A couple of follow ups.

First on Monday's post about using return stacking to slightly increase the retirement withdrawal rate, I forgot about the WisdomTree Core Efficient Plus Fund (NTSX) which is leveraged up such that 67% in that fund equals 100% into a 60/40 portfolio like the Vanguard Balanced Income Fund (VBAIX). That leaves the remaining 33% to maybe leverage up to buy more stock (not what I would do) or add diversifying strategies that could lead to a similar return as full 60/40 but with less volatility or now that interest rates are so much higher, return stack the remaining 33% into a T-bill and add an extra 170 basis points to returns.

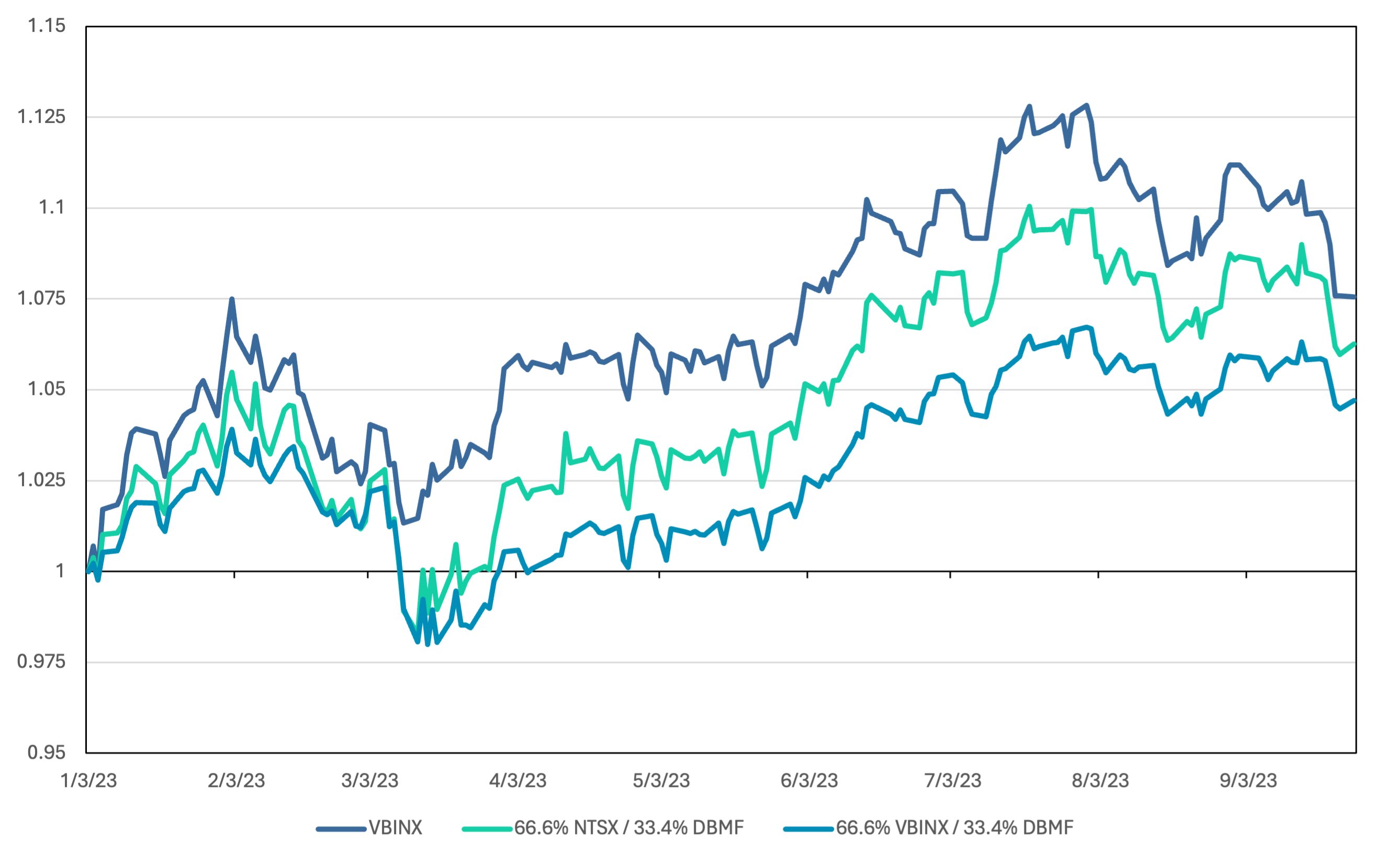

Thanks to Corey Hoffstein for the reminder as he Tweeted out the above chart. You can play around with the numbers yourself and our studies here I've been using a longer standing fund than DBMF for managed futures as you can see below.

Portfolio 1 is what I used in Monday's blog post. Portfolio 2 incorporates 20% into managed futures as we discussed last night combined with NTSX and the T-bill ETF and Portfolio 3 is just the simple NTSX/BIL combo I mentioned above.

Portfolio 1 from Monday has a lower volatility than the two return stacked portfolios with a CAGR smack in the middle of the other two but it only has 50% in equities versus 60% for the other two. The lower equity exposure in Portfolio 1 was a slight drag in four of the five years studied but in 2022 Portfolio 1 was only down 7.01% versus 11.14% for Portfolio 2 and 16.85% for Portfolio 3.

Now following up on the post last week about convertible bonds, I wondered about blending together covered call funds and convertible bond funds. Could there be some sort of return profile that compared favorably to VBAIX? Both covered calls and convertibles take on plenty of equity beta but maybe the combo does something interesting.

And then I added unstacked, managed futures at the 20% weighting we looked at on Monday and compared both to VBAIX.

Nothing very miraculous here but Portfolio 2 with managed futures did avoid most of the carnage of 2022, only going down 7.16%.

A term we've used before, not that I came up with it, is crisis alpha. Managed futures have lived up to that billing in 2008 and 2022 but I am wary about going too heavy, like 20%, for the simple reason that expecting something like managed futures or any of the others we look at to be infallible all of the time is a pretty big risk. I think a lot of people incorrectly believed bonds could be infallible. That was catastrophic last year and getting worse this year.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment