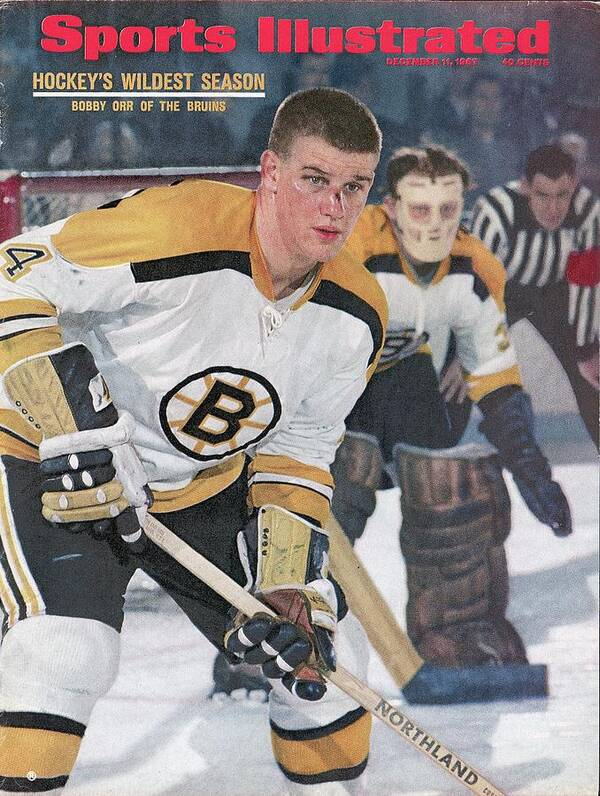

After yesterday's post about long short equity, a reader Tweeted to me about a new (to me) fund, the Militia Long/Short Equity ETF (ORR) which listed earlier this year. Part of my reply was that as a kid growing up in Boston in the 70's, I might need to buy a few shares just for the symbol.

There's not a lot of color on ORR's website but it is high turnover and the approach is fundamentally driven.

It came out right before things got squirrely so the first few months serve a useful test. That it has outperformed right out of the blocks is obviously better than the alternative but maybe more interesting is the differentiation captured in the two boxes I added. Using the jargon from yesterday's post, maybe ORR should be considered a variable biased fund.

Depending on how much turnover there is, looking at the holdings may not be that helpful but I did see something very interesting. Part of the short book appears to be shorting volatility drag that often goes with leveraged ETFs and shorting the erosion that goes with crazy high yielding derivative income funds. We talked about this recently with a filing from Defiance that will short 2x long MSTR ETFs and short 2x short MSTR ETFs.

ORR is short a couple of those ETFs but to be clear, the above just borrows part of their idea, the actual fund has a lot more going on under the hood. The symbols I chose, allow for a long backtest as follows.

The results are of course interesting but don't account for the cost to borrow the shares. TNA appears to cost about 100 basis points per Fintel, SDIV is 60-70 basis points and XYLD usually ranges from 1.2%-1.4%. Those are annual costs. Where the backtest is total return, the expense of paying the dividends should be accounted for.

I wanted to check in on the ReturnStacked Bonds & Merger Arbitrage ETF (RSBA). It started trading late last year. The idea is that each dollar invested gives $1 of exposure to US Treasuries of varying maturities and $1 of exposure to merger arbitrage. The fund's website shows AUM just under $19 million.

We talk about merger arbitrage as a proxy for how investors hope fixed income will trade. It usually have little to no volatility and tends to move upward very gradually. I've owned the Merger Fund (MERIX) for clients since the financial crisis. The fund is having a relatively good year in 2025, up 4.39% per Yahoo Finance.

Portfolios 2 and 3 use ETFs from F/m to dial in the maturities that RSBA shows on its site. UST in Portfolio 4 is a 2x version of the iShares 7-10 Year Treasury ETF (IEF) but I would note that factoring in distributions, UST's total return lags IEF by 11 basis points.

When we look at results for any of the ReturnStacked funds, they often don't look so great. For someone who wants Treasuries with duration (I do not) as well as merger arbitrage (I do want that one), there appears to be better ways to build that combo. I will say that while the characteristics of merger arb are similar from manager to manager, the exact results can differ from manager to manager.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment