I had a very entertaining Sunday morning listening to a webinar about portable alpha and then reading a paper referenced in the webinar. You'll see why it was so entertaining in just a bit. The webinar was 59 minutes long with four participants and one moderator. One of the participants was Rodrigo Gordillo from ReSolve Asset Management and he is also one of the ReturnStacked guys, another was Lauren Sholder from Winton and I don't know who the other two were or who the moderator was or who put on the webinar.

Assuming I would get a blog post out of it, I figured I could get the details after watching. I made it 54 minutes in, we then went for a hike with the dogs and then when I settled back in to watch the last five minutes, I got an error message telling me to reload the page. When I reloaded it, the webinar had disappeared as did the Tweet I saw that pointed me to the webinar. My hunch is that it got posted before a proper compliance review and was taken down. This is the link I had but again, appears to be a dead link for now. https://vimeo.com/1021091039/646ff635cd . Kind of funny, when Vimeo couldn't find the webinar, the page said VimeUhOh.

Portable alpha in its simplest form is the strategy of blending plain vanilla beta exposures like equities and bonds in such a way where futures contracts replace one of the two, leaving cash or room to add alpha seeking strategies. The PIMCO StocksPLUS Long Duration (PSLDX) offers 100% exposure to equities and 100% exposure to long bonds. If an investor put 50% of their portfolio into PSLDX then in theory they have a 100% allocated stock and bond portfolio. That leaves 50% to put into alpha seeking strategies.

The webinar started with some history of portable alpha. I've heard this several times but haven't relayed it here. It was a PIMCO invention in the 1980's that blew up in 2008 because practitioners were leveraging up to buy assets with equity beta. The way it's been told, the leverage was used to find stock pickers believed to be capable of outperforming the indexes. If you don't recall hearing about this in 2008 it's because it was much more of an institutional problem than a problem for retail sized accounts.

With the experience of 2008 under the industry's belt, the conversation around portable alpha has become more about how to get more effective diversification in a capital efficient manner. Capital efficient just means leveraged.

A key point reiterated a few different ways was the extent that the assets used for portable alpha has to be a negatively correlated to the beta assets of equities or fixed income. Otherwise, portable alpha would be taking on more risk which was the lesson of what not to do from 2008. They briefly touched on an idea we've looked at before which is to dial up or down beta based on the top down environment. We've looked at top down in terms of both qualitative factors and technical factors. The last time I added the ProShares Short S&P 500 (SH) was in September 2021 which was an example of both qualitative where it really looked like Congress was willing to endure a technical default over the debt limit and technical when the S&P 500 was more than 20% above its 200 day moving average. Adding SH in that instance allowed me to dial down the net exposure without selling anything.

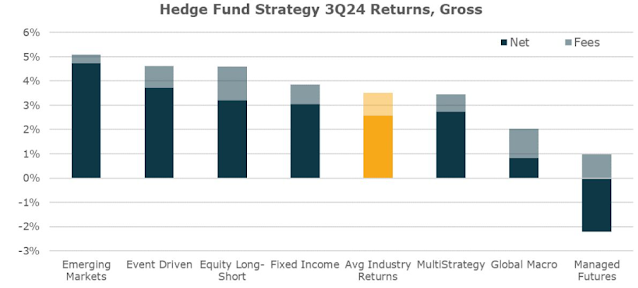

There was a consensus among the group that trend has tended to be the best answer to "porting" alpha into a portfolio. This was conveyed by the participants in a very matter of fact way, well of course managed futures is the best alternative strategy for this. Managed futures isn't the only way to do this but they seemed to be saying it was most reliable among several other alternative strategies noting that only managed futures has been consistently lowly or negatively correlated. That reiterates the idea we talk about being reliable and meeting the expectation set by a strategy/fund. The point of all of this they said is to reduce volatility while understanding that volatilities can change. Long bond volatility has changed, it has become a source of unreliable volatility as I've been saying for quite a while now.

Then Rodrigo referenced a paper by Jason Josephiac from Meketa that sounded interesting. I have the correct spellings now but just based on his mentioning the paper, it took a while to find it on Google. The paper also lists Ryan Lobdell and Brian Dana as authors of the paper too.

The paper explores diversifiers in almost the exact same manner as I do but with very clever descriptions. They talk about first responders, second responders and diversifiers. Here's breakdown.

