Barron's had a short article about replacing 60/40 with 60/30/10 due to inflation. I'm always going to want to dig into an article like that. In this case the the idea was 60% in equities, 30% in bonds and 10% in TIPS. TIPS or treasury inflation protected securities are conceptually straight forward. In addition to an interest payment, the price gets adjusted higher at the rate of reported headline inflation. So maybe you buy a TIPS at 100 cents on the dollar but after holding it for some numbers of years you might get 120 cents on the dollar back at maturity. The 20 cents would be the inflation protection. One complicating factor is that tax is owed annually on the amount of the par value adjustment so qualified accounts might be better for individual TIPS.

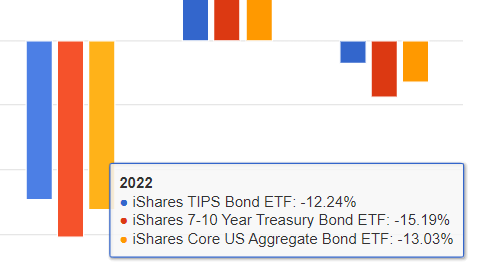

The article quotes an analyst from Alliance Bernstein as saying "if there are any unexpected inflation hikes, you are immunized from those spikes." That sounds good of course but in reality, being immunized isn't exactly how it played out in 2022. Inflation did spike but so did interest rates and investors learned that TIPS are interest rate sensitive just like bonds.

Obviously, TIP did a little better in 2022 but I would bet that someone holding TIP would have hoped for better than 79 basis points versus AGG. Short dated TIPS ETFs did much better, dropping mid-single digits but that still might have been a mild disappointment. An investor might think, inflation spiked, well that's not good but at least I have some TIPS and then they see their TIPS exposure is down too.

That's what makes the Barron's article a little of a head scratcher. So 10% in TIPS to protect against inflation?

Yes, the short dated TIPS exposure helped incrementally versus the other two but it was very slight. The worst year for all three was of course 2022. If someone had made this suggestion ten years ago, ok, yeah, if inflation comes back a decent allocation to TIPS might help. But now, inflation did come back and a decent allocation to TIPS did almost nothing. From here, going forward if inflation stays where it is and interest rates stay about the same then yes you might a "real yield" kicker to help but if rates spike to a higher level, TIPS would again go down.

I think putting the 10% into broad commodities or managed futures Would be a more effective hedge against inflation than TIPS. It might make sense to do other things in addition to 10% in commodities or managed futures for more robust protection against inflation but for now we'll stick with the 10% highlighted in Barron's.

In this study, broad commodities did better than gold in 2022 but on the next go around gold might do better. Broad commodities and managed futures were both up a lot in 2022, gold was flat, long dated TIPS were down low double digits and short dated TIPS were down mid single digits.

The correlation matrix helps shed some light.

Having negatively correlated assets was more reliable than TIPS exposure and for my money, that will continue into the future.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment