. What tools can you use, so using tools implies adding something not selling VBAIX, to reduce volatility? The article points out the various drawbacks of using inverse funds, yes the article is right but when the stock market drops today, what will an inverse fund do? It will go up. When a the stock market goes down this week, what will an inverse fund do? It will go up. For a month? Ok, it starts getting a little less reliable at this point but in a truly rough month for the stock market, it is very very likely that an inverse fund will go up.

SH is a client holding that I added pretty close to election day. It's been rough over the last month and SH is up. It's not up the exact amount that the S&P 500 is down but do you think it's close? Regardless of whether you think it is close, it was a rough month for stocks and SH was up. The 2x version of SH has symbol SDS and for the last month, Yahoo has it up 17.39%. Is that close? It's not exact but is it close? Again, either way, a rough month for stocks and SDS was up. I'd argue they are reliable in this regard but not down to the basis point. While I am confident in these, don't use them if you are not, I keep the allocation to SH very small for that instance when it somehow goes down in a rough month for equities. All the risks noted, the odds that a small allocation will reduce net long exposure are very high. I would also note that I am nowhere near as confident in inverse funds tracking narrower indexes or individual stocks, I've only ever used SH or SDS.

For the previous month, Yahoo has the SPDR Gold Trust (GLD) up 3.5%. For the previous month the iShares commodity ETF with symbol COMT was down 2.5% so ok, hasn't been working on this go around but when the S&P 500 was bottoming out in the fall of 2022 with a 21% drop, COMT was up 21%. Maybe you want commodity exposure or maybe you don't but there's something to it as a hedge.

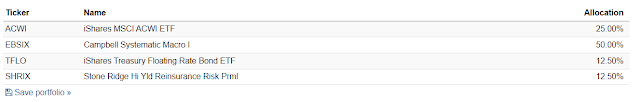

Long time readers might know about my use of BTAL for clients (personal holding too) in this regard. A long short fund that we've looked at once or twice might also be useful too but I'm not sure is charted below.

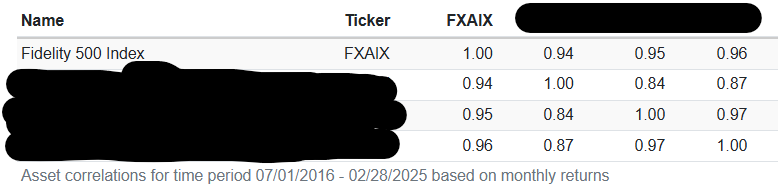

Invenomic Institutional (BIVIX), for retail investors the symbol is BIVRX, has plenty of history of differentiating from the the S&P 500 but in 2021 it was up a ton when the S&P 500 was also up a lot. BIVIX is actively managed and

the fact sheet uses the word quantitative not systematic so maybe there will be times where it does correlate and times when it doesn't. Where there is BTAL that I would say is very reliable, BIVIX that might be reliable, there must be others that we don't know about that could function in this hedging role.

For anyone interested in doing the work, maybe Barron's wasn't, there are ways to reduce net long exposure with hedges without having to sell in case equities did not go down. As things get worse, the hedge will grow to protect more of the portfolio and if things get better, the hedge will shrink, acting as less of a drag on overall returns.

The concepts here are very simple to understand which makes it easy to sift through whether this is or is not something you want to do and then go learn from there if interested.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.