A few minutes after the close on Thursday, Carl Quintanilla Tweeted that today was the worst single day ever for the iShares 20+ Year Treasury ETF (TLT) as part of the fallout of Wednesday's Fed presser which has taken equities down a couple of pegs too.

As I did my normal routine of reading and scrolling I ran into a couple things noting the rough go for bonds. Ed Bradford noted that the US treasury that matures in May 2050 is now trading below 50 cents on the dollar. Of course, someone holding that paper can wait until maturity to get all their money back but they will be collecting a yield far below the prevailing market while they wait.

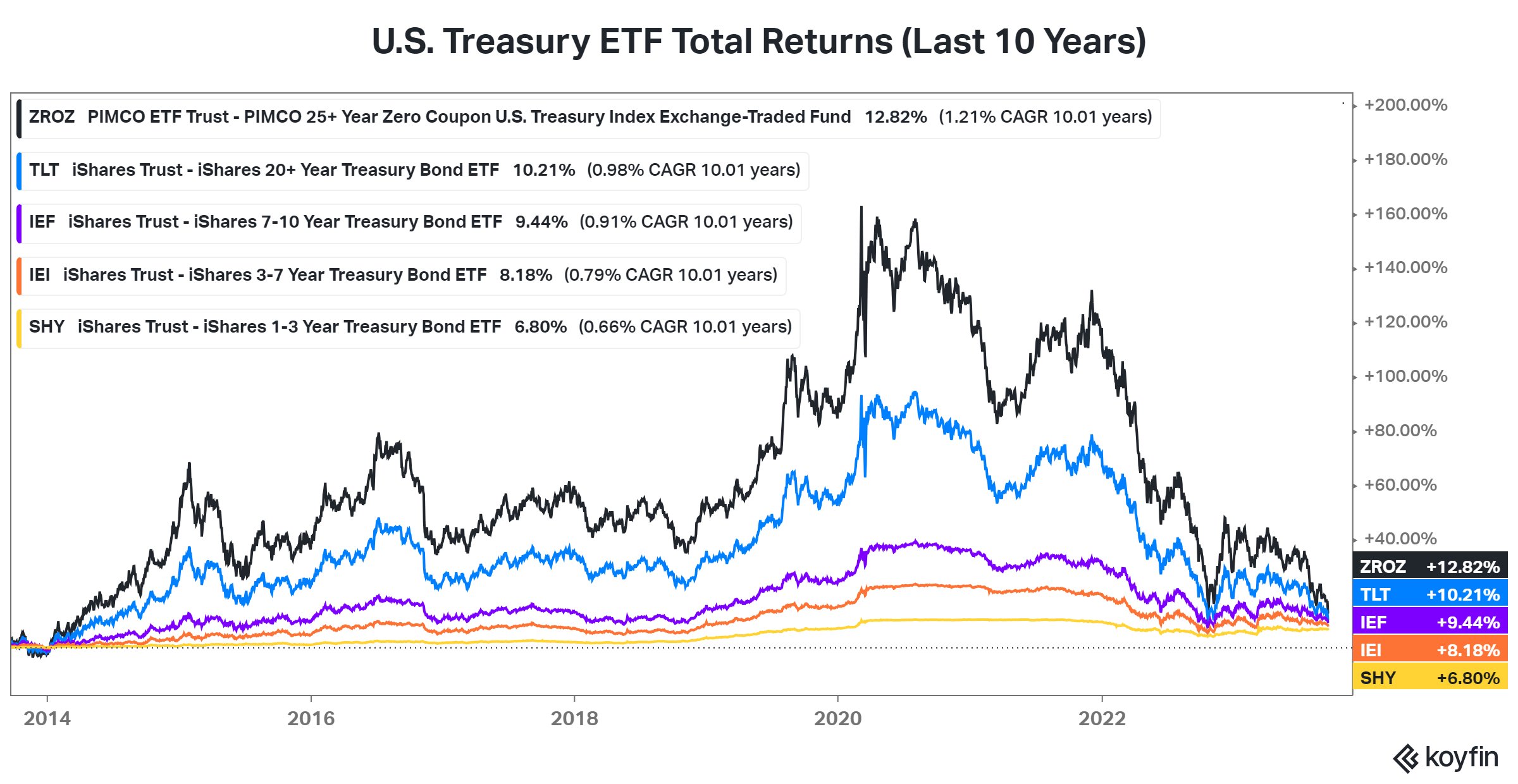

I've seen a couple of references to a big, really big, round trip in price for fixed income ETFs.

Yikes. That image is from Stocktwits. Notice the CAGRs. Unlike the decade long round trip to nowhere for equities in the 2000's, bond ETFs don't necessarily need to go back to where they were. Yields could hover in the current range for many years, drift a little higher or a little lower but the ten year going back below 1%, hey someone bought down there, is very unlikely to happen again. Getting anywhere close to 1% on the ten year is very unlikely to happen again.

Over the course of the year, I've seen quite a few pundits saying now (whenever they were being interviewed) was the time to add duration. That call made no sense to me as we wrote about countless times and it still doesn't. I've been "right" about bonds with any sort of duration carrying far more risk than we've seen in many years, decades really. I was not predicting what interest rates would do, I'm pretty bad at that. That ability eludes most people but recognition that risks are elevated is more accessible and that describes what has been going on in bonds for many years.

The declines this year are not as bad as 2022's carnage but from the start of 2022 TLT is down 38%, ZROZ is down 51%, IEF is down 20% and the AGG ETF is down 16%. This has become a long-ish term event. Last year bonds with any sort of duration provided no protection in the bear market and today as a microcosm they still don't. TLT was down 2.57% on Thursday and ZROZ was down 4.14%.

We've looked at countless alternative strategies bundled into funds that I believe offer a superior offset to equity volatility. There are also more choices in the more traditional fixed income market that are very short in duration that now have yields close to 5% either way.

I've done more with individual treasuries that mature in a year or less. When the next one matures, I'll either look at a similar maturity but would consider two years if I can get greater than 5%. One and two year paper can drop in price but par is only a year or two away, not 27 year away in the case of the May 2050 issue mentioned above and I think getting paid 5% to wait for even a couple of years is ok, 27 years would be tougher.

Of course, brokerage firm money market funds are paying close to 5% these days too. They are fixed at $1 per share and usually they have to be bought and sold in the same manner as mutual funds.

The knock against all the short duration fixed income segments is reinvestment risk. Reinvestment risk is often cited by people averring for taking on duration. That is a risk to be sure. If rates go back down, so will yields on short term fixed income products. That risk then is one of opportunity cost. If you need to pay for something and have to sell a short term asset to do so, you'd be very unlikely to lock in a big loss as rates go down. If you have a long duration asset and are forced to sell to pay for something expensive after rates have taken another big leg up, you would be locking in a big loss.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment