A very long running theme to my writing going back almost to the beginning has been to avoid allocating too much to specific diversifiers. We've talked about this in relation to MLPs. gold and REITs going back 18 or 19 years and more recently we've talked about what a bad idea a 20 or 25% weighting to managed futures is. The behavior carried forward from REITs and the others to managed futures maybe a year or year and a half ago with a lot of content pointing to huge allocations to managed futures.

I wrote a similar post along these lines recently. There a couple more recent points we can add in to this discussion. First was Corey Hoffstein cowrote a paper that he gave a TLDR version on Twitter that appeared to be in support of managed futures replication which is typically how ETFs put on the strategy. The mutual fund wrapper is more amenable to full implementation. The takeaway for me was the potential performance dispersion across different funds. If you have interest in the space and maybe monitor a few funds you'll notice day to day differences of course and those differences can be pretty big over longer periods.

The differences are a little more nuanced than being long or short some currency or commodity. The differences often relate to different forms of risk weighting, the extent to which a strategy might use any faster signals for positioning and how the fund handles it when a 10 month signal conflicts with a 30 day signal as some examples. Here are four different managed futures mutual funds going back five years.

There are some distortions from how Yahoo handles year end distributions which were big at the end of 2022. The dispersion among the four is pretty wide but they all worked when investors needed them to work in 2022. Now check out the five year period below.

Would you have wanted 25% of your account in managed futures in that run? Research that concludes 25% into managed futures is overly academic, IMO, for real world implementation. I'm saying this as someone that has been a true believe for more than 15 years.

I don't think a five year run like the one above is going to be repeated anytime soon but as a group, they could easily languish for a long time. A "permanent" low-mid single digit weighting would merely be a drag on returns but a 20-25% weighting could be a real problem.

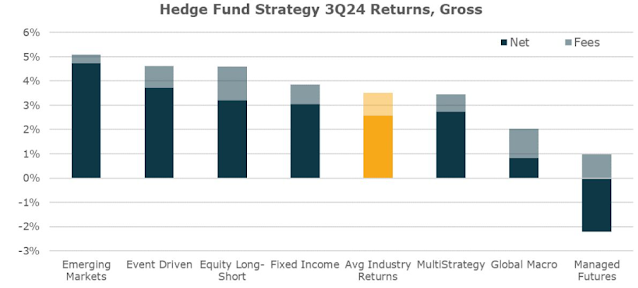

This bar chart comes from Bob Elliott and Unlimited Funds.

That's a lot of alternative strategies that did well in the third quarter with one that did poorly. I always say that no strategy can always be best and I should add that every strategy will take a turn being worst. By Bob's work, managed futures were down a little over 2% in the third quarter while the S&P 500 was up 4%. Repeating what I said frequently back when managed futures was struggling, it was doing what it was supposed to. Managed futures tends to have a negative correlation to equities so if equities go up, it should not be a surprise if managed futures go down. Managed futures can of course go up with equities but I would not expect it do so.

The next time there is some sort of stock market calamity, not a crash but more like a bear market sort of event, my guess is that futures will do well and again bring out the put 25% into managed futures crowd. Assuming you do not want to be in the business of guessing when managed futures will have a great run, think of the strategy as a way to diversify volatility in the thing that will provide the most growth which of course is equities. In that light, a small allocation will make much more sense.

An exception to quite a few of the "rules" we talk about is the Standpoint Multi-Asset Fund (BLNDX) which is a client at personal holding. It blends equities and managed futures in search of an all-weather result and for my money it delivers that result very consistently. Yes, ReturnStacked Stocks and Managed Futures (RSST) does something similar but they have different goals, they set different expectations and for my money, literally, it does a much better job of meeting the expectation they set than RSST. Even still, the exposure to BLNDX is nowhere close to 20-25%.

I think there is a vanity aspect to putting so much into managed futures. It is a sophisticated strategy that is intellectually appealing and plays to your ego. It's ok to feel that emotion but the point is to not succumb to that emotion. Diversify your diversifiers because Q3, 2024 will not be the last time managed futures lags the other alternatives.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment