GMO posted a short paper in support of its Benchmark Free Asset Allocation Strategy (BFAAS). The paper positions BFAAS as a substitute for 60/40. GMO is most known for founder Jeremy Grantham, the G in GMO. Grantham perpetually calls out the bear case and while he gets that wrong most of the time, similar to people like John Hussman and Nouriel Roubini, he always has an interesting take on the prevailing bear case. There is always a bear case but markets tend to go up in spite of whatever the bear case of the day is. Understanding the prevailing bear case is important because no one's plans, financial and otherwise, get disrupted but everything going right.

GMO is very much a value investing shop so a lot of what they talk about in the paper is how expensive US growth is so they devote effort to finding attractively priced equities elsewhere to slot into BFAAS. For this post we'll focus on BFAAS' asset allocation. Based on the stats, it's worth spending a little time digging in.

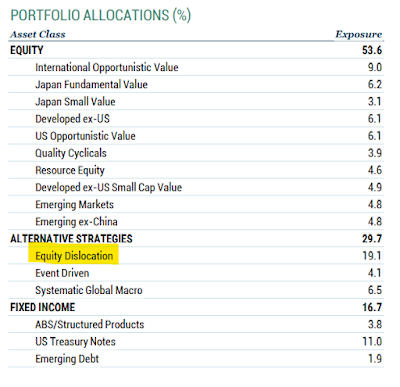

The asset mix is 53.6% to equities, 29.7% in alternative strategies and 16.7% in fixed income. A more detailed look at the asset mix shows the the following.

I highlighted "equity dislocation." That is a long/short strategy they run that seeks "returns from a narrowing of the valuation dislocation between cheap value stocks and egregiously expensive growth stocks." That sounds a little BTAL-ish. That fund goes short high volatility stocks and long low volatility stocks. BTAL is a client and personal holding. There's no qualitative value assessment with BTAL though so while I think it is similar, they aren't quite the same thing.

Long/short funds are tricky. It's a vague term that can mean different things as the chart helps explain.

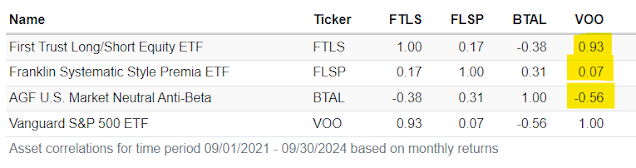

All three are long/short funds but they have different objectives and comparing them to each other beyond simply trying to understand what they are trying to do isn't productive. First Trust Long/Short (FTLS) is up a lot. It is trying to be more of an equity proxy. It's not up as much as the S&P 500 but is up a good amount and also managed to mostly trade sideways in 2022 which I wouldn't have expected. The Franklin Systematic Style Premia ETF (FLSP) is very clear up front what its trying to do, "aims to maintain a relatively low correlation to traditional asset classes and to deliver positive returns in rising or falling markets." Being mostly a horizontal line that tilts upward is the right expectation for this one. Comparing it to FTLS isn't the right way to look at it, the comparison would be to other market neutral or absolute return type strategies. We talk about BTAL all the time. It has a negative correlation that I believe it reliable so the result on the chart is right in line with that. It is capable of going up a lot when stocks go down a lot as opposed to FLSP which would hopefully be up a little, no matter what is going on. The correlation matrix captures exactly what I mean.

This list from VettaFi might help with sorting this point out. There are funds on there though that aren't quite long short in the context we're working with but its a good list to research off of.

I'm not terribly interested in trying to replicate the equity portion of BFAAS. It is heavy foreign and value. The history for value being any kind of timing indicator is lousy. If your portfolio is diversified, then you already have some value and some foreign. The replication is the same for both below except for the equity dislocation (long/short) sleeve, Portfolio 1 with FTLS and Portfolio 2 with BTAL. I didn't run it with FLSP because that one didn't start until late 2021 and the bear market of 2022 skewed all of them very favorably. The longer look creates better context.

The results of either version are valid. The one with BTAL has a lower CAGR and standard deviation which makes sense because of the correlations of FTLS and BTAL. A huge weighting to something with a negative correlation is going to create something of a drag. I am surprised that the Sharpe Ratio for the version with FTLS is lower than VBAIX.

The paper makes a salient point that I make all the time but might be good to read it from someone else. "Given our valuation-sensitive philosophy, BFAS tends to trail in extended periods of elevated valuations while protecting capital in drawdowns." No portfolio can always be best. Whatever valid portfolio you construct is guaranteed to lag some amount of the time.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment