The latest retirement disaster article from Yahoo focuses on 55 year olds who have a "median savings of less than $50,000." Yahoo says it's "bleak" because this cohort is "only about a decade from retiring."

Anyone else skeptical about that $50,000 figure? It is pretty clear that all age cohorts are woefully undersaved but, yeesh, I don't know about that. A harsh reality is that $50,000 is not a retirement fund but it is a pretty robust emergency fund.

We've gone over the math before that starting as late as 55 can catch a lot of the way up if they can afford to save a very high percentage of their income. At that age it is not crazy to think a house could paid off or very close to being paid off so what had been mortgage payments can go toward retirement savings. At that age it is not crazy to think that kids could be grown and out on their own. It might be reasonable to think that if someone hasn't saved a lot of money by 55 that they didn't have a high income so the hurdle to clear with their savings is lower.

A 55 year old couple able to meet all their needs on a $70,000 income, even if that means having very little left over for savings will get $2997 in Social Security ($1998 primary benefit and $999 spousal benefit) at age 67 which is a meaningful percentage of their net income. Smart Asset calculates $70,000 gross income working out to $57,187 after tax.

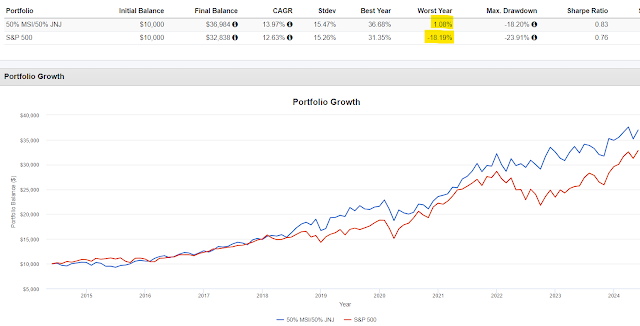

If they can put their previous mortgage payment, lets go with $1500/mo, into a 60/40 fund, they would end up with $415,000 including the $50,000 they started with based on June, 2014-June 2024 results for the Vanguard Balanced Index Fund (VBAIX) or they'd have $500,000 if they put 80% into stocks. Obviously you can discount those numbers if you expect lower returns going forward.

A 4% withdrawal rate of $400,000 (so I am giving the balance little haircut) is $16,000 and dialing up the risk slightly, a 5% withdrawal would be $20,000. Social Security plus the $16,000 would add up to $51,964 and they were netting $57,187 so there is a gap of $5223 per year. But there really isn't because they are no longer saving the $1500/mo ($18000/yr) mortgage equivalent.

There is not much margin for error in this scenario but being 55 and extremely undersaved doesn't have to be a catastrophe either. If this couple could figure out how to create a third income stream, they have 12 years to do this, they could create a pretty good margin for error.

Flipping the switch from paying a mortgage to saving into a retirement account seems plausible to me. I realize that not every undersaved 55 year old can do this but some can.

Like I've been saying for 20 years now of blogging, people figure this out for themselves because they have to. Chances are that you, reading an investing blog are probably not extremely undersaved but you know people who are. You can certainly share the example in this post to help them think about this differently and start to hustle and scramble a little more than maybe they have previously.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.