Jason Buck from Mutiny Funds and creator of the Cockroach Portfolio gave a web presentation about Cockroach via RCM Alternatives. We've looked at the Cockroach Portfolio several times before. Its original was influence by the Permanent Portfolio created by Harry Browne which allocates 25% each to stocks, long bonds, gold and cash. The big idea is that no matter what is going on in the world, at least one of the four will be going up.

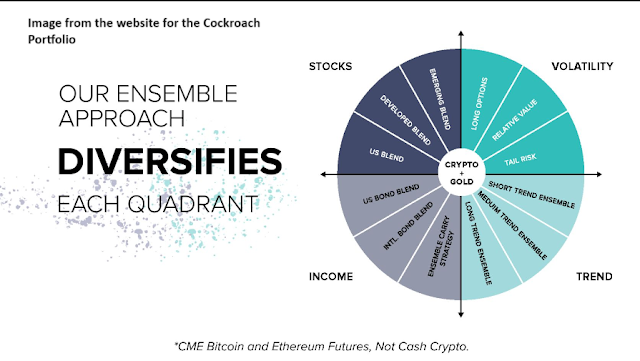

The Cockroach divides into four quadrants plus one more. I realize that's a silly way to word it but I think it better captures how Mutiny presents it.

As we've said previously, trying to mimic it with exchange traded products doesn't really work due, I believe, to the limitations of the funds available to recreate the volatility quadrant. I am intrigued by the portfolio and even though mimicking it to get any sort of reasonable CAGR may not be realistic without the 4% Bitcoin allocation (a point we figured out in previous posts), that doesn't mean there isn't some bit of process or influence we can't take away.

One thing I learned in the web show today is that the Cockroach leverages up, the four quadrants are actually 50% each and then 20% to crypto and gold which is split 4% to crypto and 16% to gold.

Now knowing the actual Cockroach leverages up, here's an updated replication using retail accessible funds.

It still isn't quite right of course for a couple of reasons. I used VMNIX as a proxy for carry because we compared that fund to currency carry and they were similar but at this point, I don't know what variation of carry that Cockroach uses. As we said yesterday, there's no fund that tracks the version of carry built around futures yield. If you run this without Bitcoin, the CAGR going back to mid 2017 which is as far as it goes because of TAIL's inception date was 4.03%. With Bitcoin, the CAGR jumps up to 10.96%. That's a powerful argument for barbelling in the context we talk about all time here.

In terms of looking forward, I don't think it makes sense to model it to rely on Bitcoin performing anywhere close to what it's done in the previous X number of years. Even if Bitcoin goes to $1 million, it wouldn't come anywhere close to matching previous gains.

Where this post is a step toward figuring out whether a portfolio resembling the Cockroach could come together to blend decent upcapture with an all-weather effect when the next crisis comes along or just in the face of the next "regular" bear market, I built the following.

The weightings are adjusted to get to an unlevered version. With the capitally efficient funds now trading, you could get the leverage in there up to 120% pretty easily but we'll stick with a simpler approach for now.

Instead of true volatility products, I used client and personal holding BTAL. The long term bleed of TAIL and to a lesser extent VIXM is a much larger drag than the huge weighting I have to BTAL for this post.

VIXM obviously had serious crisis alpha during the pandemic crash but BTAL still did well.

In the web show, Jason mentioned that the income quadrant averages out to a 15 year duration. He said if you have a diversified portfolio then something you own should make you want to puke and for him, I guess it's his fixed income duration. Using a floating rate vehicle as a substitute, as we've been talking about for ages, removes another huge drag on returns as we try to figure this out.

The version I built for this post was certainly all weather during the pandemic crash and 2022 which is interesting because they were two completely different types of events. If you take away the 2% allocated to Bitcoin and add it to gold, the CAGR drops to 6.74%. Going forward, Bitcoin is very unlikely to repeat its past performance (repeated for emphasis).

Part of the drive underlying the Cockroach is the threat that equities lag for an extended period similar to the 1930's, 1970's and much of the 2000's. I think that concern, although valid that it could happen again, really hampers returns. They go up in more decades than not. I get not wanting a "normal" 60% in equities but investors who need growth for their financial plans to work, need more than a 1/4 of their assets in stocks.

Tweaking it to 40% equities and no Bitcoin as follows.

It looks a lot like 60/40 in terms of growth, with only half the standard deviation and it retains the all-weather benefits from 2020 and 2022.

Including a percent or two to Bitcoin for it's asymmetry makes sense but I didn't want to skew the result to something that I don't think can be repeated.

Regardless of what you think of the long term result, good or bad, a portfolio with this sort of low volatility is going to have quite a few years that you lag far behind more typical benchmarks. Finally, I would reiterate the importance of understanding when something is very unlikely to be repeatable like the blue line portfolio. Bitcoin was up 10X in the period studied. Of course that could happen again, but, repeated for emphasis, I don't think it should be modeled in looking forward.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment