I stumbled into yet another new (to me) ETF to kind of experiment with. For now, I'm going to leave the name out of it and just call it the Mystery ETF and to make the post easier for everyone, lets give it symbol $$F. I'll share the name on a subsequent post. This should be a good way to work through the expectation that a fund is setting, whether it generally meets that expectation and how it might fit into a simple portfolio. The fund started trading in late 2021 and is small, with $69 million in AUM. It would be fair to call it an alternative strategy but it uses standard assets.

A couple of snippets from the fact sheet are that $$F "is focused on delivering growth, but with an emphasis on risk management through stop loss techniques and use of defensive allocations" and "attempts to limit the downside during bear markets then capture upside when the market rebounds." It will have equity exposure at times and can get defensive so it should be less volatile than the S&P 500.

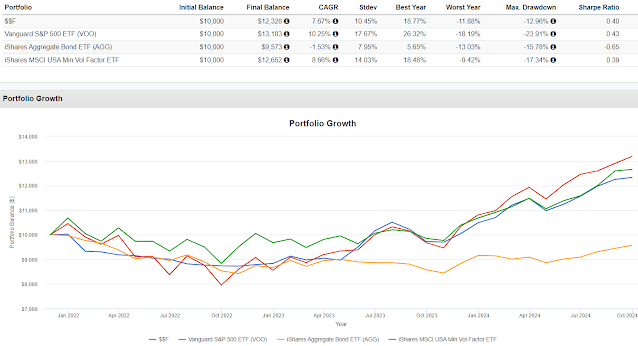

$$F is also much less volatile than USMV but only trails by 99 basis points for CAGR. It hasn't looked anything like AGG but I'm not sure the three year window we have to study allows for drawing an accurate conclusion on that. The 2022 results;

So, is $$F generally meeting its expectation? The return was remarkably smooth until about April of 2023 when I imagine it flipped out of defensive mode and started to look a little more like the equity market. In 2023, $$F was about 700 basis points behind VOO but 800 basis points ahead of USMV and this year it is 445 basis points behind VOO and 93 basis points behind USMV.

If I have the messaging correct from $$F, it is telling you it will be less volatile so the results thus far make sense to me. The chart above is instructive, you can see how it pivoted from some sort of defense to some sort of fully invested posture. I can't tell if $$F could be a substitute for the Vanguard Balanced Index Fund (VBAIX) which is a proxy for a 60/40 portfolio. With the short period available to study, the distortion of the bond component in 2022 weighs too heavily to draw a firm conclusion but I modeled it out below with a couple of other comparisons.

This is also skewed because AQR Managed Futures was up 35% in 2022 which may not be repeatable the next time stocks go down a lot. The year by year might be more useful.

Blending $$F with momentum delivers a valid result that is in the mix with the benchmark VBAIX but with less volatility. The point of this post is not to run out and buy $$F but to try to understand what a fund is trying to do and then assessing whether it is doing what the provider says it will do. Where $$F has a process that determines its allocation, I'm not sure that a little less than three years is enough time to know it can repeat what it has done so far but it makes a good impression and the result thus far are better than not really coming close to what it said it would do.

I'll share the name later this week.

And another new ETF to look at. Are there quick little comments either said you or that you read or short quotes that although not necessarily sage advice, stay with you for whatever reason? One that stays with me was someone on Twitter commenting ages ago to "just put it all in a quality/momentum fund and leave it alone." The only fund I knew of that combined those two was the Alpha Architect Quantitative Momentum ETF (QMOM) which despite the name does blend quality with momentum.

I would say QMOM has been a rough hold, lagging the S&P 500 by 192 basis points annualized which is ok but QMOM has been 50% more volatile than the S&P 500. In nine full and partial years, it has lagged the S&P 500 in six of those years. It was down much less in 2022 but interestingly, it was down in 2021 too. The CAGR might be overstated in terms of expectations due to going up 62% in 2020 versus 18% for the S&P 500. I would not assume that outperforming by 44% in one year could ever be repeated and that result might be part of the story for why QMOM fell in 2021.

Despite the challenges QMOM has had, the person putting so much faith into quality and momentum still could be onto something. At least I play around with this idea every so often. This gets us to the SMI 3Fourteen Full Cycle Trend ETF (FCTE). FCTE is a concentrated portfolio of 20 stocks that "uses a proprietary Quality screen to narrow the potential universe, then applies a variety of proprietary Trend and Momentum screens to select the ETF's portfolio." The fund just started trading in July and already has $472 million in assets which is astounding for a fund that ETF-Twitter doesn't talk about and for a fund that I've never received a solicitant email for. The fund might be a BYOA situation or bring your own assets as Eric Balchunas says but either way, it's impressive and the fund has done well so far.

It came out of the blocks strong and then pulled away again in the first half of September. JOET is the Virtus Terranova US Quality Momentum ETF that somehow involves CNBC personality Joe Terranova. As a side note, I bailed on CNBC in favor of Bloomberg so long ago, I have no idea if Terranova is still on CNBC. Beyond assuming at least slight differences in determining quality and momentum between FCTE and JOET, JOET does not appear to be a concentrated portfolio. Three months is way too soon to draw any conclusion about FCTE versus JOET or FCTE versus anything but I am intrigued by the quality/momentum blend.

Modeling the idea out, QMOM and JOET don't do relatively well so I'm leaving those out so there is less noise and a longer period to look at.

Everything is plainly labeled. 75% Momentum/25% Quality is interesting. For the same standard deviation as the S&P 500, the backtest got 191 more basis points of compounded growth. And you can see that both momentum/quality blends had some crisis alpha in 2022.

The year by year doesn't show a ton of differentiation but there was some. The reason to mention that point is the less something looks like the S&P 500 the harder it can be to hold, behaviorally. It's funny to say but you want some differentiation, not too much. Also, there is nothing in the back test that stands out as being unrepeatable like the one year QMOM was up 62%.

FCTE could turn out to be a better mousetrap, I have no idea but I think it is in the right part of the factor world and it makes a good enough impression to want to follow it.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment