Simplify announced it is closing four ETFs including the Simplify US Equity PLUS QIS ETF (SPQ) and the Simplify Macro Strategy ETF (FIG).

Despite the firm's name, they've bundled a lot of very complex strategies into ETFs. While I have been critical of quite a few of their funds and have found a some that appear to work well, I have to tip my hat at their willingness to try a lot of very different ideas.

QIS is short for quantitative investment strategies and Simplify has ETF QIS that is devoted to quantitative investment strategies with $97 million in AUM so SPQ combined 100% S&P 500 with a 50% overlay of the QIS fund. If you look at the QIS holdings info, I think some of the things would be recognizable like calls and puts on equity indexes and currency positions but also plenty of things that would not be recognizable unless you know what MSSIQUA1A is. Generically, quantitative investment strategies do work as differentiated return streams but I don't know if it can be packaged into an ETF. Testfol.io has the QIS ETF compounding negatively at -2.95% since its inception in July, 2023.

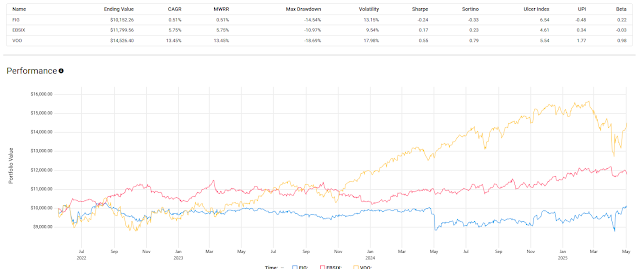

SPQ, the fund that combines the S&P 500 and the QIS fund has lagged far behind the S&P 500 of late. It tracked sort of closely for a while but started falling further behind late in 2024.

I threw ReturnStacked US Stocks and Managed Futures (RSST) in there because they do something similar. They both leverage up to add exposure to an alternative strategy on top of 100% equity. Maybe in a different type of market event, SPQ could have had a better run but without anything else to go on, it simply becomes a datapoint for the difficulty of bundling equities with an alternative using leverage.

We've looked at FIG a couple of times before. It's not necessarily that it has done poorly but maybe it just hasn't done anything?

The chart is helpful. EBSIX is a fund we use occasionally for blogging purposes and is in the macro realm. The FIG literature talks about it seeking a differentiated return stream. Eye of the beholder whether FIG has been differentiated enough to be helpful but it is much easier to make out EBSIX as being differentiated a meaningful amount of the time. The idea is not to keep up with equities, equities are the thing that goes up the most, most of the time so a differentiator like macro shouldn't be expected to keep up with equities. FIG only shows $11 million in AUM so maybe that figure and the return profile was enough for them to close it.

It is fun to look at these types of funds when they come out and to try to track them but as another reiteration, a lot of these funds will turn out to not be very useful. Part of the story here could be that they are too complex. As interesting as these are, they are best used in small doses. A lot of simplicity (plain vanilla stocks) hedged with a little complexity.

The information, analysis and opinions expressed herein reflect our judgment and opinions as of the date of writing and are subject to change at any time without notice. They are not intended to constitute legal, tax, securities or investment advice or a recommended course of action in any given situation.

No comments:

Post a Comment