What they've called First Responders, I've referred to as having a direct cause and effect. Stocks go down, they go up. This group has included BTAL, inverse index funds, long VIX (long volatility), tail risk (index put options) and they include long duration treasuries which I am saying I don't think they are reliable anymore. First Responders should "work" right away with fast declines and to a lesser extent large declines. Long volatility and tail risk might stop working during a decline if after a while, volatility compresses. VIX mostly dropped from April, 2022-August, 2022 while the S&P 500 was moving lower.

Second responders is a shorter list with managed futures obviously and I would add gold into this category but gold might be a little less reliable for this group. We've talked about the different nuances between different managed futures funds but when the trend does actually change, the strategy has tended to go up when stocks go down. I've been saying this for ages, the panelists said this too. I have confidence but do not assume infallibility.

The Third Responder category as they have it seems pretty broad. I would divide that one in two. The group as they define it focuses on zero correlation. I would have this group just be what I've described previously as horizontal lines that tilt upward no matter what is going on. This includes various forms of arbitrage like they said, along with insurance linked securities (catastrophe bonds/risk transfer) and market neutral. Distinct from that group, I would add a category called You're Saying There's A Chance. This is where I would put things like global macro, certain types of long/short or risk premia and maybe even Bitcoin. These types of funds are legitimately uncorrelated return streams that are capable of going up a lot in a broad market decline but the reliability is not very high. Here's an example of each from 2022. They were all up a ton in 2022 but there's no great way to assess whether they could repeat that performance in the next bear market, but there is a chance...

There was one other point from the paper to touch. The concept of

label masking diversification which isn't effective diversification. Here's a list of how someone might build a portfolio and think they are diversified.

The first five rely on the same things. High yield is a pretty close cousin too and depending on the hedge funds chosen, they too could being relying on the same things meaning they could all go up together and so then they could all go down together, they all have equity beta. You also hear about infrastructure as an alternative diversifier. It's not. These things (most of the list and infrastructure) all have equity beta. You're not going to diversify equity beta with more equity beta. BTAL is the AGFiQ US Market Neutral Anti-Beta ETF. It has a negative beta, it's a First Responder.

If First Responder, Second Responder, Diversifier and my extra category You're Saying There's A Chance helps sort all these out, good. We talk about examples from all of these groups constantly, Portfoliovisualizer has a correlation tool to perform the screening process of making sure you're looking at the right thing and then you can start to learn about the funds themselves beyond just the correlation stats.

If you even believe in any of this, plenty of people do not, I would still focus on a lot of simplicity with beta, hedged with a little complexity. As far as portable alpha, where part of the appeal is to reduce tracking error, first you need to decide how important that really is. I am trying to smooth out the ride for clients so they can take what they need without being overly stressed by market volatility. That implies I want tracking error. If you're a do-it-yourselfer, I don't know why you would care at all about tracking error.

And a follow up. The other day I mentioned the STKD Bitcoin & Gold ETF (BTGD) and was skeptical that it can work. It leverages up to 100% bitcoin and 100% gold. I back tested it and it showed no differentiation between just holding Bitcoin. I checked Portfoliovisualizer again and got the same long term result. The 21Shares Bytetree BOLD ETP has the same exposures as BTGD, trading in London. Here is a YTD chart from Bloomberg that does show differentiation.

Building the chart was difficult. Yahoo recognizes the fund but it didn't chart it. When I overlayed Bitcoin on the Bloomberg chart, it was wrong, it was also wrong when I tried ProShares Bitcoin Strategy ETF (BITO) which is futures based so I couldn't get the full two years that the Bytetree fund has been trading.

If the Bytree fund is the better representation than my backtest, then maybe BTGD will work. There are periods on that chart when Bytree moves in the same direction as the iShares S&P 500 ETF (IVV) and other periods where it goes in the opposite direction. Could BTGD turn out to be a muted proxy for Bitcoin? I don't know but that might be interesting. It needs a little more than three days to prove out. Here backtest I referenced the other day but just looking at 2024.

There's differentiation but it's not crystal clear what BTGD will actually do. Since I mentioned it above, the correlation of the 100/100 backtest to the S&P 500 shows 0.68 compared to 0.18% for just Bitcoin and 0.09% for just GLD which is worth noting.

BTAL and QGMIX are client and personal holdings.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.