We've all seen Tweets or notes in articles or other places where someone says something like $1000 invested in Amazon in nineteen ninety whatever would be worth a gazillion dollars today. Reactions to that sort of comment might be some mix of hindsight bias, regret and maybe a couple of things. We've talked about this before. The prompt today is a passage from Phillip Fisher shared by Koyfin that addresses the power of holding stocks, or now ETFs too, for a very long time.

I'd never seen this before but holding on in the manner Fisher describes is something I try to do. My longest tenured clients have had some holdings for a full 20 years now and quite a few more names for 15 years. Holding a stock for than long will be challenging. Take a look at the long term chart of any stock you think has been a great performer for a long period of time and you will see some painful drawdowns. In 2018, Nvidia was down 30% versus 4% for the S&P 500 and in 2022 it was cut in half versus 18% for the S&P 500. The Nvidia example ties right in with the Fisher quote.

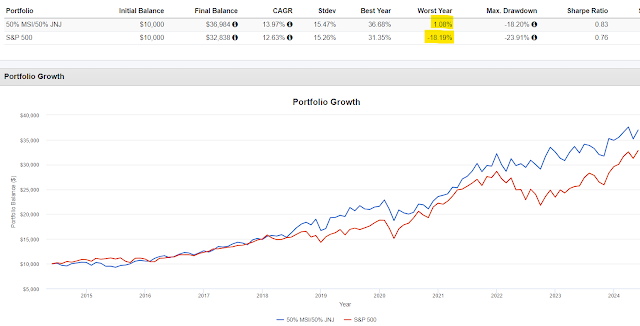

Let's look at a couple of stocks compared to the S&P. Coincidental to the Fisher quote, I bought client holding Motorola Solutions (MSI) in 2013. The catalyst was a deadline for emergency services having to drop wide band radio frequencies in favor of narrow band which meant new radios for anyone still using wide band. A quick side note, this was not the only time where my involvement with Walker Fire helped with my day job. The other stock is Johnson & Johnson (JNJ) which is simply a very blue chip type of name which is one of the 20 year holds I have.

When we talk about expectations for a holding, I expect something like MSI to outperform over the long term but not so with JNJ. Some of the drawdowns for MSI were far worse than the index. JNJ is far more of a yield story having been a 3-ish percent yielder for a long time so where Yahoo charts don't capture total return, you could add about 30% more to the JNJ result, still far behind the S&P 500. JNJ mostly stayed with the market but then started to disconnect around the time FANG stocks became a fad and has continued lately as we call those stocks the Magnificent Seven.

For maintaining a diversified portfolio, the attributes of both stocks are important.

We know one name was far ahead of the market and the other lagged. The compounded growth of both is a little better which is fine but what is noteworthy in this study is the worst year. Trying to smooth out the ride is a big priority for reasons we've talked about hundreds of times, and up 1% in 2022 makes a great case for why a stock with JNJ's attributes is important to hold if you use individual stocks. In 2018, the 50/50 blend was up 12% versus a 4% drop for the S&P 500. The ten year result is competitive with the index but in 11 full and partial years available for us to look at, the 50/50 lagged the index six times.

Think about that. Slight outperformance long term but lagged in individual years more often than not. At the beginning of the post I mentioned the challenge of holding on for 20 years. This 50/50 we're talking about is a slightly different type of example that makes the same point. Can you live with that? That is the challenge of being a patient investor.

Weak stock performance is going to happen and not a reason all by itself to sell if you're an investor as opposed to a trader. The next time the stock market drops 30-40%, I'd expect certain holdings like MSI to fall more and I'd expect some holdings to go down less (or maybe even up in a couple of instances). Don't frame this as infallibility because anything can happen at anytime, think more in terms of reliability. In 2008, JNJ was down just under 8% and in 2022 it was up about 7%. While that seems reliable to me, it's not infallible for future market events.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

1 comment:

The passage reflects the wisdom of Phillip Fisher on the power of long-term investing, resonating with experiences in stock holdings like Nvidia, Motorola Solutions (MSI), and Johnson & Johnson (JNJ). Despite fluctuations, holding stocks over decades can yield significant returns, albeit with challenges and drawdowns. While MSI may outperform due to specific catalysts like regulatory changes, JNJ, known for steady yields, reflects different investment goals. This underscores the importance of diversified portfolios and strategic long-term investment approaches amid market trends and fluctuations.

Post a Comment