A quote attributed to David Swensen that I hadn't seen before.

“As a general rule of thumb, the more complexity in a Wall Street creation, the faster and further investors should run.”

If you read a lot of posts here, you might have read something from me along the lines of allocating a lot to simplicity with just a little bit to complexity. Swensen was the long time manager of the Yale Endowment and anything you might find about how the endowment was allocated under Swensen probably won't look very simple but he was a big advocate of simplicity for individual investors.

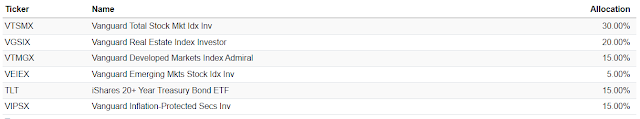

Here's how Portfoliovisualizer builds a simple Swensen portfolio.

And plugging into Testfol.io which goes back further and comparing it to VBAIX.

Swensen did better over the course of the backtest with a little more volatility and bigger drawdowns. From 2000 to 2019, Swensen outperformed 14 times. From 2020 on, VBAIX outperformed four times. I think the difference can be attributed to more duration which hasn't been doing quite as well as it used to and having less domestic equity.

The portfolio certainly is simple enough but where bonds with duration are concerned, the world got a little more complex in recent years. An investor agreeing with that comment about duration could go a couple of different ways, either go simpler like with T-bills or add a little complexity, tools to manage portfolio volatility in the manner that bonds used to.

There's no wrong choice but I prefer adding a little complexity with the various tools we talk about all the time here. These include alts that trade in the manner that I think people hope bonds will as well alts that more reliably offset equity declines which we've categorized as first responders and second responders.

I've detailed the manner in which I work these into a portfolio and maybe you think it is simple or maybe not, it is all relative. One idea that I think marries simplicity and complexity is when we take the permanent portfolio which is equal weighted 25% into stocks, long bonds, gold and cash, and try to update it to adjust to the reality that long bonds are not the reliable diversifier they once were.

Research Affiliates (RA) threw its hat in this ring with a long writeup about managed futures. They talked about "four pillars" as being "economic growth (equities), income defensiveness (bonds), absolute return (alpha) and trend following (tail risk)."

Portfolio 1 is an attempt to be true to the RA paper using AGG for bonds. Portfolio 2 uses a bond proxy with client/personal holding Merger Fund.

Portfolios 1 and 2 have been almost identical looking back. Looking forward, Portfolio 2 avoids duration risk. VBAIX has 60% in equities and PRPFX has the 25% equity sleeve but also owns commodity equities and gold so Portfolios 1 and 2 are not likely to keep up with the other two.

I would imagine that Portfolios 1 and 2 would be more all weather-ish with smaller drawdowns as has been the case in the backtest. They do have a positive real return and having half the volatility of 60/40 would be appropriate for some people like maybe those with a very low risk tolerance or someone far enough ahead of where they need to be that they could be partially in game over mode.

This quadrant style can be a valid way to go but I don't think it is ideal. We've looked at countless ways to get closer to a "normal" equity allocation but still having noticeably less volatility. This can allow for more growth opportunity over the longer term.

I would pick on RA's use of the term tail risk in conjunction with managed futures. Tail risk is typically more of a first responder sort of defensive. Managed futures has been a first responder in some events but not all events. And to repeat from many previous posts, in real life, I would not put anywhere near 25% into those alts. Loading up like that exposes the portfolio to unnecessary risks. Diversify your diversifiers.

The takeaway is the potential simplicity of quadrant-inspired portfolio construction. I'm not a fan of literally having four 25% buckets but having four or five tranches in more practical weightings makes a lot of sense.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment